Trending Now

How to Calculate Fair Market Value if the Date of Death Is on a Weekend? October 14, 2022 (90)

How to Calculate Fair Market Value if the Date of Death Is on a Weekend? October 14, 2022 (90) States with Tax-Exempt Interest from U.S. Debt Obligations June 17, 2022 (87)

States with Tax-Exempt Interest from U.S. Debt Obligations June 17, 2022 (87) How To Distribute from A College America 529 Plan to an Account Owner October 22, 2024 (73)

How To Distribute from A College America 529 Plan to an Account Owner October 22, 2024 (73) Changes to RMDs for Those Born in 1951 or Later (Secure 2.0) January 31, 2023 (71)

Changes to RMDs for Those Born in 1951 or Later (Secure 2.0) January 31, 2023 (71) How to Change a 529 Plan Account Owner May 17, 2022 (70)

How to Change a 529 Plan Account Owner May 17, 2022 (70) How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 (63)

How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 (63) How To Find the Original Purchase Date of Holdings on Schwab.com June 16, 2023 (50)

How To Find the Original Purchase Date of Holdings on Schwab.com June 16, 2023 (50) Video: The Value of Systematic Roth Conversions April 5, 2021 (47)

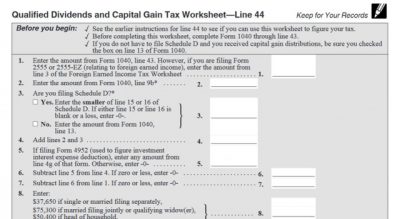

Video: The Value of Systematic Roth Conversions April 5, 2021 (47) How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet September 24, 2021 (41)

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet September 24, 2021 (41) Account Funding Priorities for 2022 December 7, 2021 (35)

Account Funding Priorities for 2022 December 7, 2021 (35) Schwab Mobile App: How to Deposit a Check August 24, 2020 (35)

Schwab Mobile App: How to Deposit a Check August 24, 2020 (35) How To Distribute from A College America 529 Plan to a Designated Beneficiary October 15, 2024 (35)

How To Distribute from A College America 529 Plan to a Designated Beneficiary October 15, 2024 (35) Charles Schwab: How to Fund Your Account with a Check September 27, 2018 (33)

Charles Schwab: How to Fund Your Account with a Check September 27, 2018 (33)

All Time Most Popular

What is a 1031 Real Estate Exchange? May 31, 2014 Despite their complexity, these exchanges have the potential to save vast amounts of money. (100,550)

What is a 1031 Real Estate Exchange? May 31, 2014 Despite their complexity, these exchanges have the potential to save vast amounts of money. (100,550) How to Avoid the Vehicle Sales Tax in Virginia November 27, 2012 "I would like to give my daughter my newer car, but the tax considerations are not simple." (95,664)

How to Avoid the Vehicle Sales Tax in Virginia November 27, 2012 "I would like to give my daughter my newer car, but the tax considerations are not simple." (95,664) Can I Contribute to Both a SEP and a 401(k)? June 1, 2016 SEP plans offer a powerful way to provide for your own retirement in the same way that 401ks do. (74,558)

Can I Contribute to Both a SEP and a 401(k)? June 1, 2016 SEP plans offer a powerful way to provide for your own retirement in the same way that 401ks do. (74,558) The Complete Guide to Your Washing Machine July 23, 2013 The complete guide to saving money while washing your clothes. What temperature should the water be? What cycle should I use? What detergent should I use? (67,538)

The Complete Guide to Your Washing Machine July 23, 2013 The complete guide to saving money while washing your clothes. What temperature should the water be? What cycle should I use? What detergent should I use? (67,538) Q&A: Can I Use 529 Funds for Off-Campus Housing? November 13, 2018 In general, you can use 529 funds to pay for your student’s off-campus housing costs. (66,563)

Q&A: Can I Use 529 Funds for Off-Campus Housing? November 13, 2018 In general, you can use 529 funds to pay for your student’s off-campus housing costs. (66,563) How to Transfer Your Economic Impact Payment Card Into Your Bank Account May 29, 2020 It took me one hour to complete from start to finish. Hopefully, now that I have bumbled my way through it on my own and documented the steps, it takes you less time. (64,361)

How to Transfer Your Economic Impact Payment Card Into Your Bank Account May 29, 2020 It took me one hour to complete from start to finish. Hopefully, now that I have bumbled my way through it on my own and documented the steps, it takes you less time. (64,361) Fund Your Child’s Roth with Chore Income April 23, 2019 There are many opportunities to pay your children. If that payment can be counted as earned income, then the child is eligible to fund their Roth IRA. (48,716)

Fund Your Child’s Roth with Chore Income April 23, 2019 There are many opportunities to pay your children. If that payment can be counted as earned income, then the child is eligible to fund their Roth IRA. (48,716) Why is Bob Cratchit So Poor? December 12, 2005 At first glance, this story fills us with pity for the Cratchit family, always struggling to make ends meet. But is that the true story? (46,885)

Why is Bob Cratchit So Poor? December 12, 2005 At first glance, this story fills us with pity for the Cratchit family, always struggling to make ends meet. But is that the true story? (46,885) Charles Schwab: How to Order More Checks or Deposit Slips September 22, 2018 With Schwab Bank, any time you need more checks or deposit slips you can simply request them for free. (46,778)

