After my daughter turned three years old in 2019, my husband realized that she had come into her own as a useful farmhand. She was trustworthy to stay in our yard without extreme supervision, treated basic farm tools with care, and performed many of his simple tasks independently. Her first job was pulling weeds for one cent per weed, and she funded her Roth IRA for $1.70 in 2019. As the fall of 2019 gave way to the winter of 2020, her assigned tasks evolved and her earning potential increased. Over the course of 2020, she earned $12.51 as a household employee doing tasks like sweeping the garage, unloading the dishwasher, sorting the laundry, watering the plants, and picking up sticks.

After my daughter turned three years old in 2019, my husband realized that she had come into her own as a useful farmhand. She was trustworthy to stay in our yard without extreme supervision, treated basic farm tools with care, and performed many of his simple tasks independently. Her first job was pulling weeds for one cent per weed, and she funded her Roth IRA for $1.70 in 2019. As the fall of 2019 gave way to the winter of 2020, her assigned tasks evolved and her earning potential increased. Over the course of 2020, she earned $12.51 as a household employee doing tasks like sweeping the garage, unloading the dishwasher, sorting the laundry, watering the plants, and picking up sticks.

Although it is a little known fact, household work such as this does indeed qualify as earned income, even if the employer is the child’s parents. As she was under the tax return filing requirements and exempted from payroll taxes, she was able to contribute the full amount she had earned to her Roth IRA without taxation or trouble.

For a step-by-step guide for setting this up for yourself, read my first year’s article “Funding a 3-Year-Old’s Roth IRA.”

Tasks & Earnings Record

In total for the year, my daughter worked on 34 different days earning $21.50.

We continued to hire her for several of the same tasks as last year such as sorting laundry, unloading the dishwasher, watering the plants, and picking up sticks. Some new ones we added this year were:

- Monitoring the laundry. I currently have the family chore of laundering my own clothes, my daughter’s clothes, and the household sheets & towels. Alas though, I have a poor memory for moving my laundry on to the dryer. I will put it in the washing machine and forget that I have laundry at all until nighttime when it has an odd smell and I have to wash it again. So this year, I paid my daughter to babysit my washing machine cycle. She would read in our nearby reading nook listening for the end of the cycle. Then, when the cycle finished, she would come find me, and remind me to move the load on to the dryer.

- Feeding the cats. As I have mentioned before in articles, we have two Balinese cats. While one of our cats could regulate his own eating from a gravity feeder, our other cat would get fat from the buffet. As a result, we feed our cats at regular mealtimes. My husband is responsible for feeding the cats in the morning and I am responsible for feeding the cats at night. Sometimes though, one of us was too rushed to do our job, so we occasionally hired our daughter to fill in for us.

Also new this year was that she was hired by her grandfather to pick up sticks in his yard (“perform minor chores around a private home”). While the rules are different for non-parent household employers, her wages of $2.50 from this new job were well below the $1,000 that would have required additional compliance from her employer.

This is our third year making contributions. Because the custodial Roth IRA for my daughter was already open, I could simply contribute what she earned and invest it. Because of this simplicity, I contributed to her Roth shortly after she earned it. After logging on, I could easily use Schwab’s online transfer tool to fund her Roth IRA as I am the custodian on the account. We would also count and pay her the coins when she came to collect her earnings, and she would tuck them gingerly into her wallet.

This effectively meant that we, as her household employer, paid her what she earned and, as her parents, gave her a cash gift to fund her Roth IRA.

Investment Performance

Last year, her portfolio was a blend of Schwab S&P 500 Index (SWPPX) and Schwab U.S. Mid Cap (SWMCX). This year, I added Schwab Small Cap Index (SWSSX) and Schwab U.S. Large-Cap Value Index (SWLVX) to the portfolio. Each purchase represents an adorably small number of shares, like the 0.0340 shares (that’s one thirtieth of a share) of SWMCX bought for $2.

That’s why we’ve picked mutual funds instead of exchange-traded funds (ETFs). Although there are many advantages of ETFs over mutual funds, most custodians do not yet allow fractional trading (purchasing less than one share) of ETFs. In contrast, mutual funds allow you to buy a specific dollar amount because the managers will simply pool your assets into their invested assets and make their purchases accordingly.

