Allan S. Roth writing for Financial Planning magazine has a great article entitled “Calculating An Advisor’s Value.” I’ve written my own version of “How Do Financial Advisors Earn Their Fee?” and there is some overlap, but I thought it would be valuable to analyze Roth’s article which explains research done by Morningstar. Here is how Roth’s article begins:

Allan S. Roth writing for Financial Planning magazine has a great article entitled “Calculating An Advisor’s Value.” I’ve written my own version of “How Do Financial Advisors Earn Their Fee?” and there is some overlap, but I thought it would be valuable to analyze Roth’s article which explains research done by Morningstar. Here is how Roth’s article begins:

How can you quantify smart financial advice? And more important: How do your clients do so? A new Morningstar approach may help advisors put a value on their performance.

In the wake of alpha, focused on picking individual managers, and beta, which looks at how much systematic stock market risk to take, researchers at Morningstar have devised what they’re calling gamma to quantify the benefit planners can deliver to clients.

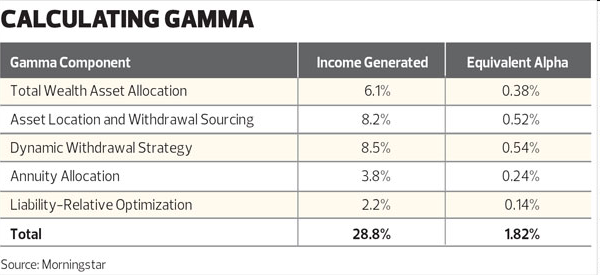

Gamma is defined as the additional value achieved by an individual from making more intelligent planning decisions. According to Morningstar, planners can add the equivalent of a 1.82% annual arithmetic return to clients through five components of gamma. Over time, that can translate to nearly 29% more that clients can spend in retirement.

Morningstar research executives David Blanchett and Paul Kaplan list five components of client service that make up gamma. (The table below spells out the payoff Morningstar expects from each element of its calculation.) None of these should come as much of a surprise to a good planner:

- Total wealth asset allocation

- Tax efficiency

- Dynamic withdrawal strategies

- Annuity planning

- Liability-relative optimization

If one or two of those terms seem opaque, you’re not alone, so below are details on the actions and services planners should be providing to clients in each of the five areas, as well as a few others.

According to Morningstar, each of these components is worth a certain percent more each year and a cumulative amount over time. Here is the chart from the article:

There is nothing magic about these strategies except that most individual investors don’t do them. They are counter intuitive and our brains are often wired to do the exact opposite. I’m often asked, “How do you earn your fee?” and this is a small part of the answer.

Each is an important enough concept that I have commented on each one separately.

- Total Wealth Asset Allocation

- Tax Efficiency

- Asset Location and Withdrawal Sourcing

- Dynamic Withdrawal Strategy

- Annuity Allocation

- Liability-Relative Optimization

- Risk Management and Estate Planning