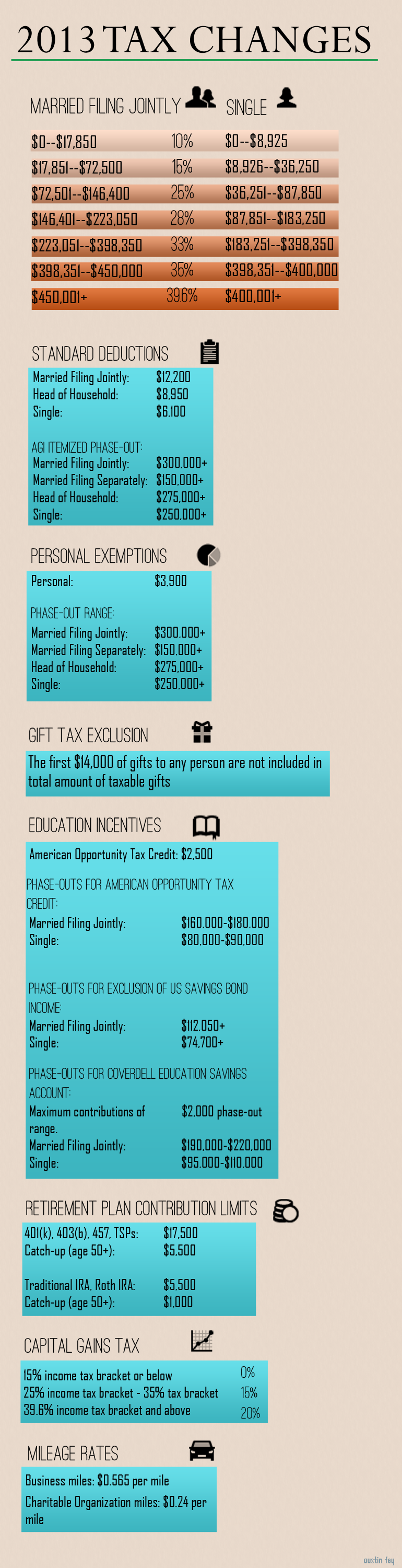

2013 brought many changes, many of them small (but notable), into the tax code. Here’s a breakdown of the highlights:

Related Articles

We have no secret ingredient at Marotta Wealth Management. Instead, we openly and publicly publish our strategies as articles on our website. |

Follow Austin Fey:

Austin Fey

Wealth Manager

Austin Fey is a Wealth Manager at Marotta Wealth Management, specializing in charitable giving and asset allocations. She is a regular contributor to our Marotta On Money articles, often giving advice to those just getting started in finance.

Latest posts from Austin Fey

- #TBT How to Make a Financial Independence Bucket - July 4, 2024

- 2024 Tax Facts - November 13, 2023

- #TBT Harvest Major Capital Losses Whenever You Have Them - October 26, 2023

2 Responses

Dave

An error in the last line. IRS mileage rate for charitable organizations is still 14 cents.

Austin Johnston

Thanks for catching that, Dave! You’re right — the last line on mileage for charitable organizations should say $0.14, not $0.24. Sorry about that; thanks for reading closely!