How do our current tax brackets compare to historical ones? Are our taxes higher than the past? When was the most expensive time period for the U.S. income tax?

How do our current tax brackets compare to historical ones? Are our taxes higher than the past? When was the most expensive time period for the U.S. income tax?

To evaluate the burden of historical tax brackets, either the brackets must be inflation adjusted to present day dollars or present day dollars need to be deflated to historical values for taxation. In my analysis, I have used the married filing jointly brackets from the Tax Foundation’s Historical U.S. Federal Individual Income Tax Rates & Brackets, 1862-2021 . Then, I have selected six 2023 amounts starting at one million dollars of taxable income and then halving to produce five more amounts.

I have then deflated those starting values back to historical values using Inflation Data’s Historical CPI-U Table so that I can calculate the income tax owed by that valuation.

The effective rate is calculated by dividing the tax owed by the taxable income. The Tax Owed stated in 2023 dollars is then calculated by inflating the tax owed back to 2023 using the CPI-U.

Limitations

It should be noted that this analysis does not take into consideration the effect of tax deductions or exclusions on tax owed.

For example, in 2023 a couple could have a taxable income of $500,000 by having a gross income of $527,700 and taking the $27,700 joint standard deduction. However in 2017 when the joint standard deduction was only $12,700 which is maybe $15,300 in 2023 dollars, the couple could only have a gross income of $515,300 (stated in 2023 dollars) to arrive at the same taxable income from the joint standard deduction.

This is how more liberal tax deduction rules reduce your taxable income more while stricter tax deduction rules create more tax burden.

None of this complexity is represented in the analysis below. The analysis looks at taxable income only, ignoring that in some years the taxpayer could technically have had more gross income to arrive at that taxable amount.

Similarly, we are only looking at taxable ordinary income. In modern days, qualified income, such as capital gains, is taxed at a separate lower rate. However, across our history, qualified income has been taxed many different ways. In this analysis, the complexity of qualified income has been ignored entirely. We have assumed that the entire taxable income amount is ordinary income alone.

For similar reasons, Alternative Minimum Tax rules have also been ignored.

Results

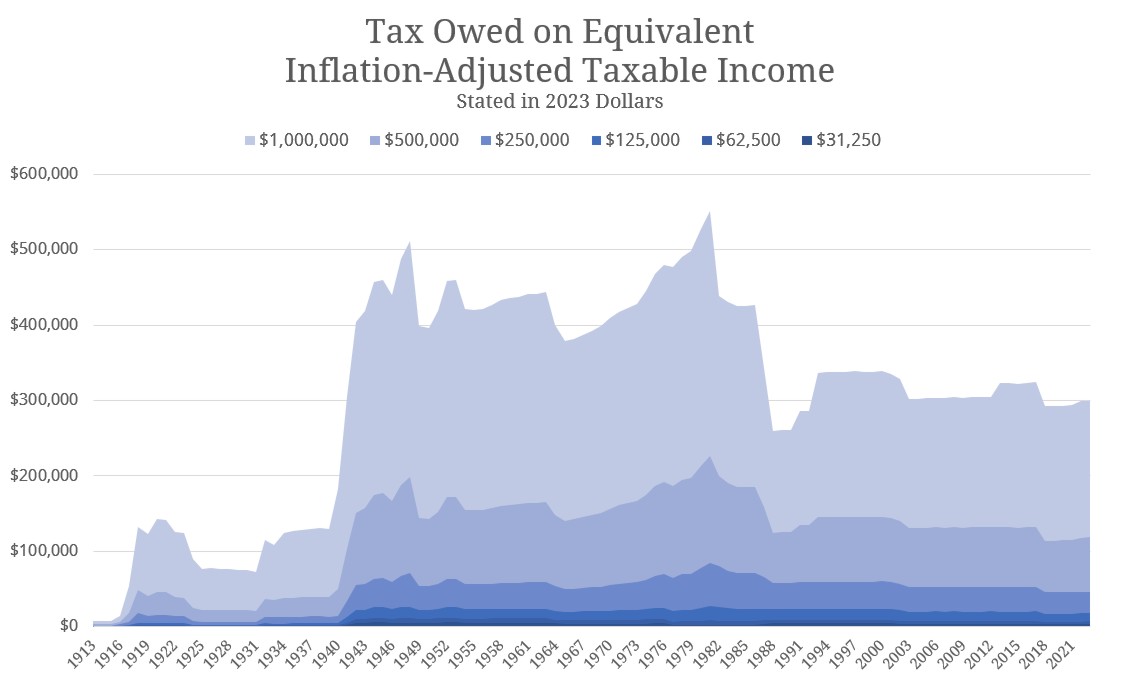

These two charts shows the six different taxable income amounts in various shades of blue. The darkest shade is the smallest taxable income of $31,250 while the lightest shade is the largest taxable income of $1,000,000.

