A stock’s valuation is measured on a continuum from “Value” to “Growth.” In broad strokes, Value stocks are cheap and Growth stocks are expensive. Generally speaking, Value stocks outperform Growth stocks. Investing based upon this finding is called “Value Investing.” Value Investing has boasted superior returns for at least half a century.

A stock’s valuation is measured on a continuum from “Value” to “Growth.” In broad strokes, Value stocks are cheap and Growth stocks are expensive. Generally speaking, Value stocks outperform Growth stocks. Investing based upon this finding is called “Value Investing.” Value Investing has boasted superior returns for at least half a century.

However, for the past 12 years (June 30, 2007 through June 30, 2019), the Russell 3000 Growth Index outperformed the Russell 3000 Value Index by 4.17% annually. This has caused many people to write articles with titles like “Does Value Investing Still Work?” or “Is Value Investing Dead?”

Value stocks and Growth stocks ebb and flow. Which styles win for any given year is unknown. However, over the long haul, there has been a superiority to the returns of Value stocks.

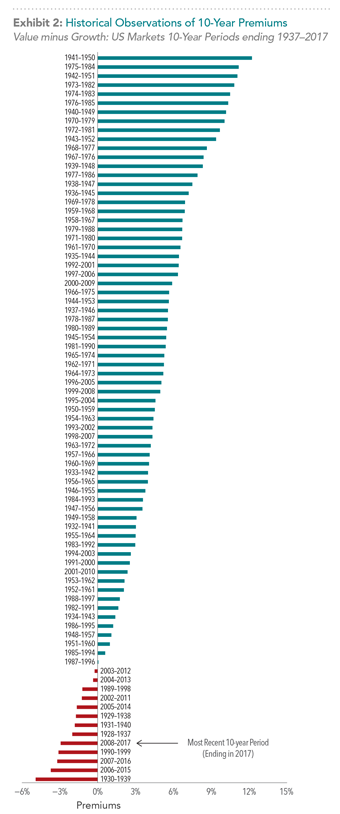

To demonstrate this fact, Dimensional created the following chart for their article “Where’s the Value?” that displays the advantage of Value stocks over Growth stocks for various rolling 10-year time periods. Below is that chart. Note that it is sorted from best return (1941-1950) to worst return (1930-1939). You can see that most time periods advantage Value stocks (the green bars).

This chart illustrates that although the ten years from 2006-2015, 2007-2016, and 2008-2017 have been some of the worst decades for Value Investing, the overall historical record still shows a better return with Value stocks.

It is generally good to tilt toward Small and Value in any static asset allocation. Adding a dynamic tilt based on forward P/E ratios may boost returns by purchasing a category when it is historically inexpensive and under-weighting it when it is historically expensive.

While Value has been underperforming Growth since 2007, the forward P/E ratios over that time period have been suggesting that Growth was relatively inexpensive. This means that, during that time period, a dynamic tilt suggested tilting more towards Growth than you otherwise would have.

Now that Growth investments have appreciated so much more than Value, forward P/E ratios are starting to suggest that Growth investments are comparatively more expensive. Dynamic tilt is starting to recommend tilting away from Growth again and back towards Value.

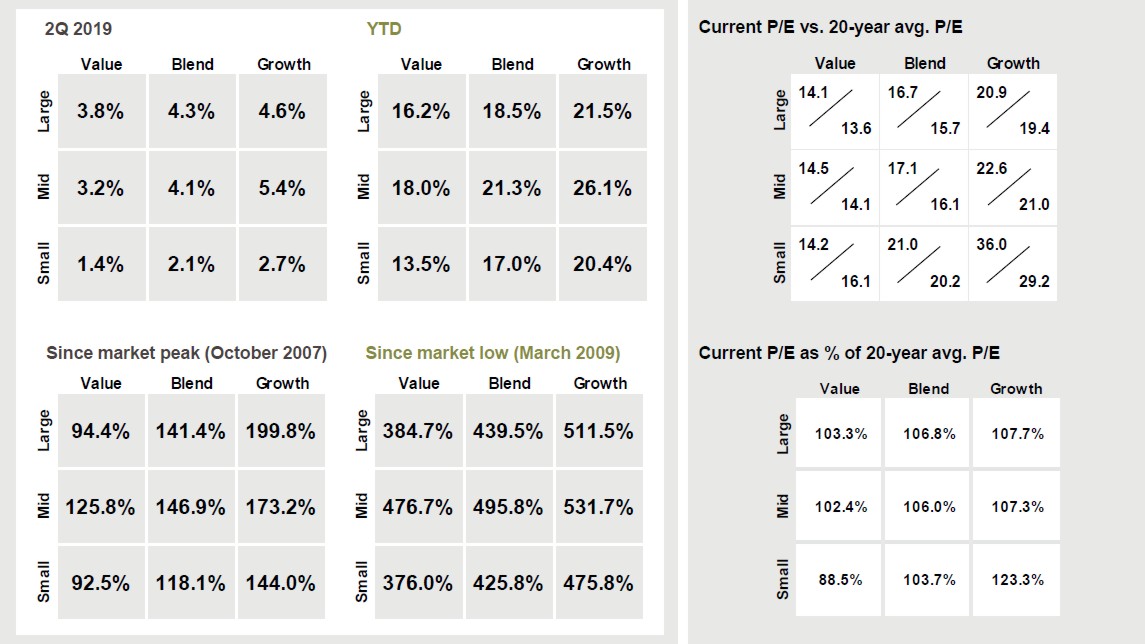

Here is a chart from J.P. Morgan’s latest quarterly Guide to the Markets showing both the superior performance of Growth (see how the Large, Mid, and Small Growth returns are large compared to the remaining six boxes for each time period) and the relatively inexpensive historical valuation of Small-cap Value (see how the “Current P/E as % of 20-year avg. P/E” for Small Value is less than 100%).

Recently forward P/E ratios have been suggestive that the Growth trend may be waning and Value investing may once again outperform growth. But who is to tell when this will happen? Valuations based on forward P/E ratios are suggestive not predictive.

It is interesting though that the dynamic tilt recommends moving away from Growth at the same time that pundits in the media are questioning Value Investing as a strategy. It confirms that the crowd is usually wrong and it pays to be a contrarian. Be patient and give a brilliant investment plan time to perform.

I don’t have a crystal ball, and I don’t know which category will perform best over the next decade. But I would think it likely that something like SPDR S&P 600 Small Cap Value ETF (SLYV) will out perform SPDR S&P 600 Small Cap Growth ETF (SLYG) over the next decade, or the Vanguard Small-Cap Value ETF (VBR) will out perform Vanguard Growth ETF (VUG) or Vanguard Small-Cap Growth ETF (VBK).

Time will tell.

Photo by Kendra Coupland from Pexels