The stock market can be confusing for people who don’t understand how it works. Some say the stock market is “legal gambling” or that it “is all made up.” The news writes about how “the stock price turned on the news of…” or “investor sentiment caused the price to… .” These sorts of news reporting can make the stock market feel capricious. Setting the price based on emotional feelings or news headlines is silly.

The stock market can be confusing for people who don’t understand how it works. Some say the stock market is “legal gambling” or that it “is all made up.” The news writes about how “the stock price turned on the news of…” or “investor sentiment caused the price to… .” These sorts of news reporting can make the stock market feel capricious. Setting the price based on emotional feelings or news headlines is silly.

However, the market is not made up; it is made.

There is no “price preeminent” or intrinsic value for shares of stock. While there are many indicators and formulas that people use in order to try to determine what they believe a fair price is (dividend discount models, the company’s net asset value, book value, or growth potential, etc.), none of these provide a reliable stock valuation nor are they how the current stock price is actually determined.

Stock price is determined by the supply and demand of the free markets through market makers.

For every stock listed on the New York Stock Exchange, there is at least one company (and often several) who act as a market maker. A market maker is a firm that stands ready to buy or sell a particular stock on a regular and continuous basis at a publicly quoted price.

With a market maker, if more people want to buy the stock than are willing to sell, the market maker sells some of their holdings in order to create a market. After someone buys at the asking price, the market maker can move the bid and ask prices up slightly. Gradually as the price moves up, less people want to buy the stock. This natural resistance ensures the market maker won’t run out of stock.

Similarly, sometimes there are more people who want to sell a stock than buy it. Every time someone sells, the market maker must buy it. Once they do, they can also move the bid and ask prices down slightly. As the price the market maker is willing to pay for a stock goes down, fewer and fewer people are willing to sell at the lowered price. Thus, the market maker will not need to spend piles of cash buying up unwanted stock.

Market makers have to buy stock as long as people want to sell it. They also have to be able to sell stock as long as investors want to buy it. Their ability to move the price provides the negative feedback to allow them to make the market, no matter how many buyers and sellers there are.

Often, when the market moves really sharply, that’s when people criticize the market for being illusory, made-up gambling. However, it is at these moments of sharp volatility that the genius of the system is apparent.

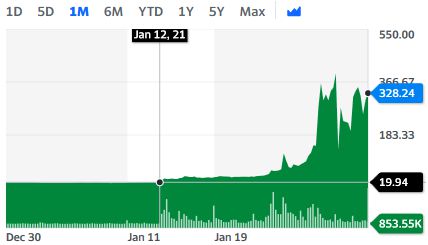

Take for example the recent GameStop (GME) news for instance. Here is the 1 month chart (December 30, 2020 through January 30, 2021) of GME:

The green line is the price, and the white tick marks at the bottom show the trading volume of the stock. The higher the white bar, the more trades that are placed. You can see that for months there was only minimal trading activity and the price was fairly consistent

However, around January 12, 2021, the trading volume increased as organized investors took to the markets.

Here is the 5-day chart (January 25-30, 2021) of GME:

While this kind of activity on such a low profitability company may be foolish, this graph shows that the market is not made up. We, the investors, control it.

In the scenario where there is not a market maker but there exists more people who want to buy GameStop than want to sell it, those potential buyers would just be unable to purchase. No one would be willing to give up their stock.

However, because there are market makers, there is always a market in GameStop stock. What is more, the market maker ensures they do not run out of stock by increasing the price. Eventually, either potential buyers are priced out or the high price inspires sellers.

Similarly, when more people want to sell (or even short sell) GameStop stock, someone needs to buy the stock. If there weren’t market makers, no one would be willing to purchase the stock. But market makers have to be willing to both purchase and sell stock based on the need. The difference between the price they are willing to purchase stock (bid) and the price they are willing to sell stock (ask) is called the spread. They make money based on this difference.

On Wednesday, Thursday, and Friday you could see the stock ticking up and down about 3 times a second in a viral tug of war based on investor actions. Every unbalanced purchase pushed the stock higher, every unbalanced sell pushed the stock down, and while the stock traded between the bid and ask price the stock didn’t move.

Regardless of the wisdom of the trades, the market makers were able to handle the viral volume.

The market moves every day with about one third of one percent (0.33% or 0.37%) of shares being traded. In this way, people who buy or sell move the markets significantly. And when even a small crowd of investors decide to act together, the market price can jump rapidly.

In this way, the stock market crowdsources the price of a stock through the use of market makers. As a result, the value of a stock is simply what people are willing to pay for it.

Photo by Joanna Kosinska on Unsplash