In “What Is Turnover Rate?” I wrote:

Because active fund managers are chasing returns, they tend to invest strongly in one sector or group of sectors on the theory that if it goes up, they win big. Of course, they’re just as likely to be wrong than right. As a result, funds with high turnover rates often have more highly concentrated positions. ROSFX holds just 116 holdings with 21.07% of the fund invested in the top 10 holdings. Meanwhile, VBR has 825 holdings and its top ten holdings represent just 4.8% of the total investment. DFSVX has 1,208 holdings with 9.41% represented in the top ten positions. Active managers have not yet learned that diversification outperforms the S&P 500 over the long-term.

I knew that statement was generally true, but I decided to determine exactly what the relationship was between turnover and number of holdings.

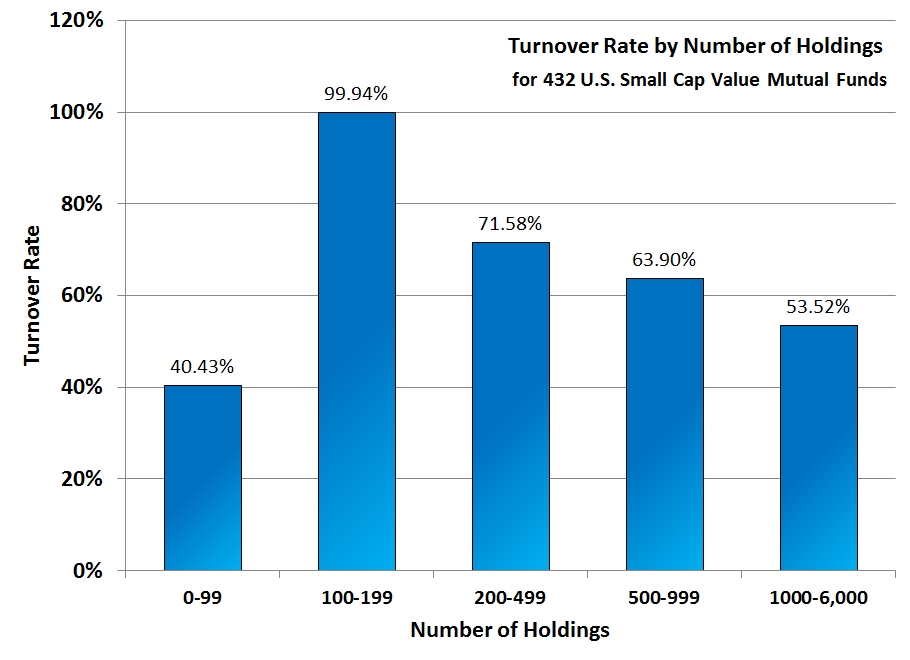

I used Morningstar to export the turnover rate and number of holdings for all the mutual funds in the U.S. Small Cap Value Morningstar category. There were 432 funds represented.

I split the 432 funds into the following roughly-equal categories: 0-99 holdings (95), 100-199 holdings (123), 200-499 holdings (87), 500-999 holdings (48), and 1,000-6,000 holdings (79).

Here is the relationship between number of holdings and turnover rate:

The general trend (more holdings less turnover) is obviously true for funds with at least 100 holdings.

I was surprised by how high the turnover rate is for every category. The stock funds we select to use in client portfolios usually have turnover rates of 10% or under. We screen out mutual funds with a turnover rate over 50%. However, the average turnover rate for an actively managed stock fund is 130% and these pull every category up. Apparently there are more active managers than we thought.

Most surprising was the category of mutual funds with less than 100 holdings. This category broke the trend and had the lowest average turnover rate. Perhaps fund managers who select fewer funds are more attached to their selections and willing to give them time to appreciate. That would be the wise way to invest and we know that investment philosophy matters; chasing returns is a surefire way to lose them.

In an upcoming blog post, we will look at how number of holdings and returns are correlated.

Photo used here under Flickr Creative Commons.