In 2009, David Marotta wrote a five-part article series for the Charlottesville Business Journal covering basic investment strategies. Its advice is still relevant today.

He begins with rebalancing, correlation, and asset allocation in “Investment Strategies Part 1: Rebalance into Stable Investments in an Appreciating Market.” Portfolio construction begins with the most basic allocation between investments that offer a greater chance of appreciation (stocks) and those that provide portfolio stability (bonds). Decisions made at this level are the most critical in determining how well behaved your portfolio returns will be. There is an optimum allocation between stocks and bonds for a given withdrawal rate, and this allocation should be customized for each individual based on cash flow needs.

The stable asset classes are like the iron rods that support a sailing ship. They don’t make the ship go faster, but they do keep it from capsizing in a storm. Meanwhile, the stocks in appreciation are the wind that is driving you to your financial goals. Stocks are volatile so exposure brings risks, but insufficient appreciation jeopardizes your retirement from lack of return.

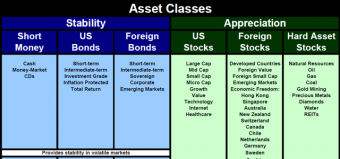

In “Investment Strategies Part 2: Use Correlation to Define Asset Classes,” David dives into Stability and Appreciation to talk about how you define your asset classes. He writes, “To boost returns and protect your investments, you can use the investment metric called correlation.” He shows how we used correlation to define our top-level asset categories.

The asset classes in Stability are:

- Short Money, fixed-income investments with a maturity date of two years or less;

- U.S. Bonds, which generally pay a higher interest rate the longer their duration and the worse their credit quality, but drop in value when interest rates rise;

- Foreign Bonds, which can balance domestic currency values and interest rates with what’s happening in the rest of the world. Like U.S. bonds, foreign bonds are categorized by quality and duration.

Meanwhile, we divide appreciation into U.S. stocks, Foreign stocks, and Resource Stocks.

In the U.S. Stocks asset class, most investors have primarily U.S. large-cap stocks that mimic the S&P 500, but we recommend having more diversification than that. On average, small-cap outperforms large-cap, and value outperforms growth. That being said, a well-balanced portfolio should include a broad spectrum of stocks, including a generous helping of growth-oriented stocks.

In Foreign Stocks, we have found that overweighting specific countries can be advantageous. We use the Heritage Foundation’s ratings to select countries that combine the greatest economic freedom with large investable markets. We call this strategy Freedom Investing, and you can read about its performance here.

Finally, Resource Stocks include companies that own and produce an underlying natural resource. These include oil, natural gas, precious and base metals, and resources like real estate, diamonds, coal, lumber and even water. We suggest diversifying resource stocks by resource type, geographic location of a company’s reserves, and company size.

After defining asset classes and sectors, David goes on to explore rebalancing more in depth in “Investment Strategies Part 3: Rebalance Regularly Between Asset Classes and Subcategories.” He introduces us to Bernstein’s formula, which approximates the extra return you can expect by rebalancing your portfolio regularly, and discusses the six lessons we can learn from it.

Unattended portfolios can quickly become more volatile as the stocks outgrow the bonds. However, tending to your portfolio too frequently can stifle some of the volatility that produces returns.

The strategy of chasing returns is sadly common because people wrongly believe that an investment is going up (present tense) just because it went up (past tense). Although some people talk about “the momentum of the markets,” the stock markets are more volatile than such simplistic language and a rebalancing schedule is better at getting the rebalancing bonus than market timing.

At Marotta Wealth Management, we set a non-biased rebalancing schedule to help remove the emotional desire to time the markets, rebalancing when your portfolio is significantly far enough out of balance to warrant action or once a quarter.

This kind of periodic rebalancing either provides more stability or produces a rebalancing bonus, depending on the direction of the rebalance.

After showing how rebalancing between asset allocations can boost returns, he cautions us in “Investment Strategies Part 4: Don’t Rebalance at the Sector Level” writing, “Rebalancing between asset classes boosts returns and decreases volatility. But setting your asset classes based on sectors of the economy is not an effective strategy.”

One industry could lose value indefinitely as another industry rises to take its place. Rebalancing into a failing industry would only bring your returns down with it.

You dodge this problem by having broader asset class definitions. Technology, Basic Materials, and Manufacturing are good, broad definitions while VHS Rentals, Diamonds, and Buggy Whips are too narrowly defined and may fail you.

It is even better to have two levels of asset class definitions: asset classes, like U.S. Stocks and Resource Stocks, which are non-correlated categories and then sub-categories, like Technology, Basic Materials, and Manufacturing, which although have some correlation are not highly correlated.

He finishes the series with “Investment Strategies Part 5: In Defense of Diversification.” Having written these articles right after the Crash of 2007-2008, David writes in his Part 5 article:

Fickle followers of asset allocation point to the market drop in the fourth quarter of 2008 as evidence that diversification has been discredited. Every investment philosophy and asset class moved downward at the same time. They point out that asset classes are more highly correlated when stocks move down than when they move up. In other words, they complain that just when diversification was supposed to help, it failed.

He addresses this sentiment, reminding us that no better way exists to protect your investments than diversification.

Diversification is a staple of financial advice. Don’t put all your eggs in one basket because if you drop the basket you won’t have any eggs. In the same way, don’t put all your assets in one company stock because if that company doesn’t perform well you might have jeopardized your financial needs.

Diversification is responsible. It is the difference between being willing to break every bone in your body as an Olympic skier and safely skiing with friends.

In month-to-month snapshots, diversification dampens both the highs and the lows. You always have an investment to complain about and an investment that is your darling. But the goal isn’t to invest only in what goes up. The goal is to support your financial needs, which is why your portfolio needs diversification.

I encourage you to read all of these articles and see how you can implement them in your own investments.

If you’d like assistance with investing, you may enjoy looking into getting started as a client with Marotta Wealth Management. Currently, we include Asset Allocation Design and Portfolio Management at all our Service Levels.

Photo by RawPixel from Pexels

Investment Strategies Part 1: Rebalance into Stable Investments in an Appreciating Market

Diversifying your portfolio means finding assets that have value on their own merits but do not move exactly alike. A critical investment metric called “correlation” is used to construct a portfolio most likely to meet your personal financial goals.

Investment Strategies Part 2: Use Correlation to Define Asset Classes

Generally, a correlation that can drop below 0.6 with other asset classes is a good candidate to become its own asset class.

Investment Strategies Part 3: Rebalance Regularly Between Asset Classes and Subcategories

In this formula is deep wisdom, both for portfolio construction and for determining which categories are worth regular rebalancing.

Investment Strategies Part 4: Don’t Rebalance at the Sector Level

Rebalancing between asset classes boosts returns and decreases volatility. But setting your asset classes based on sectors of the economy is not an effective strategy.

Investment Strategies Part 5: In Defense of Diversification

Diversifying your asset allocation among investments with a low correlation can and should reduce your portfolio’s volatility and boost your returns. But critics are claiming this strategy is no longer valid. That’s because they don’t understand the nature of what happened in 2008.

If you enjoyed this series, you will likely also enjoy some of the following articles:

What Is Correlation?

The correlation between two investment is used in portfolio construction and rebalancing.

The Complete Guide to Creating an Investment Plan

This is a summary of the six steps required to create a well-crafted investment plan.

What is the Correlation of the Asset Classes?

Asset classes are best defined by looking at the correlation of their returns. These four 2015 articles take a close examination at the three appreciation asset classes.