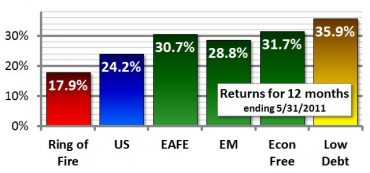

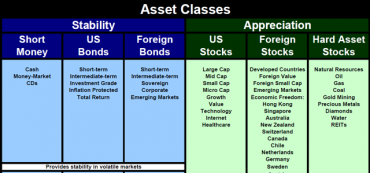

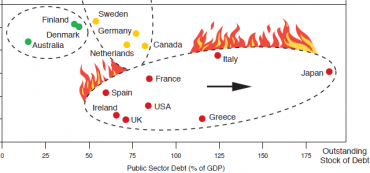

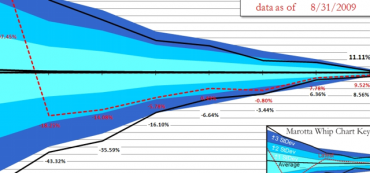

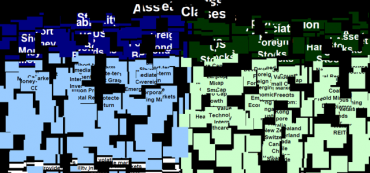

Continue to Avoid the ‘Ring of Fire’ Countries

Americans seem to be divided on the importance of raising the U.S. debt ceiling. Regardless of your personal politics, avoid investing in countries that cavalierly allow their debt and deficit to balloon.