My husband is an aspiring permaculture farmer in addition to a stay-at-home father. One day, he hopes to have our 1 acre lot furnished with beautiful edible landscaping that he can use as a market garden. Right now though, we are in the early stages. Much of the work is simple tasks: picking up sticks, spreading compost, planting, and weeding.

My husband is an aspiring permaculture farmer in addition to a stay-at-home father. One day, he hopes to have our 1 acre lot furnished with beautiful edible landscaping that he can use as a market garden. Right now though, we are in the early stages. Much of the work is simple tasks: picking up sticks, spreading compost, planting, and weeding.

After my daughter turned three years old in 2019, my husband realized that she had come into her own as a useful farmhand. She was trustworthy to stay in our yard without extreme supervision, treated basic farm tools with care, and performed many of his simple tasks independently. Her first job was pulling weeds for one cent per weed, and she funded her Roth IRA for $1.70 in 2019.

As the fall of 2019 gave way to the winter of 2020, her assigned tasks evolved and her earning potential increased. Over the course of 2020, she earned $12.51 as a household employee. As she was under the tax return filing requirements and exempted from payroll taxes, she was able to contribute the full amount she had earned to her Roth IRA without taxation or trouble.

Tasks & Earnings Record

We have a lot of trees, and the trees drop a lot of sticks. In addition to the sticks being a hazard to our electric push mower, my husband uses the sticks to see if he can craft all that he needs from the resources available on our lot. This means that in the winter months, he spends a lot of time picking up and sorting sticks.

In February 2020, he offered to pay our daughter one cent per twig and five cents per large stick. He gave her specific instructions — where to put the sticks for counting, how to sort them by straightness after counting, which area of the yard to gather them from, and more.

Additionally, I realized that my daughter was finally tall enough that she could help me with one of my chores that I dislike: unloading the dishwasher. I offered to pay her a quarter if she helped me unload and put away all the silverware and utensils from the dishwasher. I provided her with the tools such as a clean dish towel with which to dry any excess water and the instructions of which drawer to put each item in.

In February alone, she made $1.86 on stick collection and $0.25 on dishwasher unloading. This wage represented approximately 1 hour and 30 minutes of work. Although her hourly wage is a far cry from a living wage, she does not yet have the job skills required to command a higher wage. She is still learning how to cheerfully persevere through an undesirable task.

By August 2020, my daughter started hitting her stride in doing chores. We watched the Princess and the Frog and, motivated by Tiana’s savings jar, her own love for the Disney princess, and her father’s clever idea of charting her saving progress on a dry erase board, she fixed her sights on purchasing herself a Tiana doll from her earnings

With more motivation and efficiency in working, she increased her wage from $0.11 to $0.25 per 5 minutes which is from $1.40 per hour to $3 per hour. Although parent-employed children are exempt from minimum wage laws, three dollars per hours is very close to the federal minimum wage for children under 20 during their first days of employment which is $4.25.

The tasks we regularly hired my daughter to complete were:

- Sweeping the garage. My husband has a small woodworking station in the garage which generates a lot of wood shavings. It’s his job to clean it up but he doesn’t like to. Fortunately, my daughter loves sweeping. So he pays her to sweep the shavings out into a specific place of our yard to compost.

- Unloading the utensils from the dishwasher. My husband and I both share the task of unloading the dishwasher, which takes a lot of time. While plates, bowls, and cups are all stored in cupboards too high up for a 4-year-old to reach, our silverware is stored in an easy to access drawer. We pay our daughter to help alleviate the task of sorting forks, knives, and spoons into their respective locations.

- Sorting the laundry. We launder our family clothes together but sorted by care instructions and drying times (as I recommend in The Complete Guide to your Washing Machine and Clothes Dryer). After the clothes come out of the dryer, they then need to be sorted into piles for each family member before they can be folded or hung in the appropriate place. Although it is our responsibility, neither my husband nor I like to do this task, so the laundry often sits in the clean hamper for a few days waiting for someone to sort it. This year, we started paying my daughter to do the sorting to great success.

- Watering the plants. As an aspiring farming family, we have a lot of indoor plants and seed starts throughout the year. These require various watering schedules and other care needs. Watering the plants is my husband’s job, but he doesn’t always have time to do it. Luckily, my daughter has a great memory and is very careful with a can of water. As a result, he has been able to hire her to take care of the easy to reach plants, freeing up my husband’s time to care for the more delicate ones.

- Picking up sticks. Each winter, my husband needs to pick up sticks to protect our lawn mower from damage come Spring. It is his responsibility, but he doesn’t always have the time to do it. Thus, he hires my daughter to pick up the sticks.

In total for the year, she worked on 28 days and earned $12.51 from this employment.

Last year was our first year making contributions, so I needed to go through all of the steps of opening the Roth IRA as well as contributing. This year, since the Roth IRA was already open, I could simply contribute what she earned and invest it.

Because of this simplicity, I contributed to her Roth shortly after she earned it. After logging on, I could easily use Schwab’s online transfer tool to fund her Roth IRA as I am the custodian on the account. We would also count and pay her the coins when she came to collect her earnings, and she would tuck them gingerly into her wallet.

This effectively meant that we as her household employer paid her what she earned and as her parents gave her a cash gift to fund her Roth IRA.

