We set-up and maintain low cost 401(k), 403(b), or other employer sponsored retirement plans that offer a large variety of investment options to meet our client’s specific needs for their business via our Retirement Plan Management service.

We set-up and maintain low cost 401(k), 403(b), or other employer sponsored retirement plans that offer a large variety of investment options to meet our client’s specific needs for their business via our Retirement Plan Management service.

We often get the question from plan participants, “What should I invest in?” Here are our recommendations in order.

1. Marotta Unitized Trust Model Portfolios

Our first recommendation for retirement plan participants is to use one of the age appropriate Marotta Unitized Trust Model Portfolio options. I believe the unitized trusts are simply better than the mutual fund model portfolios.

The expense ratios are 0.24% or lower, they invest in developed countries high in economic freedom, and the tilt is dynamically adjusted monthly based on forward P/E ratios. All that and we don’t charge any additional fees for participants in the unitized trust options. We make the same revenue as the static mutual fund model portfolios.

You can choose one of the unitized trust models or you can customize the Stock and Bond blend even more by setting your own allocation between the All Stock and All Bond unitized trust options.

2. Mutual Fund Model Portfolios

We developed our first retirement plan offering after a small business owner client asked us to review three retirement plan proposals. We thought they were all terrible and laden with fees. We crafted model portfolios using low-cost mutual funds and created the retirement plan we wanted for ourselves. These model portfolios also have expense ratios of 0.24% or lower.

Our second recommendation is to use one of these age-appropriate mutual fund Model Portfolios. The Model Portfolios have a recommended percent allocation to stocks varying from 100% to 0% based on your age.

Although they are not dynamically adjusted monthly, they do rebalance regularly. Marotta receives no additional compensation for the use of either the Marotta Unitized Trust Model Portfolios nor the Mutual Fund Model Portfolios.

3. Build your own portfolio using the available mutual funds

As a third option, retirement plan participants can use any combination of mutual funds to build their own portfolio. Offering retirement plan participants many acceptable low-cost investment options is one of the hallmarks of a good retirement plan trustee.

While we believe the unitized trust options and model portfolios offer our best investment management, participants are free to disagree and craft their own asset allocation using the wide selection of fund options.

You can also mix and match by investing in the unitized trust options with a few mutual funds beside in order to adjust to your own target tilt and exposure. For example, if you wanted a more aggressive portfolio, you could use the all-stock unitized trust with a bit extra in the emerging markets fund beside.

That being said, we want to make it clear that an age appropriate unitized trust option is the option we recommend.

4. Select a core fund

Fourth, participants can select a core fund. Having made our primary recommendations clear, there is a fourth option available in which participants can put all of their assets in a single fund. We believe in diversification, and some of the fund choices are intended to be part of a larger asset allocation. A fund comprised only of healthcare stocks isn’t very well diversified.

However, if someone wants to put their assets in a single fund, only a few funds might be appropriate for a single fund strategy. These funds are called “core funds.”

We define a core fund as any fund which might be able to represent some mix of stocks or bonds and approximate a place near the efficient frontier of investing. Some core funds might represent an all-stock portfolio well, others a 60-40 mix, and still others an all-bond portfolio. Alternately, participants could use one or two of these to build a simple asset allocation near the efficient frontier. It is suggested that retirement plans have at least three core funds. We have eight core funds as a part of the Marotta retirement plan offerings. Here they are in order from most aggressive to most conservative:

1. Vanguard Total World Stock Index Fund Investor Shares (VTWSX)

With an expense ratio of just 0.19%, this mutual fund aims to invest in every stock in the world in direct proportion to its capitalization. It invests in 8,126 different stocks with the 10 largest holdings representing just 10.50% of the fund’s assets. It is benchmarked against the FTSE Global All Cap Index.

This is the type of global index that asset allocation and portfolio construction is trying to beat by over-weighting certain categories and under-weighting others.

We have recommended this fund in other articles as a good choice for single fund investing of small amounts of money in your health savings account.

