Tax Efficient Investing

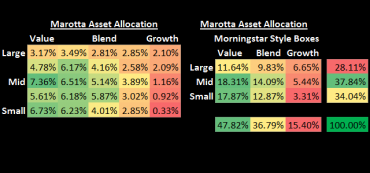

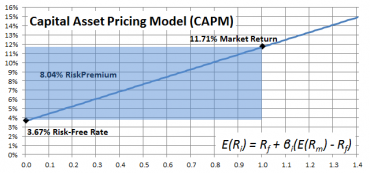

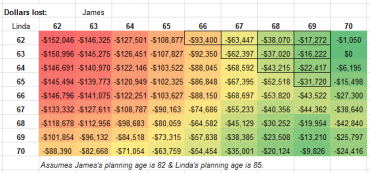

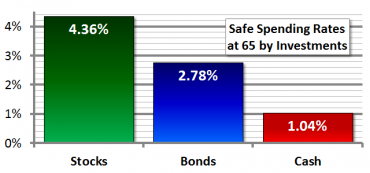

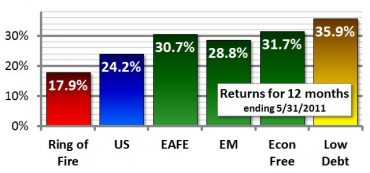

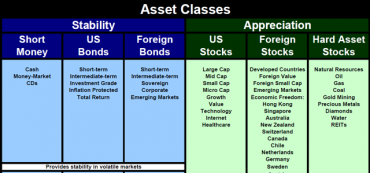

It can be useful to maintain a grid where all of the available asset classes are arranged in order, by tax efficiency and potential return based on time horizon, so clients can clearly see when and where tax-deferral can offer the greatest benefits.