Childhood is a time of acquiring lots of behavior that will be useful for the rest of life. Just as learning to speak would be difficult if the child was never allowed to attempt to make the sounds, so too learning to deal with money is difficult if the child is never given the opportunity to attempt to handle it.

When it comes to teaching financial lessons, setting a good parental example is important, but actually giving the child some experience making wise financial decisions is essential. This includes both giving the child decision making authority with their own money and giving the child the means to earn money outside of or instead of an allowance.

We talk frequently with our now 2.5-year-old daughter about the certain tasks that every family member is expected to do. For example, we all are responsible for cleaning up after ourselves at the table or cleaning up our own clothes, toys, and things after we are done. However, there are also tasks for which my daughter is not responsible. In fact, I am responsible for them. However, I would be very interested in outsourcing these jobs to someone for pay. After all, the route from wealth to well-being is spending money to buy free time.

In this manner, there are many opportunities to pay your children. And if that payment can be counted as earned income, then the child is eligible to fund their Roth IRA. So the rest of this article is to step through the means by which you can use chore or odd job earnings to fund a Roth IRA.

The first decision that must be made is how the child will be hired. When it comes to chores, there are two main options.

- The child may be a self-employed independent contractor.

- The child may be a household employee of their parents.

Independent Contractor

If your child is an independent contractor, then the child’s earnings must be reported as Self-Employed on Schedule C. Also, if their net earnings from self-employment is more than $400, the child would need to pay self-employment tax (Medicare and Social Security) on Schedule SE.

The perk of being an independent contractor is that your child could work for many different families. For example, they could be neighborhood childcare, being paid both to watch their younger siblings and watch the neighbor’s kids.

It is important to note that even being an independent contractor runs into child labor laws.

If your child is under the age of 14, then, according to YouthRules.Gov, the list of potential occupations is limited to:

- deliver newspapers to customers;

- babysit on a casual basis;

- work as an actor or performer in movies, TV, radio, or theater;

- work as a homeworker gathering evergreens and making evergreen wreaths; and

- work for a business owned entirely by your parents as long as it is not in mining, manufacturing, or any of the 17 hazardous occupations.

At age 14 or 15, the list expands to include the following:

- retail occupations;

- intellectual or creative work such as computer programming, teaching, tutoring, singing, acting, or playing an instrument;

- errands or delivery work by foot, bicycle and public transportation;

- clean-up and yard work which does not include using power-driven mowers, cutters, trimmers, edgers, or similar equipment;

- work in connection with cars and trucks such as dispensing gasoline or oil and washing or hand polishing;

- some kitchen and food service work including reheating food, washing dishes, cleaning equipment, and limited cooking;

- cleaning vegetables and fruits, wrapping sealing, and labeling, weighing pricing, and stocking of items when performed in areas separate from a freezer or meat cooler;

- loading or unloading objects for use at a worksite including rakes, hand-held clippers, and shovels;

- 14- and 15-year-olds who meet certain requirements can perform limited tasks in sawmills and woodshops; and

- 15-year-olds who meet certain requirements can perform lifeguard duties at traditional swimming pools and water amusement parks.

At age 16 or 17, any job that has not been declared hazardous by the Secretary of Labor is permissible for 16- and 17-year-olds.

Household Employee

If they are considered a household employee of their parents, there are a few exceptions that benefit everyone. First, your list of jobs allowed under child labor laws expands significantly as you are allowed to “work for a business owned entirely by your parents as long as it is not in mining, manufacturing, or any of the 17 hazardous occupations” at any age. Second, your child’s wages are exempt from FICA taxes if they are working for a business owned solely by their parent(s).

If you can be counted as a household employee depends on one question: Does the employer have control over how the work is done (such as when, where, with which tools) ? If the employer does, then the individual is an employee. As the IRS says, “The worker is your employee if you can control not only what work is done, but how it is done.” And later, “If only the worker can control how the work is done, the worker isn’t your employee but is self-employed. A self-employed worker usually provides his or her own tools and offers services to the general public in an independent business.”

When it comes to chores, most parents have specific guidelines on how and when they want the chores completed. They are also providing their children with the tools to do so. Furthermore, their child is normally not offering services to the general public. For these reasons, I would guess, most paid children are “household employees” of their parents.

The IRS examples of individuals who may be household employees are, “Babysitters, Butlers, Caretakers, Cooks, Domestic workers, Drivers, Health aides, House cleaning workers, Housekeepers, Maids, Nannies, Private nurses, and Yard workers.” As this list also overlaps with most chores parents want to delegate to their children, there is a strong precedent here for being able to count your children as household employees.

There is a benefit to being counted in this way. As the IRS states in its page on “Family Help,” “Payments for the services of a child under age 18 who works for his or her parent in a trade or business are not subject to social security and Medicare taxes if the trade or business is a sole proprietorship or a partnership in which each partner is a parent of the child.” This means that wages earned from their parent employer to an under age 18 child employee are not subject to the FICA taxes of Social Security and Medicare.