The first chart shows the effective tax rate. The effective rate is the tax owed divided by the taxable income. A flat tax rate on this graph would mean that all taxable income amounts would share the same effective tax rate and you would only be able to see the darkest shade. Each time you can see a lighter color, that is a symptom of our progressive tax code. In a progressive tax, the more taxable income you have, the more effective rate you are forced to pay. You can see from the spectrum of this graph that our tax code is very progressive.

On this graph, you can also see the effect of bracket creep. The effective tax rate leading up to 1981 moves upward even though no major legislation increased taxes. In 1977, the Tax Reduction and Simplification Act reduced taxation for the lowest incomes. This can be seen in the steep decline for the darkest colors. However, it was Ronald Regan’s Economic Recovery Tax Act of 1981 which actually corrected the problem and changed our tax brackets to adjust for inflation. After that change, you can see that the effective rate is more level, only changing in size upon acts of Congress.

The second chart shows tax owed stated in 2023 dollars. When looking at the effective rate, it can be easy to forget just how much in taxes people are paying. For example, the 1979 effective rates for the six taxable incomes span from 49.8% to 6.5% while the 1979 tax owed spans from $498,149 to $2,029. Placed in dollars, it is easier to see the true burden and effect of a progressive tax code.

Conclusions

Nothing is more permanent than a temporary tax. Neither is anything more temporary than permanent tax relief.

In 1895, the income tax was ruled unconstitutional because it violated Article 1 Section 9 of the Constitution, which declares that direct taxes could only be levied upon states in proportion to their population compared to the nation as a whole.

Rather than create a tax system which followed the constitution, President Taft in 1909 proposed a constitutional amendment that would explicitly repeal the mandate that direct taxation be in proportion to a state’s population, allowing income taxes to be levied. In 1913, enough states ratified the Sixteenth Amendment that it became a part of the Constitution. (Interestingly, Rhode Island, Connecticut, Utah, and Virginia have never ratified it to this day.)

The sixteenth amendment is the only one to repeal a part of the original Constitution. Our politicians wanted the right to tax people unequally that much.

Since 1913, the income tax system has gotten more complex, unequal, and burdensome. When will it stop?

As Matheson Russell wrote in his 2015 article “Sordid History of the Income Tax“:

The income tax’s roots lie in class envy. Alexander Hamilton in Federalist 36 wrote that it should be “a fixed point of policy in the national administration to go as far as may be practicable in making the luxury of the rich tributary to the public treasury.” He saw wealth not as property belonging to a person as a right, but luxury that, as much as possible, should be taken away for the benefit of others. For Hamilton and people like him, it is a virtue to forcibly confiscate property as long as the victim is unpopular.

The income tax has always been unfair – that is its precise appeal. The concept is well-meaning; to lift the burdens of the most burdened is virtuous. But to forcibly do this at the expense of an unpopular minority (“the rich”) is heinous, particularly because there is no clear way to determine who “the rich” are. There is always more to take from those who have more. That is why the first thing that happened after deciding in 1861 that the industrious ought to be taxed more than poor is that rates were raised on the wealthiest. That is why they have fluctuated so wildly across history.

There is always more to take. When a government with the power to take everything believes property is “luxury” and that it is right to wrench it away to give to someone else, there is no clear way to stop.

Beware the politician who asks your permission to pick another person’s pocket. Simpler and broader methods of taxing are fairer than highly targeted taxes. The “let’s tax that guy” mentality slips into systemic oppression and incentivizes rent seeking.

Our country was founded on the desire to have representation if we were going to have taxation. Alas, now we have taxation because of representation as the government taxes us so they can use the revenue on government programs to buyback voters.

Alas, the Tax Foundation’s 2023 study “America’s Progressive Tax and Transfer System: Federal, State, and Local Tax and Transfer Distributions ” found (quote from newsletter):

In 2019, households in the bottom quintile received an effective net tax-and-transfer benefit of $1.27 for every dollar they earned in income. Households in the top quintile experienced an effective reduction of $0.31 for every dollar they earned.

There is no virtue in giving away someone else’s money.

It’s time we scrap the tax code. The time has come to adopt a tax code that looks like someone designed it on purpose.

Photo by Glenn Carstens-Peters on Unsplash. Image has been cropped.