In December 2017, the Tax Cuts and Jobs Act was signed into law by President Trump. The bill included several major changes to the tax code. Oddly though, a significant number of those changes were created with expiration dates. Most were scheduled to sunset in January 2026.

In December 2017, the Tax Cuts and Jobs Act was signed into law by President Trump. The bill included several major changes to the tax code. Oddly though, a significant number of those changes were created with expiration dates. Most were scheduled to sunset in January 2026.

After its passing, the Joint Committee on Taxation released a “List of Expiring Federal Tax Provisions” to summarize the expiring tax changes. Here are some of the important tax changes that they list as expiring on December 31, 2025:

- Modification of individual income tax rates and special rules for unearned income of children (sec. 1(j))

- Child tax credit: Increased credit amount, increased refundable amount, reduced earned income threshold, modification of identification requirements (sec. 24(h))

- Increase in exemption amount and phaseout threshold of individual AMT (sec. 55)

- Increase in standard deduction of individuals (sec. 63(c)(7))

- Suspension of miscellaneous itemized deduction (sec. 67(g))

- Suspension of limitation on itemized deductions (sec. 68(f))

- Limitation on deduction for State, local, etc., taxes (sec. 164(b)(6))

- Qualified business income deduction (sec. 199A(i))

- Increase in estate and gift tax exemption (sec. 2010(c)(3)(C))

Why create tax rules which expire so soon after they are made? The justification is a fluke of Senatorial decorum called “reconciliation.” As the Center on Budget and Policy Priorities explains, “Created by the Congressional Budget Act of 1974, reconciliation allows for expedited consideration of certain tax, spending, and debt limit legislation. In the Senate, reconciliation bills aren’t subject to filibuster and the scope of amendments is limited, giving this process real advantages for enacting controversial budget and tax measures.”

Republications knew that The Tax Cuts and Jobs Act could only be passed under the simple majority of reconciliation rules, so they needed to give heed to its requirements. Under the Byrd Rule, the Senate required that the Tax Cuts and Jobs Act be projected to impact the deficit by less than $1.5 trillion over ten years and have minimal deficit impact thereafter. To limit the on-paper, 10-year deficit impact, they sunset the tax provisions after only 8 years in 2026. This kept the projected deficit low while punting the question of if we should continue these tax cuts to a new Congress.

The on-paper projections of the effect of tax law is a little odd, as the Congressional committees use straight line projections to estimate the effect of new regulation. For example, how much tax revenue would be collected if we increase the capital gains tax to 90%? The right answer is likely $0. Who would sell their capital asset only to lose 90% of it when they could hold it and wait for a step-up in basis to keep it all? However, a straight line projection assumes no change in behavior and does simple math to estimate the tax. On paper, a 90% tax is a revenue boon.

There are similar projection errors looking backward. How much deficit did the Tax Cuts and Jobs Act end up creating? Trump’s financial aid and co-worker on the Tax Cuts and Jobs Act, Stephen Moore, claims that the tax cuts paid for themselves . He concluded this by simply subtracting revenue collected in 2017 from revenue collected in 2022. This math is also too simplistic as inflation between those years alone could account for the increase. We would need to do what we expected we would have collected under the old rules compared to what we did collect, but then we get back to the problem of straight line projections versus behavior changes. The whole thing is a pickle.

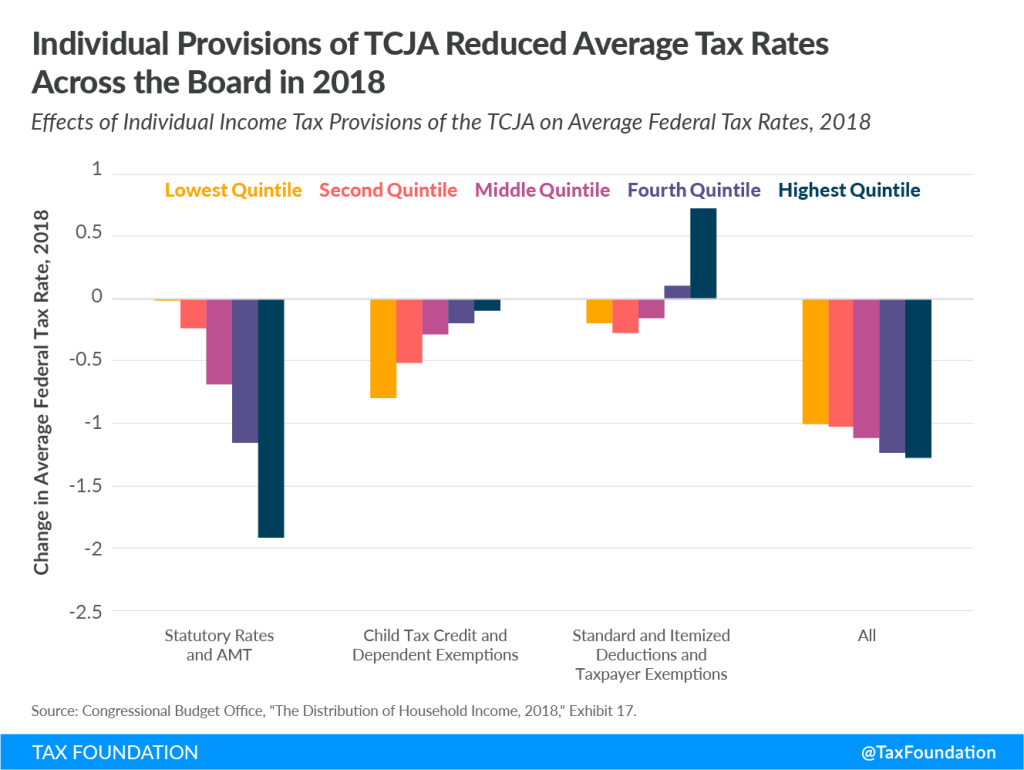

Some have criticized the Tax Cuts and Jobs Act as only helping the wealthy, but that we can test and this claim hasn’t held true. In August 2021, The Tax Foundation reported on the Congressional Budget Office finding that “the TCJA reduced federal tax rates for households across every income level while increasing the share of tax paid by the top 1 percent.”

