None of us can anticipate all of our expenses. Every stage of life brings a whole new set of unanticipated needs. Even after identifying every outflow you think you might have, there will still be significant unexpected costs. For this reason, we recommend constantly budgeting for financial surprises in an Unknown Budget.

None of us can anticipate all of our expenses. Every stage of life brings a whole new set of unanticipated needs. Even after identifying every outflow you think you might have, there will still be significant unexpected costs. For this reason, we recommend constantly budgeting for financial surprises in an Unknown Budget.

That being said, there are several large expenses which can be anticipated and prepared for even though they are irregular and the timing of them unpredictable.

In 2015, the PEW Charitable Trust analyzed the frequency and impact of household financial shocks . Among households surveyed, 24% stated that, “the place you live or appliances needed major repair or replacement” during the past 12 months.

Major home repairs are a very common upset to family finances. Even though they are common, they are also almost always surprises.

Megan’s last memorable home repair was $12,000 for a new roof and upstairs ceiling after rain leaked into the guest room.

David’s last memorable home repair is currently $3,000 to relocate a colony of 20 to 30 bats living in the attic as well as repair and seal the house’s siding so they don’t come back.

These are the financial shock of a major home repair. They are expensive and surprising.

Although we do not agree with this strategy, some recommend replacing items before they fail in order to avoid surprises and upsets. The thought is that being without an essential item is so inconvenient that you will either suffer because you do not have it, make a hasty decision in purchasing a replacement, or incur additional costs because of the break. This group suggests you take the time to shop for what you really want before the predecessor fails. In this way, you will have a newer item selected and installed before your old one breaks.

We believe instead that you’d be better off waiting until the first one breaks in a way it cannot be repaired. Here is our reasoning:

First, you do not know when an appliance or feature of your house is going to break. Your current one might last a long time. Some appliances last 30 years or more without any problems. Also, we think it this is more than just perception; appliances today are not built to last as long as they used to be. If you have a 20-year-old washing machine that is not giving you any troubles, it may last longer than a brand new washing machine that has built-in obsolesce.

Second, although an appliance may cause trouble when it breaks, you can prepare for many of these troublesome scenarios. The quintessential example of a troublesome break is a hot water heater. Imagine that your hot water heater rusts out, busts a hole, and leaks wherever it sits. This could cause water damage.

However, instead of living in fear of this possibility, we say you should just anticipate it. Anticipating the possibility means that we put our hot water heater on a drain pan. Water from any minor leaks will be contained. It would have to be a major leak before it would be a problem.

Third, saving and investing while you wait for your first appliances to break can earn you a significant amount of money.

Image that an appliance costs $2,000 and you are tempted to replace it every 10 years but it might easily last 15 years.

Over 30 years, you would spend $6,000 replacing it three times, once every 10 years. If you only replace it every 15 years though, you would only spend $4,000 replacing it twice over the same time period. Waiting the extra 5 years is an obvious savings of $2,000, the price of one appliance. However, when you consider the time-value of money, the savings is actually much greater.

Assume that you save and invest $200 per year in a budget for the purchase of a new version of this appliance. Assume your investments earn 7% annually. If you purchase a new appliance every 15 years instead of every 10 and let your investments continue to grow those extra 5 years, at the end of 30 years you would have $6,156 more in investments than if you purchased a new appliance every 10 years.

In other words, assuming that you save and invest the difference, you could have saved over three times the cost of the appliance over 30 years.

On average people replace their appliances more frequently than necessary even though an appliance may last much longer than expected. If an appliance does break, it is much cheaper to repair, if possible, than it is to replace. Knowing which appliances can be easily repaired and which appliances are not economical to repair is important. The internet can tell you that.

I (David) am terrible at appliance repairs. In my youth when we did not have money, even I was able to repair a dryer, a refrigerator, and a washing machine by myself without much in the way of instructions. For today’s do-it-yourself crowd, the Internet abounds with step-by-step video tutorials on how to repair nearly every popular make and model.

Even if you cannot attempt the repair personally, calling a repair shop can still be the most affordable option. One suggestion is to consider making repairs that cost less than half of the price of a new unit. Finding an honest appliance repair shop is probably more important than finding the cheapest hourly rate. An honest shop will tell you which appliances are worth attempting to fix.

When it comes to estimating ongoing required home repairs, we usually recommend using 1% of the value of your home as a ballpark estimate. Your costs will likely be lower than 1% for years until some major repair or renovation needs to be done. Then, all in one year, you may need to put on a new roof, replace half the windows, and repair the heating and cooling system. As an example, if your home is assessed for $300,000 you would set aside $3,000 a year for home repairs.

If you have an older home that may have deferred maintenance, we’d recommend increasing the minimum to 2% of the value of your house.

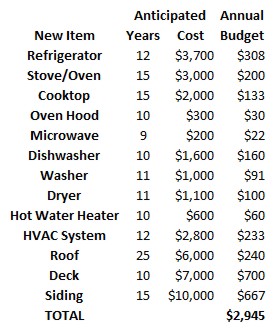

If you’d like to get more specific for your home, you can budget for home and appliance repairs by estimating costs. You can do so by researching the anticipated cost of a new appliance and dividing by the number of years you expect that appliance to last. The total is the amount you should be budgeting each year for home and appliance repair. We have a simple example budget of around $3,000 per year for such repairs, but if you go this route, you should do the research for your own home to get an accurate estimate.

If you’d like to get more specific for your home, you can budget for home and appliance repairs by estimating costs. You can do so by researching the anticipated cost of a new appliance and dividing by the number of years you expect that appliance to last. The total is the amount you should be budgeting each year for home and appliance repair. We have a simple example budget of around $3,000 per year for such repairs, but if you go this route, you should do the research for your own home to get an accurate estimate.

If budgeting thousands of dollars per year for unexpected and unknown home and appliance repairs seems excessive, you will understand why unanticipated expenses can catch many families unprepared.

If you cannot afford to budget for home and appliance repairs, then you are likely a good candidate to rent. In rentals, the landlord is the one who shoulders the risk of major home repairs rather than you.

Some praise home ownership as a wise investment decision, but we disagree.

You can rent for your entire life and do just fine financially. Your rent will increase with inflation, but so will your investments if you keep them. If renting allows you to aggressively save and invest, it could be the best financial decision. It’s not throwing money away; it’s giving yourself the opportunity to build equity by investing in the markets.

The home you live in is not an investment. An investment is something that pays you money. Buying a house with a 30-year mortgage can be a winning equation, but it isn’t always.

Sinking your money into home ownership has an opportunity cost. Every dollar you turn into home equity you’re not investing in the markets. The equity of your house may keep up with inflation, but the stock market on average has returns over inflation. If you don’t benefit much from the tax advantages of having a mortgage and can find a rent low enough, you may actually make more money renting and investing rather than buying.

If you do not have the margin in your finances to budget completely for major home and appliance repairs, mortgage payments, and property taxes, then it is likely wiser for you to save, invest, and rent until you do.

Photo by Tierra Mallorca on Unsplash