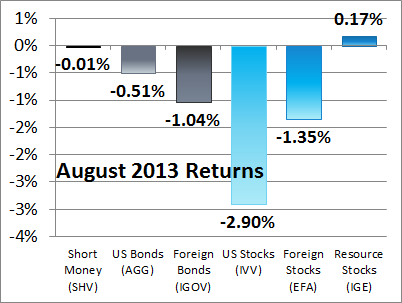

Returns in August were negative across the board with US stocks losing the most.

Many investors, however, still think that US stocks are “doing better” (present tense) because their year to date returns are higher than foreign. This even though foreign stocks and resource stocks have done better than US stocks for the past two months.

This recency bias causes most investors to under perform the very investments they are invested in as they chase returns. Greg Fisher has a great article in the September 2013 issue of Financial Advisor Magazine on this subject entitled, “The Driver Of Future Behavior” which I highly recommend reading.

The short answer is to have an asset allocation and regularly rebalance back to it. Rebalancing is a contrarian investment strategy and should avoid the lost return associated with chasing returns as well as receive a nice rebalancing bonus as well. Don’t let the returns of a month, a quarter, or even a year sway you from what is otherwise a brilliant investment strategy.