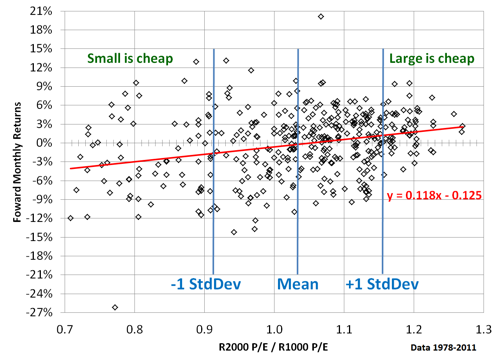

In “Using Dynamic Asset Allocation to Boost Returns” I showed that there are times when large cap or small cap are relatively cheap and will outperform the other.

The same thing is true for a dynamic asset allocation between growth and value. Although the average ratio of the Russell 1000 Growth forward looking P/E ratio to the Russell 1000 Value forward looking P/E ratio is normally high (1.45) the range of values shows that there are times when it gets over one standard deviation above or below that norm. When growth is relatively cheap, it will outperform value.

Currently growth and large are relatively cheap and small and value is relatively expensive. For that reason, the R1000 or S&P 500 should outperform the R2000 small cap value.

Subscribe to Marotta On Money and receive free access to the presentation: The Ten Best ETFs of 2012.