The Bush tax cuts are scheduled to expire at the end of this year. Also ending are provisions for dividend and capital gains taxes. Though these may not be the final tax rates, these numbers are part of President Obama’s proposed 2013 changes.

The qualified dividend tax rate is currently at a maximum of 15%, as are capital gains. Starting January 1, 2013, dividend tax rates will go up to the investor’s ordinary income rate. Ordinary income tax rates are also set to go up in 2013, with the highest tax bracket moving from 35% to 39.6% plus a 3.8% Medicare tax, meaning the highest tax bracket effectively moves up to 43.4%.

Dividends are already taxed twice: corporations pay taxes on their profits, and when they distribute dividends to investors, the investors also pay taxes on the dividends. Many countries adjust for this double taxation by keeping individual dividend taxes low.

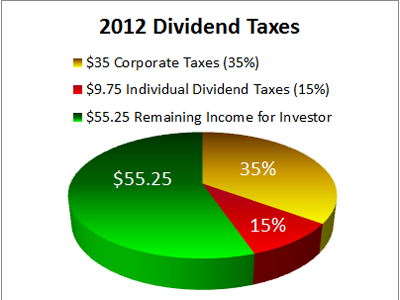

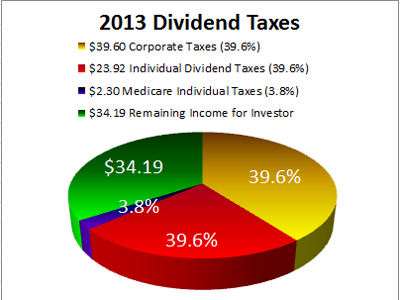

Here is an example to illustrate the difference between current dividend taxes and future dividend taxes:

The ABC Company has $100 to distribute to Joe (in the top income tax bracket) as a dividend payment. First, ABC pays taxes at a top corporate rate of 35%, leaving $65. Joe receives the $65 dividend payment, and pays a 15% federal tax, leaving him with dividend income of $55.25.

Next year, the ABC Company has $100 to distribute to Joe. ABC pays taxes at the top corporate rate of 39.6%, leaving $60.40. Joe receives the dividend payment, and pays taxes of 39.6% ($23.92 in taxes) plus 3.8% ($2.30 in taxes), leaving him with $34.19.

Of course, not everyone is in the highest tax bracket, but unless you will be in or below the 15% tax bracket next year (with income up to $35,350 if single; $70,700 if married filing jointly), your dividend tax rate is also going up next year.

One important aspect of financial planning is putting your assets in appropriate vehicles to maximize their value. Using dividend stocks for an income stream has been a popular strategy, but now capital gains will be taxed at 15-20%, and will only be taxed once. Consider putting dividend stocks in a Roth IRA instead of a taxable account; you will keep up to 43.4% of your dividend income stream.

We are not tax advisors, and we encourage you to talk to your financial advisor or CPA about how to structure your investments to avoid getting gauged. Talk to a fee-only financial planner about a strategy for your investments going forward.

2 Responses

Steve Haworth

2012 dividend tax figure is wrong. 35+15 = 50% Pie graph in incorrect.

Austin Johnston

Hi Steve,

Thanks for checking my math — it’s better to check than not! However, the calculation isn’t quite as simple as 35% + 15% = 50%.

This is because the company pays taxes on $100, and the investor pays taxes on $65, not $100.

Here’s the breakdown:

The $100 the company sets aside for a dividend is first taxed at 35% (100 * 0.35 = $35 tax. Then subtract the $35 from $100), leaving $65 for the investor, BEFORE investor taxes.

Then the investor is taxed 15% on the $65 they received (65 * 0.15 = $9.75 tax. Subtract the $9.75 from $65), and the remaining amount is $55.25.