They even generated a nice chart which shows the effect of three tax cut provisions on various quintiles of taxpayers. This shows how the deduction and exemption change helped lower income taxpayers while increasing taxes on the wealthy, while the reduced statutory rates helped all. In the end, this resulted in the Tax Cuts and Jobs Act helping each quintile approximately evenly (the far right “All” category).

What you are allowed to deduct has often been a game of playing favorites. The Tax Cuts and Jobs Act boosted the size of the standard deduction and removed some of the favoritism. Although, it also added the Qualified Business Income Deduction, which helps REIT investors and small business owners.

If we revert to the pre-TCJA rules, we’ll get back personal exemptions, which favor larger families; the unlimited SALT deduction and misc itemized deductions (including deductible investment advisor fees), which favors the wealthy; and the lower standard deduction, which hurts the poor. These changes could help some taxpayers (like those in high tax states) and hurt others (like small families who don’t itemize).

The decreased bracket thresholds and increased bracket rates will increase taxes for most taxpayers. Furthermore, the Tax Cuts and Jobs Act took the teeth out of Alternative Minimum Tax (AMT). A reversion back to the old rules means that we will once again need to do planning around it.

While off stage, the 2017 brackets, deductions, and more have theoretically been receiving their inflation adjustments, so if they come back in 2026 as the rules say they will, they will be the same but adjusted for inflation to larger dollar amounts than when we last saw them.

Brackets used to be adjusted using the CPI-U. However, as The Tax Foundation reports, “Despite most of the individual income tax code returning to its pre-TCJA structure, inflation adjustments will continue to be determined by the Chained Consumer Price Index (C-CPI), as set by TCJA, which will result in most taxes increasing when compared to their pre-TCJA levels .” The Chained CPI has an intentional substitution adjustment that the CPI-U does not have which results in further under-reporting of actual inflation.

I was unable to find a monthly C-CPI-U data set starting before 2021. If anyone knows where to find it, I’d love for you to let me know. However, I have estimated the pre-TCJA thresholds and deductions in 2023 dollars using CPI-U. Those are as follows:

| pre-TCJA | 2023 Actual | |||

|---|---|---|---|---|

| Married | Single | Married | Single | |

| Standard Deduction | $15,300 | $7,650 | $27,700 | $13,850 |

| Personal Exemptions | $4,850 per person | N/A | ||

| Exemption / Itemized Deduction Phaseout Threshold AGI | $378,700 | $189,350 | N/A | |

| QBI Phaseout Threshold | N/A | $364,200 | $182,100 | |

| AMT Exemption | $194,194 | $97,097 | $1,156,300 | $578,150 |

| pre-TCJA | 2023 Actual | |||

| Rate | Threshold | Threshold | Rate | |

| Married Filing Jointly : 1st Bracket | 10% | $0 | $0 | 10% |

| Married Filing Jointly : 2nd Bracket | 15% | $22,500 | $22,000 | 12% |

| Married Filing Jointly : 3rd Bracket | 25% | $91,600 | $89,450 | 22% |

| Married Filing Jointly : 4th Bracket | 28% | $184,750 | $190,750 | 24% |

| Married Filing Jointly : 5th Bracket | 33% | $281,600 | $364,200 | 32% |

| Married Filing Jointly : 6th Bracket | 35% | $502,900 | $462,500 | 35% |

| Married Filing Jointly : 7th Bracket | 39.6% | $568,050 | $693,750 | 37% |

Will these brackets come back? Rules as written indicate they will, but our politicians will have a say in it.

Biden has repeatedly called for a repeal of the Tax Cuts and Jobs Act and has released a budget proposal which does as much and then also adds several new tax bullets targeted at the wealthy. It appears that for him “wealthy” starts at an AGI of $400,000.

Meanwhile, many House Republicans have campaigned on the promise of trying to make the Tax Cuts and Jobs Act permanent . Indeed, there have already been two proposed TCJA Permanency Acts, one in September 2022 and one in February 2023. Neither have progressed into anything, nor are they expected to any time soon. However, from a cursory review of the proposed text, it is looking like these congressmen are intending to make new tax law inspired by the TCJA more than making what we have now permanent.

In my view, making the law permanent would be writing a bill which removes the expiration phrases from our current tax law. Instead of that, they are letting the Tax Cuts and Jobs Act expiration happen while rewriting the pre-TCJA code with updated dollars and percentages… and those updated dollars aren’t always the same.

Unfortunately, this just adds to the uncertainty. Will the current tax code sunset in 2026? Probably. It seems that even the proponents for keeping what we have are not really keeping what we have. However, what tax code will we have in 2026? That is anyone’s guess.

In an upcoming article, I will be discussing how to create a tax plan when you have tax uncertainty. To make sure that you don’t miss that article, I recommend that you subscribe to our free weekly newsletter here.

Photo by Aske Hippe Brun on Unsplash. Image has been cropped.

April 19, 2023 Update: A prior version of this article incorrectly reported the 2023 Actual brackets under pre-TCJA and the pre-TCJA brackets under 2023 Actual. This has been corrected.