On Thursday, December 19, 2019, the S&P 500 Price Index closed above 3,200 for the first time in history. It marked the 31st record close of 2019 and its third 100 point milestone for the year. Average investors don’t know what to make of such news stories. Some think such a Bull Market bodes well for stock investments. Others think the market makes new highs before it dips. Neither position is warranted.

On Thursday, December 19, 2019, the S&P 500 Price Index closed above 3,200 for the first time in history. It marked the 31st record close of 2019 and its third 100 point milestone for the year. Average investors don’t know what to make of such news stories. Some think such a Bull Market bodes well for stock investments. Others think the market makes new highs before it dips. Neither position is warranted.

The markets are inherently volatile and also inherently profitable.

We can measure when the S&P 500 Price Index sets a new high, but there is no such thing as a new low. The markets have continued to trend upward for hundreds of years. When people question, “Well, the market can’t just go up forever, can it?,” the correct answer is, “That is what it has done so far, with bear markets and crashes along the way up.”

When the S&P 500 Price Index sets a new high, it may fall below that high, cross it again on the way back up, and cross it again on the way back down. What is assured, or at least has always happened, is that at some point the index will cross it on the way back up never to go below that value again.

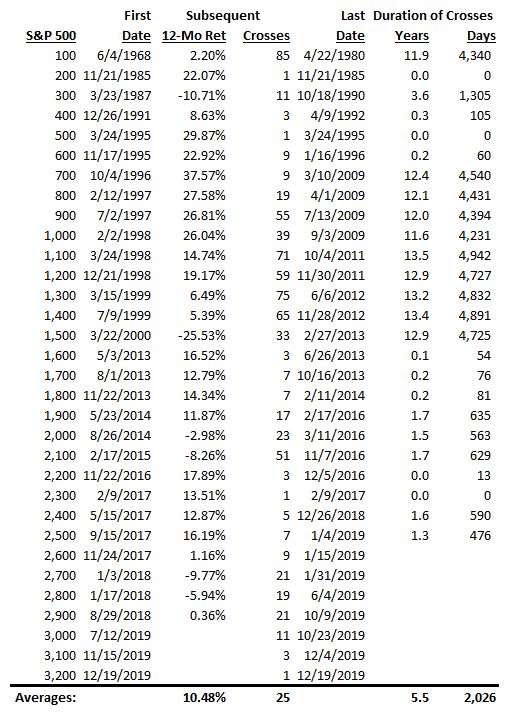

For example, the S&P 500 first reached 1,100 on March 24, 1998. It crossed above and below 1,100 fifteen times over the next 223 days until November 2, 1998 when it rose above 1,100 again. It stayed above 1,100 until September 7, 2001 when, during the Dot Com Bear Market it dropped below 1,100 again. It crossed above and below 1,100 again eleven times over the next 255 days until May 20, 2002 when it went below 1,100. It did not rise above 1,100 again until December 29, 2003. It bounced above and below 1,100 until October 26, 2004 when it rose above 1,100. But four years later on October 3, 2008 it dropped below 1,100 again during the 2008 financial crisis. It did not rise above 1,100 again until over a year later on November 16, 2009. All told, the S&P 500 Price Index crossed 1,100 a total of 71 times over 13.5 years.

Investors currently enamored by the decade of U.S. stock returns since the March 2009 bottom of the Financial Crisis have forgotten the prior decade when U.S. stocks performed so badly.

The largest number of times the S&P 500 crossed a hundreds value was the first hundred when the S&P 500 Price Index reached 100 on June 4, 1968. The index went on to cross that value 85 times over the next 11.9 years. Now, it has stayed above 100 since April 22, 1980.

Three times the S&P 500 Price Index has set a new one-hundred-mark high without ever falling below that high again. On November 21, 1985 it crossed 200 to never go below it again. On March 24, 1995, it crossed 500 and never looked back. Most recently, it crossed 2,300 on February 9, 2017 and, at least to date, has not dropped below that value.

The average number of times the S&P 500 crosses a new hundreds value is 25, taking on average 5.5 years in the process.

Setting a new high has little to do with the subsequent return of an index. If anything, setting a new high seems to be something of an auspicious omen for subsequent returns over the next year.

The average return of the S&P 500 Price Index since 1950 has been 7.79%. (The S&P 500 Total Return Index, which includes reinvested dividends is higher.)

After setting a new hundreds record, the subsequent 12-month return of the S&P 500 Price Index averages 10.48%. And so far 79% of subsequent 12-month returns have been positive.

The worst crossing was 1,500 on March 22, 2000. The subsequent 12-month return was -25.53% with the start of the Dot Com Bubble. It took 12.9 years for the S&P 500 to finally cross 1,500 again never to go below.

The best crossing was 700 on October 4, 1996. The subsequent rise over the next 12 months was a stellar 37.57%. Even this auspicious return, however, was revisited four times between March 3-10, 2009, 12.4 years later at the bottom of the 2008 Financial Crisis.

On average after crossing a new high, the S&P 500 crosses that new high a total of 25 times over 5.5 years. This is normal.

This normal volatility is one of the reasons we recommend having at least 5 to 7 years of safe spending in bonds. The markets are volatile over short periods of time.

If this S&P 500 Price Index were an average crossing, we would expect to see the S&P 500 trading up 10.48% at 3,535 a year from now on December 19, 2020. We would also expect to see the S&P 500 subsequently drop below and rise above 3,200 another 25 times, not staying above that number until July 5, 2025.

If that level of volatility isn’t your expectation, you are not yet familiar with normal volatility in the markets.

Here is a complete guide to the S&P 500 Price Indexes crossing 100 point milestones:

A 20% Bear market at the current level of the S&P 500 Price Index would bring the S&P 500 down to 2,560. Bear markets are part of normal expected volatile stock market returns. Thus, I have left out the duration of crosses for any value which is less than 20% below the S&P 500 current value.

Photo by Alina Strong on Unsplash