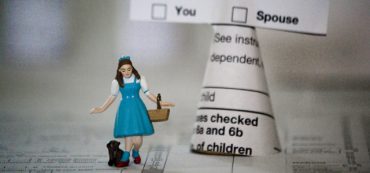

Giving Gifts to the Wrong Beneficiaries–Mistake #5

Knowing which assets to give away to your beneficiaries can save your estate and your beneficiaries big tax bills, even if you have a small net worth. If you plan on making a gift to charity from your estate, you can be even more tax savvy with your giving.