In Publication 926, Household Employer’s Tax Guide, the IRS raises the age to 21 for child household employees, stating “Don’t count wages you pay to any of the following individuals as social security or Medicare wages, even if these wages are $2,100 or more during the year. … 2. Your child who is under the age of 21.” It is also worth to note that, “You’re not required to withhold federal income tax from wages you pay a household employee.” Also, you only need to file forms with the IRS for household employees “if you pay any of the following wages to the employee: Social security and Medicare wages, FUTA wages, Wages from which you withhold federal income tax.”

These exceptions should make payroll in your household easy.

In this way as a Household Employer, you likely can pay your child any amount without having it be subject to withholding, Social Security, or Medicare and thus without having to present any IRS forms to your child employee. Plus, you only need to file a federal tax return for your child if they meet the regular IRS rules for filing require them to file. (See Publication 929, Tax Rules for Children and Dependents for information on this.)

Picking a Job, Assigning Pay, and Keeping Records

When it comes to picking what job your child does, my advice is that there should be two lists of chores. First, the chores your child does because they are a member of the household. Second, the chores you are responsible for doing but for which you are willing to pay someone else to do.

Practically, this means I would recommend making a chore chart that makes clear who is responsible for which tasks first. Then after that is complete, talk about how anyone can pay to have someone else do their chores for them. You can then make your offer for the chores you are willing to delegate and see if any children are willing to do it. (Once your child has earned some savings, you can even allow your children to delegate their tasks to another sibling by letting them use their own money to pay for the task to be done.)

When setting a price, you should ensure that their hourly rate is similar to the going rate of someone outside of the family and is appropriate based on the child’s skill and value.

If you are looking for a fair benchmark, you might benefit from looking at minimum wage laws even though minimum wage laws do not apply to parents employing their own children. Right now, the federal minimum wage is $7.25 per hour and there is a special exemption that allows youth to be paid $4.25 per hour during their first 90 days of employment. On the other end, skilled laborers such as professional house cleaners might make as much as $20 – $40 per hour.

Also, you do not have to pay by the hour. You can pay by the task. Although it helps to have the hourly wage in mind. The thought process might go, “It’d take me 2ish hours to clean that bathroom. At just over $7 per hour, I would pay $15 for a clean bathroom.” This allows the very young to be inefficient without being rewarded for their slowness.

Whenever engaging in anything IRS related, the best protection is good records. Each time your child does a job, save and record:

- when and/or for how long the child worked,

- what task they were doing,

- what they were paid,

- when you paid them, and

- how much of their pay was in cash.

The IRS says you need to “Keep your employment tax records for at least 4 years after the due date of the return on which you report the taxes or the date the taxes were paid, whichever is later.” However, we recommend keeping your records basically forever.

Roth IRA Funding

Once your child has earned the income, then your child is eligible for an amount of Roth IRA funding. There are many ways for you to get money into the Roth account.

First, the money that is contributed does not need to be the very same money they earned. Unlike a 401(k) plan, which requires salary deferrals in order to fund, you or anyone else can fund your Roth IRA with any money.

The child can contribute. Parents can contribute. Grandparents can contribute. A random friend can contribute. The only hitch is that you are limited in how much you can contribute up to their earned income or this year’s IRA contribution limit whichever is smaller.

If you want to maximize the amount that is put in while still giving the child a choice, one clever suggestion is that you or a grandparent could offer a Roth contribution match as gift. For example, every dollar the child contributes, you promise to also contribute one dollar. In this way, the child can save half of all their earnings as spending money while still getting the full allowable amount into their Roth IRA to grow tax-free.

This also provides early exposure to a real conversation they will have later in life when they are offered an employer match and asked how much they want to contribute to their 401(k) plan.

All in all, there are so many positive financial lessons that can be learned from this interaction, I highly recommend that you consider seeing if your family has any household jobs that are waiting for employees to fill them.

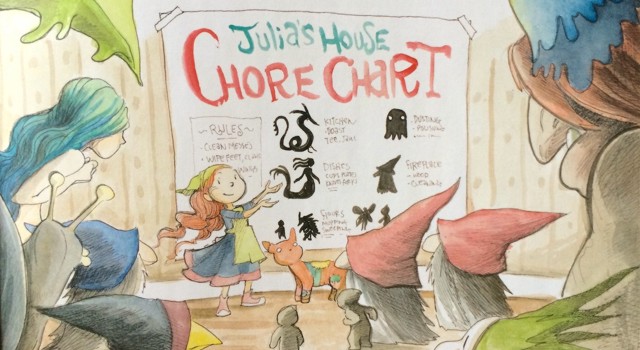

The photo is an excerpt from Julia’s House for Lost Creatures by Ben Hatke. This book has been a great resource in making the concept of household tasks fun. In the book, Julia has a boarding house for fantasy creatures. The house is in chaos until Julia establishes a chore chart so everyone pitches in to make the house great. I highly recommend it!