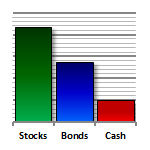

Portfolio construction begins with the most basic allocation between investments that offer a greater chance of appreciation (stocks) and those that provide portfolio stability (bonds). There is no such thing as a safe investment that pays market rates of return.

Here are several articles on the wisdom of the risk-return decision:

Follow David John Marotta:

President, CFP®, AIF®, AAMS®

David John Marotta is the Founder and President of Marotta Wealth Management. He played for the State Department chess team at age 11, graduated from Stanford, taught Computer and Information Science, and still loves math and strategy games. In addition to his financial writing, David is a co-author of The Haunting of Bob Cratchit.