Charles Schwab: How to Order More Checks or Deposit Slips September 22, 2018 With Schwab Bank, any time you need more checks or deposit slips you can simply request them for free. (46,778) How to Lower Your AGI and Why You’d Want To July 26, 2017 Here are 8 reasons you'd want to lower your AGI and 8 methods to lower your AGI. (46,496)

How to Lower Your AGI and Why You’d Want To July 26, 2017 Here are 8 reasons you'd want to lower your AGI and 8 methods to lower your AGI. (46,496) Funding a 3-Year-Old’s Roth IRA March 27, 2020 My daughter was employed at her first job, earned her first income, and was able to fund her Roth IRA for the first time. (41,921)

Funding a 3-Year-Old’s Roth IRA March 27, 2020 My daughter was employed at her first job, earned her first income, and was able to fund her Roth IRA for the first time. (41,921) Charles Schwab: How to Fund Your Account with a Check September 27, 2018 If you are doing a one-time funding from another account, sometimes the lowest tech option can be the easiest. (36,308)

Charles Schwab: How to Fund Your Account with a Check September 27, 2018 If you are doing a one-time funding from another account, sometimes the lowest tech option can be the easiest. (36,308) How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet May 16, 2017 The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. (35,181)

How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet May 16, 2017 The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. (35,181) Mailbag: Should I Pay Off My Mortgage Early? April 13, 2012 Some say don't make extra payments, take the tax deduction. Others say you need to be debt free. (34,251)

Mailbag: Should I Pay Off My Mortgage Early? April 13, 2012 Some say don't make extra payments, take the tax deduction. Others say you need to be debt free. (34,251) How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 If you receive Social Security benefits, the portion of those benefits which will be taxable depends on your income. The taxable portion can be anywhere from 0% to a maximum of 85% of your benefits. (33,480)

How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 If you receive Social Security benefits, the portion of those benefits which will be taxable depends on your income. The taxable portion can be anywhere from 0% to a maximum of 85% of your benefits. (33,480) Q&A: Can a 529 Reimburse for Last Year’s Expenses? September 15, 2020 Unfortunately, neither "yes" nor "no" is a correct answer to this question. (33,148)

Q&A: Can a 529 Reimburse for Last Year’s Expenses? September 15, 2020 Unfortunately, neither "yes" nor "no" is a correct answer to this question. (33,148)

Popular from This Year

Account Funding Priorities for 2024 January 9, 2024 A savings waterfall helps investors navigate the financial complexity available to them. (2,112)

Account Funding Priorities for 2024 January 9, 2024 A savings waterfall helps investors navigate the financial complexity available to them. (2,112) How to See Closed Account Information at Schwab November 10, 2023 If closing an account at Schwab is in line with your goals, take comfort in knowing that you are able to close your accounts at Schwab without losing access to your important documents. (1,717)

How to See Closed Account Information at Schwab November 10, 2023 If closing an account at Schwab is in line with your goals, take comfort in knowing that you are able to close your accounts at Schwab without losing access to your important documents. (1,717) Should I Change Financial Advisors Over Poor Performance? October 31, 2023 The fact that markets are down isn't a good reason by itself to fire your advisor, but there are reasons to switch financial advisors related to performance. (1,218)

Should I Change Financial Advisors Over Poor Performance? October 31, 2023 The fact that markets are down isn't a good reason by itself to fire your advisor, but there are reasons to switch financial advisors related to performance. (1,218) In Roth Conversions, Reducing Your RMD is One of the Benefits December 5, 2023 Required minimum distributions are taxed as taxable income, the same as other types of traditional IRA withdrawals and Roth conversions. (1,205)

In Roth Conversions, Reducing Your RMD is One of the Benefits December 5, 2023 Required minimum distributions are taxed as taxable income, the same as other types of traditional IRA withdrawals and Roth conversions. (1,205) The Lie Of The Century November 7, 2023 This lie was PolitiFact's 2013 lie of the year, but we dub it the lie of the century. (1,133)

The Lie Of The Century November 7, 2023 This lie was PolitiFact's 2013 lie of the year, but we dub it the lie of the century. (1,133) Charles Schwab Bank Fraud Dept Text Message Scam May 21, 2024 We recently had a client fall prey to a sophisticated Schwab Bank scam. They gave us permission to share this fraud story with you to hopefully prevent others from being scammed. (1,124)

Charles Schwab Bank Fraud Dept Text Message Scam May 21, 2024 We recently had a client fall prey to a sophisticated Schwab Bank scam. They gave us permission to share this fraud story with you to hopefully prevent others from being scammed. (1,124)

This Quarter

How to Calculate Your Own Safe Spending Rate August 20, 2024 (842)

How to Calculate Your Own Safe Spending Rate August 20, 2024 (842) New Roth i401(k) at Schwab September 24, 2024 (485)

New Roth i401(k) at Schwab September 24, 2024 (485) Set-Up Your New Social Security Login September 10, 2024 (421)

Set-Up Your New Social Security Login September 10, 2024 (421) Three Ways to Find Full Account Numbers on Schwab.com September 3, 2024 (370)

Three Ways to Find Full Account Numbers on Schwab.com September 3, 2024 (370) Inheriting a Joint Account at Charles Schwab September 17, 2024 (358)

Inheriting a Joint Account at Charles Schwab September 17, 2024 (358) Schwab’s Investor Checking Account Cited as Favorite Checking Account September 19, 2024 (296)

Schwab’s Investor Checking Account Cited as Favorite Checking Account September 19, 2024 (296)