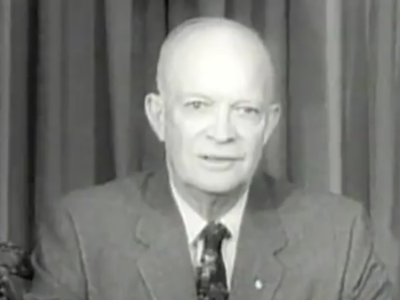

Dwight D. Eisenhower is often quoted from his February 17, 1953 News Conference in which he said,

The fact is there must be balanced budgets before we are again on a safe and sound system in our economy. That means, to my mind, that we cannot afford to reduce taxes, reduce income, until we have in sight a program of expenditures that shows that the factors of income and of outgo will be balanced. Now that is just to my mind sheer necessity.

This quote makes it sound like if Eisenhower were still alive today he would advocate keeping tax rates high or even raising them in order to balance the budget. And this quote is used by several contemporary liberal commentators to support higher taxes today.

Taken in context, Eisenhower’s quote gives a very different perspective:

And now, our last subject: taxes. In spite of some things that I have seen in the papers over the past 8 or 9 months, I personally have never promised a reduction in taxes. Never.

What I have said is, reduction of taxes is a very necessary objective of government–that if our form of economy is to endure, we must not forget private incentives and initiative and the production that comes from it. Therefore, the objective of tax reduction is an absolutely essential one, and must be attained in its proper order.

But I believe, and I think this can be demonstrated as fact by economists, both on the basis of history and on their theoretical and abstract reasoning, that until the deficit is eliminated from our budget, there is no hope of keeping our money stable. It is bound to continue to be cheapened, and if it is cheapened, then the necessary expenses of government each year cost more because the money is worth less. Therefore, there is no end to the inflation; there is finally no end to taxation; and the eventual result would, of course, be catastrophe.

So, whether we are ready to face the job this minute or any other time, the fact is there must be balanced budgets before we are again on a safe and sound system in our economy. That means, to my mind, that we cannot afford to reduce taxes, reduce income, until we have in sight a program of expenditures that shows that the factors of income and of outgo will be balanced. Now that is just to my mind sheer necessity.

I have as much reason as anyone else to deplore high taxes. I certainly am going to work with every bit of energy I have towards their reduction. And I applaud the efforts of the people in Congress that are going in that way. But I merely want to point out that unless we go at it in the proper sequence, I do not believe that taxes will be lowered. We might for the moment lower the “chit” you get for this year, but in the ensuing years, it would be a very different thing.

As you can see from the quote, Eisenhower did not favor high taxes. His point, however, is that it doesn’t help if government only taxes a little so long as it spends a lot. Because when government spends a lot it devalues our currency. And if government can’t keep our money stable they are in effect just taxing wealth which is held in dollars.

With high spending there is no end to inflation and therefore no end to taxation because we have inflation and the result is catastrophic. Whether you have high taxes which confiscates your wealth or you have high inflation which is just a tax on your buying power did not matter to Eisenhower. He deplored them both.

Eisenhower’s quote is often put in the context of the fact that the top marginal income tax rate in 1953 was 92%. The 92% tax bracket applied to income over $400,000 in 1953, equivalent to an income of $3,439,611 today. Since this tax bracket applied to very very few, the economic destruction was small. It was still a large disincentive for those subject to these rates, but the total effect on the economy was small.

In 1953 total federal tax receipts were just 18.7% of Gross Domestic Product (GDP) (17.6% On-Budget and 1.1% Off-Budget) while federal outlays were 20.4% of GDP. We were running a deficit equal to 1.7% of GDP. And the Gross Federal Debt was 71.4% of our GDP.

The top federal tax rate was reduced from 92% to 70% by Johnson in 1964 and the Gross Federal Debt was reduced from 71.4% of GDP down to 35.6% over the next two decades.

Currently the 2013 official White House numbers estimate tax receipts of 17.8% of GDP and Outlays of 23.3% of GDP for a deficit equal to 5.5% of GDP. And the Gross Federal Debt is estimated at 107.4% of GDP.

It used to be that Republicans did not distinguish between the government taxing too much and the government spending too much. They believed that both incentives toward production (low taxes) and a stable currency (low deficits) were equally important. This was the Classic Economic View which later became more nuanced in the New Classic View when distinctions favored supply side economics. But neither of these two views were in favor of high taxes.

Let’s be clear. Eisenhower deplored high taxes.

4 Responses

Luis

This is complete straw. No one should compare our current state to that. We are in a liquidity trap which makes the playing field different than any other. We can’t lower rates much further but demand side economics should prevail since we can stimulate the economy with hyperinflation in check. On the tax side probably better to have kept tax brackets the same until the economy truly recovered. Raise revenue and pay down the debt during the boom. In the meantime we just deal with the outrageous interest being paid on the debt. This is the best way out without defaulting on our obligations.

Megan Russell

It seems like your whole comment is founded on the assumption that the United States is in a “liquidity trap,” a theoretical economic state where there is a high demand for citizens to save currency rather than spend it.

First, it’s important to note that there is a whole school of economists who argue that “a lack of investment during periods of low interest rates are the result of malinvestment and time preference instead of liquidity preference.” I’m inclined to believe them.

Second, is the United States in a liquidity trap? Could it be that “the US economy is trapped, not because of a sharp increase in the demand for money, but because loose monetary policies have depleted the pool of real savings”? If that is the case “what is required to fix the economy is not to generate more inflation but the exact opposite. Setting a higher inflation target… will guarantee that the economy will stay in a depressed state for a prolonged time.”

In other words, if you want to increase US citizens’ confidence in the market, the government has to step out, definitely not step in and inflate the money supply, as you suggest.

Luis

Dear Megan,

I see your theory in principle but what is actually happening here? There hasn’t been such inflation as you stated. Please supply references of such data in your proof. Second monetary policy is not loose, it is determined through carefully analyzed metrics to avoid said inflation. I would submit that recent monetary policy helped circumvent a deflationary event. What would JP Morgan say about The Fed if he were alive today? So in conclusion the model under my theory, and that of a large majority of economists, is working -no inflation and no deflation.

David John Marotta

Here is another great article by Diana Furchtgott-Roth of MarketWatch entitled “Easy money will end in tears, Allan Meltzer says” Foremost expert gives a history lesson on economics which reads in part:

Read the full article for some of the unintended harmful consequences of forcing and holding interest rates so low.