Roth IRAs are amazing tax saving tools. Roth IRAs allow investors to grow their money tax-free. Even though there is no deduction for contributions, a Roth IRA provides the dual benefits of tax-free accumulation and tax-free distributions after age 59 1/2. The long-term benefits can be significant.

Funding your Roth IRA is usually one of the best financial decisions you can make. Roth funding puts your money where it will never be taxed again during your lifetime. Those benefits are just extended the younger you are.

You need earned income to fund your Roth IRA, but, although it is a little known fact, household work such as this does indeed qualify as earned income even if the employer is the child’s parents.

Here you can find our article series detailing how and why you should fund a custodial Roth IRA for your children.

Q&A: Do I Need a Contract to Employ My Child?

Employment contracts have their origins in very old master-servant laws. With no employment contract, you can better protect your child’s freedom and childhood.

Q&A: Can I Hire My Child If I Have a Solo-401(k)?

You can find out if your child or other employee qualifies by reviewing your 401(k) plan document.

Funding a 5-Year-Old’s Roth IRA

We continued to hire her for several of the same tasks as last year, but also added a few new ones.

Can a Grandparent Employ Their Grandchild?

While navigating the rules may be trickier, your child can still enjoy easy domestic employment even when someone else is the employer.

Q&A: Amount Paid in Non-Cash?

I would recommend that you strive to pay your children $0 in non-cash compensation. Let them purchase their own rewards.

How to Use a Roth IRA for a Minor Child (Megan Russell on Financial Planning for Entrepreneurs Podcast)

On Friday, May 14, 2021, Megan Russell was interviewed by Michael Morton of Financial Planning for Entrepreneurs podcast.

Q&A: Can Someone Else Gift to My Roth IRA?

This is a common confusion with Roth IRAs.

Funding a 4-Year-Old’s Roth IRA

My favorite part of my daughter’s Roth IRA is that she has earned it all. I have seen her work hard, learn valuable lessons, and truly earn her wage.

Roth IRAs, 529 Plans, and Financial Freedom (Megan Russell on FamVestor Podcast)

On Monday, October 26, 2020, Megan Russell was interviewed by Sunny Burns and Sunmarie Burns of the FamVestor podcast.

Do Children Need To File A Tax Return To Fund Their Roth IRA? (2020)

Don’t let stress about tax filing requirements keep you or your child from a powerful opportunity to provide for their future.

Q&A: Do I Need to File Schedule H for My Child’s Wages?

I do not need to file Schedule H and imagine that most parent household employers also do not need to file this schedule.

Funding a 3-Year-Old’s Roth IRA

My daughter was employed at her first job, earned her first income, and was able to fund her Roth IRA for the first time.

How to Fund Your Roth with Babysitting Money

For domestic tasks like babysitting there are often two options: independent contractor or household employee. Taking the time to educate yourself on the difference may be worth your while.

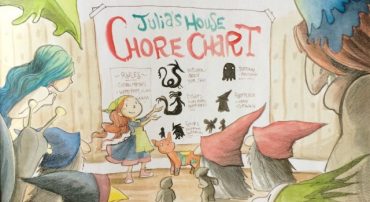

Fund Your Child’s Roth with Chore Income

There are many opportunities to pay your children. If that payment can be counted as earned income, then the child is eligible to fund their Roth IRA.

How to Open a Roth for Your Child

Someone has to be proactive about your child’s retirement and every year you don’t open a retirement account is another year you’re holding back compound interest.

Image attributions are on their related articles.