Do mutual funds with more holdings have higher average returns?

To answer this question, I exported the turnover rate and number of holdings for all the mutual funds in the U.S. Small Cap Value Morningstar category from Morningstar’s website. There were 432 funds represented. I split the 432 funds into the following roughly-equal categories: 0-99 holdings (95), 100-199 holdings (123), 200-499 holdings (87), 500-999 holdings (48), and 1,000-6,000 holdings (79).

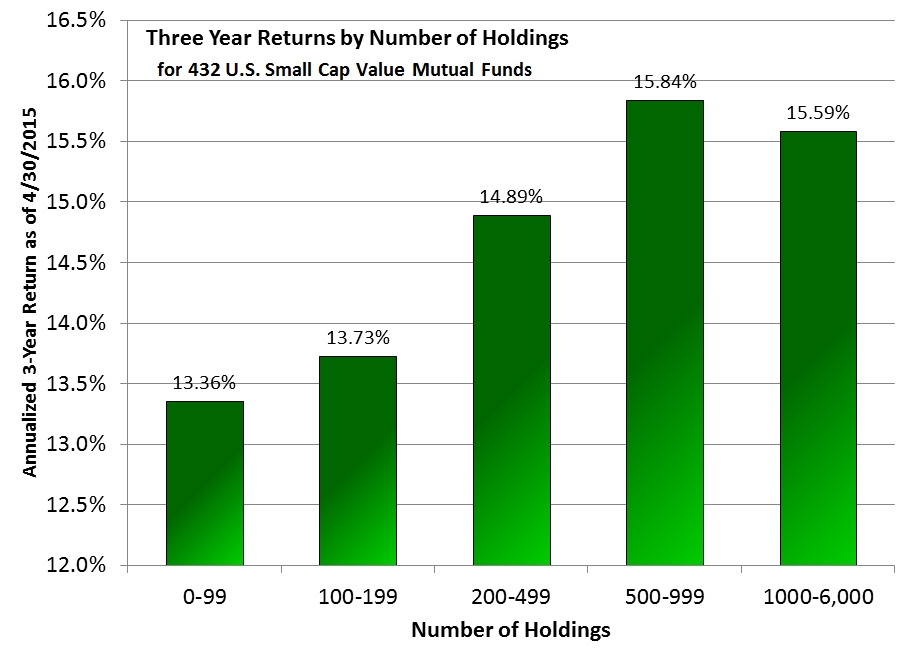

Here is the relationship between number of holdings and 3-year annualized returns as of 4/30/2015:

In “What Is Turnover Rate?” I wrote:

Because active fund managers are chasing returns, they tend to invest strongly in one sector or group of sectors on the theory that if it goes up, they win big. Of course, they’re just as likely to be wrong than right. As a result, funds with high turnover rates often have more highly concentrated positions. ROSFX holds just 116 holdings with 21.07% of the fund invested in the top 10 holdings. Meanwhile, VBR has 825 holdings and its top ten holdings represent just 4.8% of the total investment. DFSVX has 1,208 holdings with 9.41% represented in the top ten positions. Active managers have not yet learned that diversification outperforms the S&P 500 over the long-term.

Here you can see clear evidence that, at least in the small cap value arena, diversification generally helps. In fact, comparing funds with fewer than 100 holdings to those with more than 500, it helps by as much as 2.48%.

I’ve heard many pundits suggest that investors can be “overly diversified” such that they just get index returns. They then argue that you should keep your number of holdings very low. However, the data doesn’t support their case.

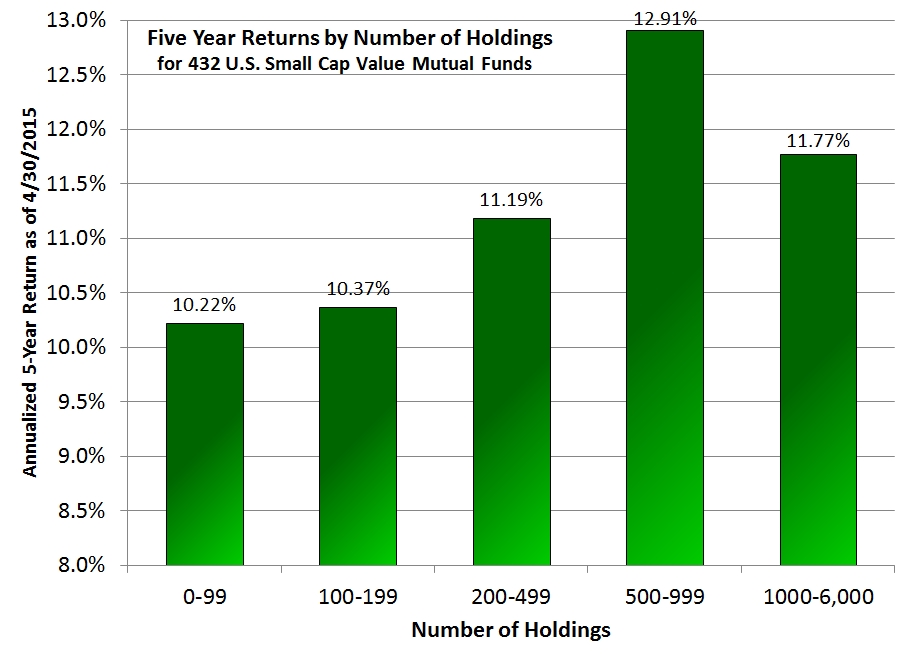

Here is the relationship between number of holdings and 5-year annualized returns as of 4/30/2015:

The 5-year cost of not diversifying appears to be 2.69%, again comparing funds with fewer than 100 holdings to those with more than 500. The boosted return for diversifying does dip down for funds with 1,000 or more holdings, but their return is still 1.55% higher than for funds with fewer than 100 holdings.

Maybe what the pundits talking about “over diversification” mean is that there are certain categories (such as small cap growth or developed countries low in economic freedom) which are best avoided since their long term historical returns suggest that they generally under-perform the market as a whole. Maybe they’re worried that investors looking to diversify will invest in these weak performers.

Avoiding categories that under-perform is not avoiding diversification. It’s just wise asset allocation.

To me, this proves that there is no such thing as “over diversification.”

Photo used here under Flickr Creative Commons.