Last year, I sold a stock that had a $17,000 capital gain and paid no tax. If I can do this, maybe you can too. Selling this stock while eligible for the 0% capital gains rate saved me at least $1,700 in extra tax bills from Uncle Sam.

Last year, I sold a stock that had a $17,000 capital gain and paid no tax. If I can do this, maybe you can too. Selling this stock while eligible for the 0% capital gains rate saved me at least $1,700 in extra tax bills from Uncle Sam.

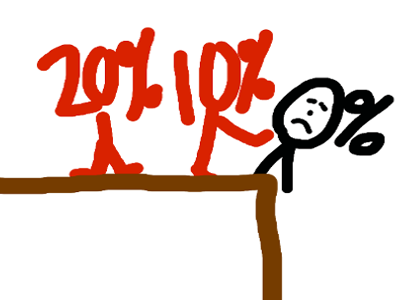

This 0% tax rate is only available for a limited time. Most infomercials that begin with such urgency are trying to get you to buy something, but in this case I want you to consider selling. The 2010 Tax Relief Act is set to expire in 2013, and long-term capital gains rates are projected to jump back up along with almost every other income tax rate.

More people qualify for the 0% tax rate than you might think. According to the 2009 IRS data (2010 and 2011 data have not yet been released), 66% of all returns were eligible. However, not all of these tax filers have appreciated stock in their portfolio.

Here are some examples of investors who might qualify for this “special offer”:

- Retirees who are in their “gap years,” defined as low-income years after paychecks have stopped and before Social Security and before IRA required minimum distributions (RMDs) have kicked in. For those who take my advice to delay Social Security, this can typically apply to those ages 62 to 70.

- Young people or families who have low incomes (or high deductions) and have inherited stock with a low basis.

The 0% rate is available to those married filing jointly couples who have a taxable income (income after deductions) of up to $70,700. For singles, the taxable income limit is $35,350.

Consider a couple with a taxable income of $50,000. They can still realize up to $20,700 in capital gains at the 0% rate.

Even if you do not qualify for the 0% rate, I recommend that you consider selling highly appreciated stocks this year. If you like the stock, you can always repurchase the stock with a reset cost basis. Better yet, repurchase a low cost exchange-traded fund (ETF) that is more diversified, and you don’t have to wait to reinvest. Some higher income investors are even gifting highly appreciated stock to their children or grandchildren to be sold at the 0% rate.

Assuming the Bush tax cuts are allowed to expire in 2013, as I expect they will be, capitals gains rates will jump up to 10% for people with lower incomes and 23.8% for people with higher incomes when you add in an additional 3.8% Medicare tax.

The only investors who shouldn’t worry about these lower rates are those who do not plan ever to sell their highly appreciated stocks in their lifetime. Stocks that are left to beneficiaries will receive a step up in basis when they are inherited. This means the lucky beneficiary will not have to pay any tax on the gains in the stock.

Before the end of the year, review your taxable investment accounts and work with a tax planner (or tax-planning software) to see if realizing capital gains in 2012 makes sense for you.

4 Responses

Ward Iutzi

A) Suppose you sell sell appreciated stocks during the year that have a gain of $30,000.

and B)

Suppose your taxable income for this year turns out to be $15,000 below the limits for the 0% capital gains rate (per your article above: $35,350 for singles and $70,700 for married filing jointly.)

Question:

Do you get to pay 0% the first $15,000 of the capital gains and have to pay the capital gains tax on only the second $15,000?

Or???

Thanks,

Ward

Matthew Illian

Ward, correct! You get 0% on the first $15,000 and 15% on the remainder.

Mary Huning

Wash sale penalties don’t apply to selling appreciated stock. You can repurchase it any time without penalty.

Matthew Illian

Mary, yes, this was an oversight on my part and I’ve corrected the column. Thanks for sharing.