Greetings! This page was designed for those attending David John Marotta’s presentation “Seven Adviser Strategies That You Should Be Using Now” to the DC Metro chapter of the American Association of Individual Investors.

If you aren’t already subscribed to the blog, subscribe now in order to receive of thousands of dollars in free weekly wealth management advice.

Advisor Strategies That Boost Returns

|

CAPM: The First Factor of Investing Modeling investment returns seeks to find an equation to predict your expected returns as much as possible. The simplest equation for the markets would be “Return equals 11.71%.” This has been the average return from 1927 through 2010, the zero factor model. |

|

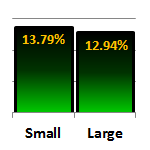

Size: The Second Factor of Investing The second factor of investing is size as measured by a stock’s total capitalization. Over time small cap will outperform large cap even after factoring out measurements of volatility. |

|

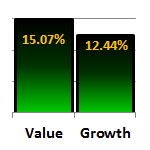

Value: The Third Factor of Investing A stock’s valuation is measured on a continuum from “value” to “growth” In broad strokes, value stocks are cheap and growth stocks are expensive. |

|

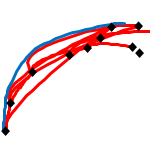

The Efficient Frontier The efficient frontier measures all investments on a scale of risk and return. Risk is commonly placed on the x-axis, and return is placed on the y-axis. |

|

Asset Allocation and the Efficient Frontier Crafting portfolio asset allocations is a combination of art and engineering. Just as a blending of colors can produce cerulean, so a blending of indexes produces a unique shade of risk and return. |

|

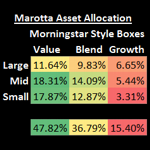

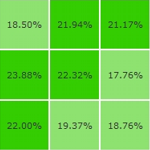

Style Boxes and the Efficient Frontier The Marotta allocation method is a proportionally weighted allocation based on the square of each Sharpe ratio. Squaring the Sharpe ratio drastically reduces asset categories in proportion to their distance from the efficient frontier. |

|

The Shiller Ten-Year P/E Ratio What we would really like to measure are the changes in price (P) that cause a company with a good long-term track record to look relatively cheap. Economist Robert Shiller created just such a measurement. |

|

Using Dynamic Asset Allocation to Boost Returns Think of static asset allocation as where to set your sails and dynamic asset allocation as a way to keep your balance as your boat glides and sometimes bounces through the waves. |

|

Style Box Annualized Returns For The Past Three Years Morningstar data for the 3-year annualized returns based on style boxes shows us three interesting lessons. |

|

Roth IRA Conversions and Roth Segregation Strategies Roth accounts have several advantages over traditional retirement accounts. |

| How to Calculate An Advisor’s Value Planners can add the equivalent of a 1.82% annual arithmetic return to clients through these five components. | |

|

Retirement Planning Retirement Planning is perhaps the single most important goal of comprehensive wealth management. |

|

Tax Planning A dollar saved on taxes is worth more than a dollar earned. If you earn another dollar, they will just tax you again. |

|

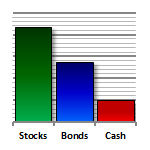

Risk – Return Decisions Portfolio construction begins with the most basic allocation between investments that offer a greater chance of appreciation (stocks) and those that provide portfolio stability (bonds). There is no such thing as a safe investment that pays market rates of return. |

|

Rebalancing asset classes and subcategories Diversifying your portfolio means finding assets that have value on their own merits but do not move exactly alike. Here are the principles on building and rebalancing asset classes and subcategories. |

|

Gold, Silver and Resource Stocks The optimum asset allocation to physical gold and silver is 0%. Instead, we recommend you use resource stocks as an inflation hedge. |

|

Rules For Selling Highly Appreciated Stock Now that the Bush tax cuts have expired and Obamacare will add additional tax burdens, many people need to think twice before realizing a large gain on their investments. |

|

Fourteen Ways to Avoid Paying Capital Gains The capital gains tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty. |

|

Smart Tax Planning for the Gap Years Many families seek financial planning advice specifically for retirement. But if they wait too long, they miss an important tax-planning opportunity. A great strategy is to take advantage of the time between retirement and Social Security at age 70, the so-called gap years. |

|

Inflation Inflation is one of the most important factors in nearly every aspect of financial planning and wealth management. |

|

|

|

|

Safeguarding Your Money Given all the greed and deceit in the world of financial services you shouldn’t have to trust your financial advisor. Here is a list of eight safeguards that should be in place to help safeguard your money. |

|

Ten Questions to Ask a Financial Advisor Here are ten questions you should ask any prospective financial advisor. |

|

|

|

|

AAII 2013 As a bonus, here are some of the aspects of comprehensive wealth management at AAII presentations in February of 2013. |