Investment Strategies Part 5: In Defense of Diversification

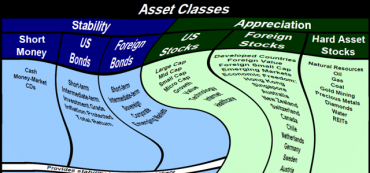

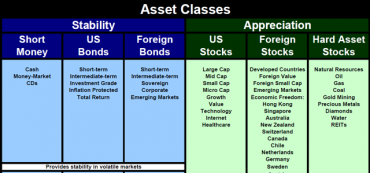

Diversifying your asset allocation among investments with a low correlation can and should reduce your portfolio’s volatility and boost your returns. But critics are claiming this strategy is no longer valid. That’s because they don’t understand the nature of what happened in 2008.