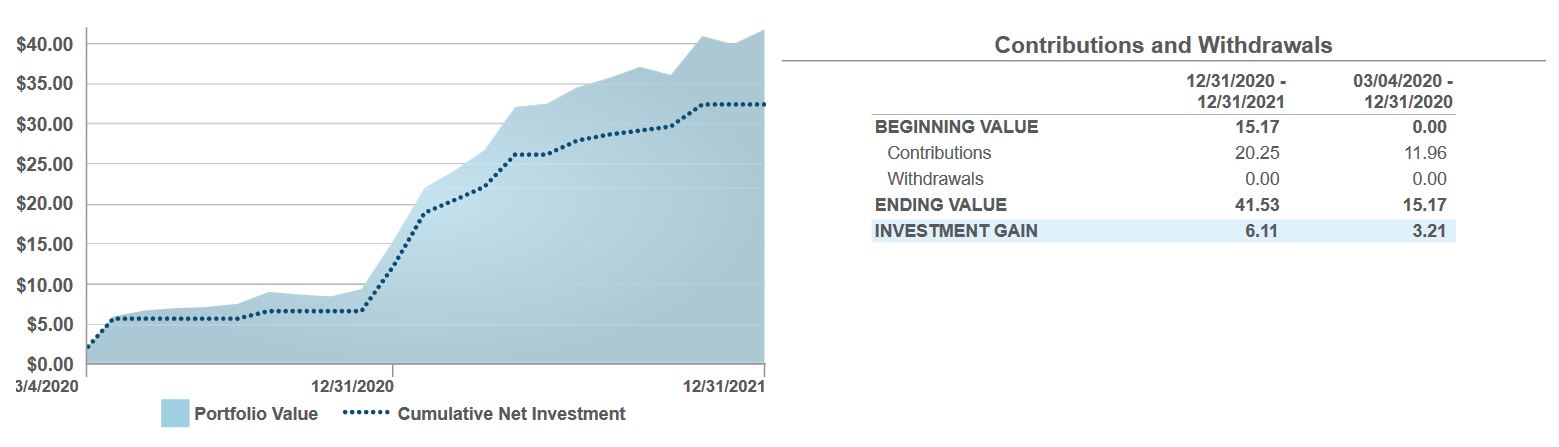

Here is the investment performance of her Roth IRA for the year as reported on her Marotta Quarterly Report. The last $2.25 of her 2020 earnings I contributed in 2021 as a prior year contribution and the final $3.25 of her 2021 earnings I contributed in 2022 as a prior year contribution. As a result, the “Contributions” line is accurate to the calendar year but not the tax year.

The dotted line on the graph represents her contributions to the account with diagonal bends representing months with contributions. The shaded line above it represents the account balance. The difference between the two is investment gain.

Again, I say that my daughter is lucky to have investment gain so soon after contributing. Thanks to the volatility of the stock market, it is typical for the market to cross each new high an average of 25 times over 5.5 years. I would expect her portfolio to dip below her contributions at some point, but I also expect that dip not to matter. She is a long-term investor with plenty of time to recover.

Tax Return

When it comes to filing a tax return for 2021, the simplest summary is if your child has more than $1,100 in total income for the year, you should read through the filing rules.

In addition to the household wages, my daughter also has an UGMA funded by great-grandparent gifts which generates small dividends, interest, and capital gains. Because she is in the 0% capital gains bracket, we occasionally intentionally harvest capital gains in her UGMA to keep the future tax burden lower.

In 2021, she had $54.22 of dividends, $114.71 in realized capital gains, and $1.76 in capital gain distributions from mutual funds. This is a total unearned income of $170.69 and a total earned income of $21.50 for a gross income of $192.19. The rounded $192 of gross income is less than the $1,100 threshold that requires tax return filing.

For this reason, no tax return was necessary.

Also, because my child is under age 21 and elected not to withhold any federal income tax, we did not need to file a Schedule H on our own return.

Concluding Thoughts

Although these numbers are admittedly small sums, large wealth happens from giving small savings time to grow. I expect that over the years, contributions like these will grow into larger and larger sums until suddenly, the same people who might mock me for having put pocket change into my daughter’s Roth IRA today will be jealous of the princely sum those small investments have grown to in the future.

Assuming an 8% annual return, a 60-year time horizon, and the tax-free growth of a Roth account, the future value of these funds can be estimated by moving the decimal point. Every $1 may be worth $10 in 30 years and $100 in 60 years, not including future contributions. With annual contributions, every $1 annually contributed may be worth $100 in 27 years and $1,000 in 56 years.

My favorite part of my daughter’s Roth IRA is still that she has earned it all. I have seen her work hard, learn valuable lessons, and truly earn her wage.

Photo by author.