I started working young in life, first as a babysitter and later as a web and graphic designer. As a financial dependent with a miserly personality, I saved and invested almost everything.

I started working young in life, first as a babysitter and later as a web and graphic designer. As a financial dependent with a miserly personality, I saved and invested almost everything.

By the time 2008 came around, I had been saving and investing for years. Although I was contributing to my Roth IRA every year and regularly investing my wages, I had no reason to look at my investments. I was a senior in high school. I mailed the checks off to my bank in deposit envelopes and signed paperwork to fund my Roth IRA. I had no need to look at my accounts. I knew the market was going down, but I accidentally took Bogle’s advice and didn’t peek at my own accounts.

That Halloween, one of my close friends and fellow high school seniors made a costume out of cardboard. It was a tombstone she wore around her neck that read “RIP 529.” I remember thinking, “I wonder if I should look at my accounts,” but I was a senior trying to get ready for multiple AP tests; I didn’t have time to look.

If I had looked, I might have worried. That 2008 Halloween, the twelve month return of my personal investments was -41.56% and, even though I had been investing for over a decade, my assets were just barely worth more than my contributions.

Because I was working for Marotta Wealth Management at the time as a computer programmer, website manager, and graphic designer, my employee benefit gave me our full client service. Without me or my emotions getting in the way, my co-workers just steadily and systematically rebalanced. They sold what had gone up and bought what had gone down. The 2008 recovery was slow, but for years my accounts quietly recovered this way and continued their long-term growth.

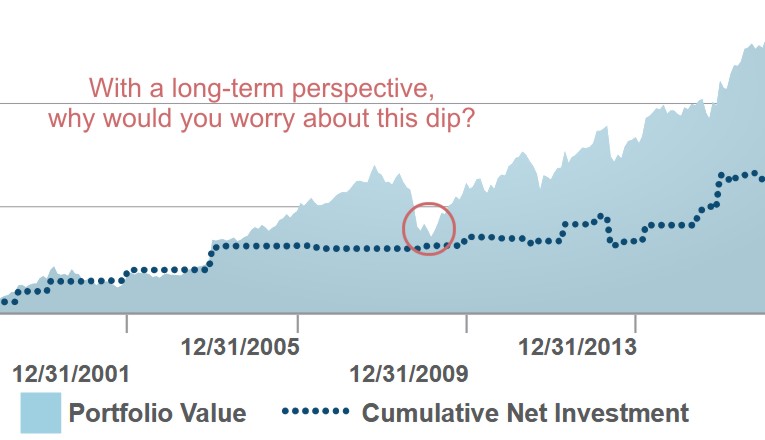

On the Marotta quarterly reports, we include a chart that shows your portfolio value (a filled line) compared to your total contributions (a dotted line). I call it the mountain chart because my portfolio value is like a mountain compounding up above my contributions.

When I look back on my mountain chart, the 2008 drop looks so small. It is a tiny V in the growing mountain. When you are investing for the long-term, there is no reason to worry about the dip. Long-term investors have time to recover.

With a over half of a century to recover, I was fine in 2008, so it is good that I didn’t panic or worry. This time in 2020, I still have over thirty years to recover and nothing to worry about. When one day I start to approach my retirement years, I will plan ahead by cultivating my stability allocation. In this way, the next time and the time after that, I will still be fine and have nothing to worry about.

The market trends upward. It has bear markets, recessions, and crashes along the way, but it still trends upward. The longer the time period you look at, the less drops there seem to be. In the long-run, these dramatic dips are but V’s in the mountain chart. Stay the course. Rebalance. Don’t peak. You will be okay.

Photo by Alex Geerts on Unsplash