2017 was such a good year for the stock markets that it set a record with 12 consecutive positive monthly returns. This was the most highs since 1910 for the Dow. And daily volatility was just 0.30%, much lower than the average of 0.65%. In February, many were wondering, “The markets can’t go up indefinitely, can they?”

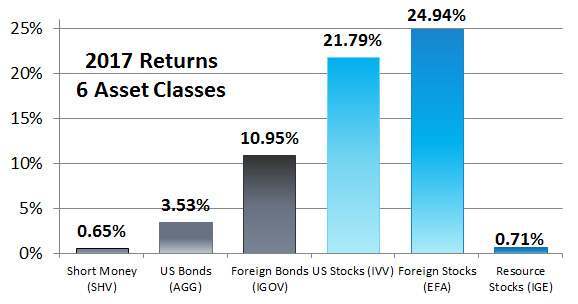

Here are the 2017 returns for iShares products that represent the six asset classes we use:

Diversification is responsible. It is the difference between being willing to break every bone in your body as an Olympic skier and safely skiing with friends.

In month to month snapshots, diversification dampens both the highs and the lows. You always have an investment to complain about and an investment that is your darling. But the goal isn’t to invest only in what goes up. The goal is to support your financial needs, which is why your portfolio needs diversification.

In 2017, the category that did the best was Foreign stocks, up 24.94%.

In 2016, the category that did the best was Resource Stocks, up 30.13%.

In 2015, the category that did the best was US Stocks, up 1.34%.

The variability of which category does the best is an advertisement for a diversified asset allocation.

Sometimes one asset class does worse than all the others. Sometimes it does better. There is always a first and last place when ranking recent returns. Neither chasing returns nor dodging corrections has been a winning strategy historically.

A balanced portfolio holding U.S. stocks, foreign stocks and resource stocks remains one of the best ways to hedge against inflation and secure financial independence for retirement. As we say, “It is always a good time to have a balanced portfolio.” This is true whether any given index is the best or worst performing.

The markets are inherently volatile. We should all disregard the monthly noise, so that no season in the markets ruins a brilliant investment strategy. Diversification works over long periods of time. One asset class can win for months at a time.

You need an asset allocation to rebalance back to it and receive the rebalancing bonus. Without an asset allocation, we are all tempted to sell what has gone down and buy what has gone up. But that is the exact opposite of what we should do.

2017 set all kinds of records. It was the only year in which the S&P 500 was up twelve straight months in a row. It was the year with the lowest volatility for the S&P 500 ever. Remember that 2017 was blissfully abnormal when you are next tempted to be disappointed. We feel losses stronger than we feel gains, but losses are easier to recoup than you think.