Investment Performance

In 2019, we used prior year Roth contribution rules to fund her Roth IRA in early 2020 for tax year 2019. We invested those 2019 contributions of $1.70 on March 5, 2020 in Schwab S&P 500 Index (SWPPX). It turns out that March 4th was a relative peak before the steep decline of the 2020 COVID Bear Market. Over the next 18 days, this one little investment would lose 28.43% and drop to a value of only $1.20.

Despite her declining investments, we made her first tax year 2020 contribution of $3.81 and invested the money in SWPPX on March 20, 2020. This ended up being just three days before the relative bottom of the COVID 2020 Bear Market on March 23. In the next 18 days, this one little investment gained 18.95% and grew to a value of $4.53.

What investment experience this young three-and-a-half-year-old already had under her belt. She could now have both mourned the loss of investing at a relative market high and rejoiced at the gain of investing at a relative market low. However by the time she cares about such things, the difference between this particular high and the low will be but a rounding error.

We funded the Roth again on August 14, buying more SWPPX. On December 2, we bought SWMCX, Schwab’s no-transaction-fee U.S. Mid Cap fund, because her overall portfolio (her taxable UGMA and Custodial Roth together) had plenty of large cap. For the rest of the year, we used our contributions to buy SWMCX.

I joked with my co-workers that “Nine dollars is too many dollars in the S&P 500!” because of course basically every investor, myself included, has far more in the S&P 500 than the mere $9 my daughter had. However, after a year of investing in SWPPX, it felt nice to diversify into something else, and it was better for her portfolio overall.

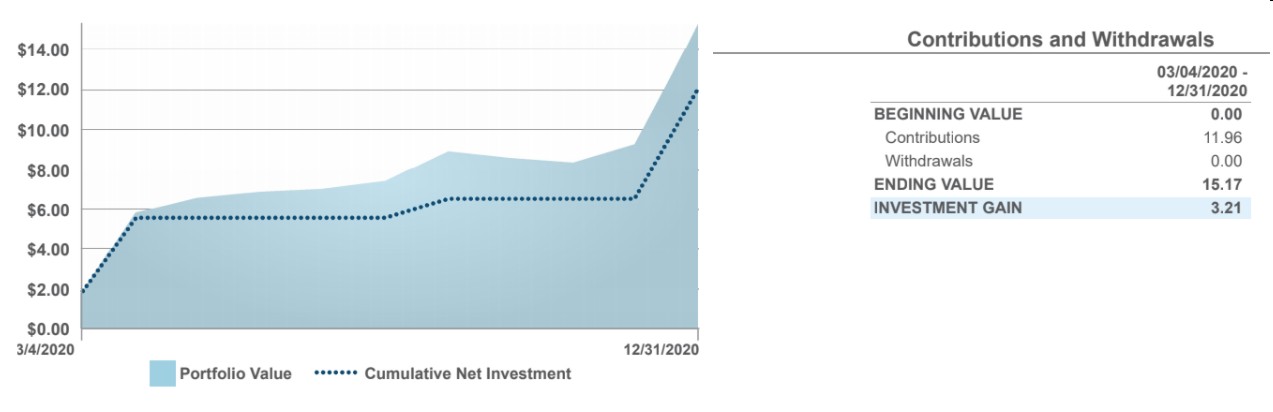

Here is the investment performance of her Roth IRA for the year as reported on her Marotta Quarterly Report. The last $2.25 of her 2020 earnings I contributed in 2021 as a prior year contribution. As a result, it is not represented on this graph.

The dotted line on the graph represents her contributions to the account with diagonal bends representing months with contributions. The shaded line above it represents the account balance. The difference between the two is investment gain.

My daughter is lucky to have investment gain immediately after contributing. The first time my husband contributed to a Roth IRA, his account balance went down. He contributed again the next year to have it go down again. Only in later years did his account start showing a gain. That’s the volatility of the stock market for you!

Tax Return

When it comes to filing a tax return for 2020, the simplest summary is if your child has more than $1,100 in total income for the year, you should read through the filing rules.

In addition to the household wages, my daughter also has an UGMA funded by great-grandparent gifts which generates small dividends, interest, and capital gains. Because she is in the 0% capital gains bracket, we occasionally intentionally harvest capital gains in her UGMA to keep the future tax burden lower.

In 2020, she had $36.25 of dividends and $109.31 in realized capital gains. This is a total unearned income of $145.56 and a total earned income of $12.51 for a gross income of $158.07. The rounded $158 of gross income is less than the $1,100 threshold that requires tax return filing.

For this reason, no tax return was necessary.

Also, because my child is under age 21 and elected not to withhold any federal income tax, we did not need to file a Schedule H on our own return.

Concluding Thoughts

Although these numbers are admittedly small sums, large wealth happens from giving small savings time to grow. I expect that over the years, contributions like these will grow into larger and larger sums until suddenly, the same people who might mock me for having put pocket change into my daughter’s Roth IRA today will be jealous of the princely sum those small investments have grown to in the future.

Assuming an 8% annual return, a 60-year time horizon, and the tax-free growth of a Roth, the future value of these funds can be estimated by moving the decimal point. Every $1 may be worth $10 in 30 years and $100 in 60 years, not including future contributions. With annual contributions, every $1 annually contributed may be worth $100 in 27 years and $1,000 in 56 years.

My favorite part of my daughter’s Roth IRA is that she has earned it all. I have seen her work hard, learn valuable lessons, and truly earn her wage.

Photo by author.