Young people often have a difficult time envisioning getting or being older. And yet, when they are older, many regret not having prepared better when they were young.

Young people often have a difficult time envisioning getting or being older. And yet, when they are older, many regret not having prepared better when they were young.

Saving and investing while you are young makes a huge difference. Those who fail to save when they are young will miss out on the power of compounding returns. For every 7 to 10 years someone fails to save and invest, they cut in half their ultimate retirement lifestyle.

In 2019, the contribution limit for Roth IRA funding is $6,000 per person for those under 50 years old.

This means that a married couple with sufficient earned income can save $12,000 in Roth.

If they didn’t save the $12,000, they could spend the same amount on an endless list of other attractive options. Paying off the mortgage, traveling abroad, buying a new car, remodeling a bathroom, building a home entertainment center, eating out for a year, buying a boat, or paying for a year of college are all enticing expenditures.

It is hard to prioritize saving, but it pays off. Here is how.

Stock investments generally appreciate at about 6.5% over inflation. Assuming inflation is just 2.0%, the expected return for a stock portfolio would be about 8.5%. A year after saving and investing $12,000, an 8.5% return might be $1,020. Because of short term volatility, their actual return might be anywhere from -22.76% to 40.38% which is anywhere from -$2,731 down to +$4,846 up.

In the year after, their account would have their initial contribution of $12,000 as well as their first-year growth of $1,020. Both of these balances would then receive the 8.5% return. This means $1,020 of growth on their initial investment and also $86.70 of compounding return on the first year’s $1,020.

This compounding return is why saving and investing while you are young produces more money than if you were to contribute more later.

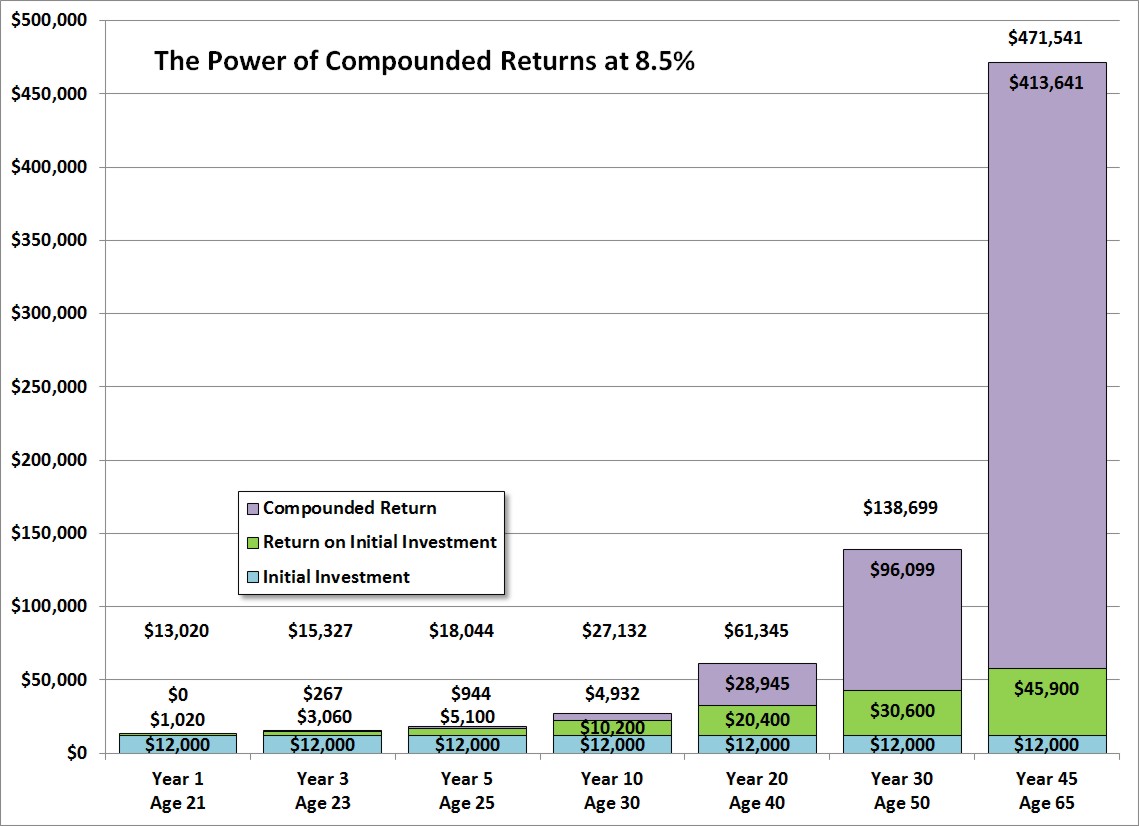

Assuming that our young couple experiences an average 8.5% return, the following graph shows how much that initial investment would be worth in the coming years, how much would be the return on the initial investment, and how much would be the compounded return on the return of the initial investment.

The blue is that first-year contribution of $12,000. The green is the cumulative growth on only that one contribution, also known as the return on investment, which is $1,020 more each year. The purple is the growth on the investment’s growth. This is the compounded return.

You can see that the compounded return is where real wealth is generated. The return on your initial investment creeps steadily up by $1,020 each year. However, the return on your investment’s return grows exponentially. In our graph, the additional compounded return added in this year is the growth on both last year’s green and purple balances.

Assuming our young couple started at age 20, by age 65 their initial $12,000 would be worth an amazing $471,541. Of that, 87.7% would be the result of compounded returns, 9.7% would be the return on the initial investment, and just 2.5% would be that initial investment.

It is important to note that although a half million dollars sounds like a lot of money, in the year 2064, inflation might have pushed the value of the dollar down by increasing prices. At even 2% inflation, cash might lose 59% of their value. Consequently, the purchasing power on these assets might only be the equivalent of $204,133 in today’s dollars.

Inflation is one of the reasons why you need to save and invest every year.

Saving $12,000 is admirable. Investing those savings is wise. Saving and investing $12,000 every working year ensures a larger retirement portfolio.

Also, as we can see from this graph, saving and investing as early as possible has a significant effect on portfolio growth. A couple who doesn’t start saving until age 35 will only experience 30 years of growth until age 65. Their $12,000 investment would only grow to $138,699 or only 29.41% of the value of what someone starting at age 20 would have had.

Save now. You can never be either too late or too early to save and invest. Soon-to-be retirees can make larger catch-up contributions. Teenagers can invest money from their first jobs. Even very young children can save in their Roth from doing chores around the house.

It is difficult to reach the young and non-affluent about critically important issues of financial planning. If they had more life experience they might have saved, and if they had saved they would be affluent. If you know someone who might appreciate this article please forward it to them.

We’ve tried to make getting started with investing as easy as possible with articles, free to use Marotta Gone-Fishing Portfolios recommendations, and even our own Investment Management “Do-It-Yourself” Service Level. Let us help you get started.

Photo by Mirko Blicke on Unsplash