2. DFA International Core Equity Portfolio (DFIEX)

This fund has an expense ratio of 0.30% and invests in a broadly diversified portfolio of foreign stocks. It invests in 5,457 different stocks with the 10 largest holdings representing 6.11% of the fund’s assets. It is benchmarked against the MSCI World ex USA Index. While we would not recommend this fund as the only core holding, it could be blended with VTSAX to create a custom mix of US and foreign stocks.

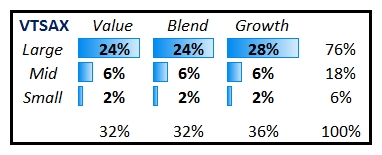

3. Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

This fund has the incredibly low expense ratio of just 0.04%. It invests in 3,641 different stocks with the 10 largest holdings representing 18.70% of the fund’s assets. It is benchmarked against the CRSP US Total Market Index and aims to invest in the entire United States investable market according to its capitalization.

This fund could stand alone, or be used in conjunction with DFIEX to blend a custom mix of US and foreign stocks.

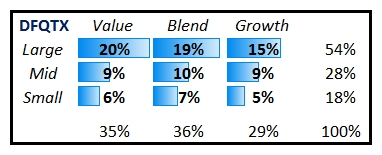

4. Dimensional US Core Equity 2 Portfolio (DFQTX)

This fund has the low expense ratio of just 0.22% and invests in a diversified portfolio of US stocks. It invests in 2,882 different stocks with the 10 largest holdings representing 13.23% of the fund’s assets. It is benchmarked against the Russell 3000 Index.

While VTSAX invests according to market capitalization, DFQAX tilts small and value according to the factors which are expected to boost long-term returns. This is the only core fund which incorporates some of the factors which are included in our unitized trust portfolios and model portfolios.

5. Vanguard STAR Fund (VGSTX)

This fund has a relatively low expense ratio of 0.32%. It invests in 11 other Vanguard mutual funds to create an asset allocation of about 60% stocks and 40% bonds. We have recommended VGSTX in other articles as a candidate for single fund investing. This is the only core fund which blends stocks and bonds together in a single fund. Other than VGSTX, if you want a specific stock and bond blend you would have to craft that blend out of these choices.

Although we recommend our unitized trust as a better investment strategy, VGSTX is a solid choice for other plans where those options are not available and the amount of money doesn’t justify a more complex asset allocation.

Core Bond Funds

Among the core funds I am including a number of bond funds for completeness even though you should probably not be putting all of your retirement plan assets in a single bond fund. You should not buy bonds out of fear. The biggest threat to your retirement is most likely inflation, not market volatility. One of the best reasons to hold bonds is to secure and satisfy the next 5 to 7 years of withdrawals.

Investing most of your assets in bonds could result in a significantly lower lifestyle in retirement.

Bond funds are included for completeness to fill out core portfolios along the efficient frontier. These bond portfolios have a much lower expected mean return along with a correspondingly lower expected volatility. It is important to know how bonds are priced and their return calculated. Bonds can and do experience years of negative returns and bonds which are lower quality or have a longer average effective maturity usually have returns with a greater volatility.

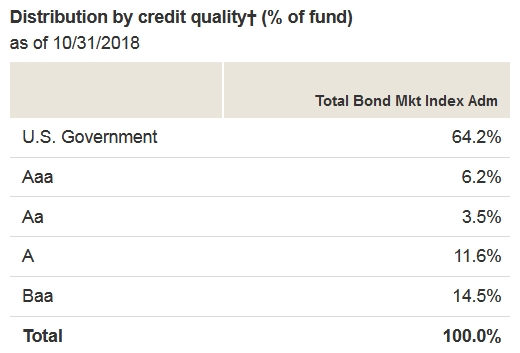

6. Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX)

This fund has the incredibly low expense ratio of just 0.05%. The average effective maturity is 8.3 years. This fund is distributed across the entire bond market of investment grade quality, often defined as BBB- or higher by Standard & Poor’s rating system.

Investment grade bonds are deemed safer based on the judgement of the rating service because the issuers resources are considered sufficient to repay their outstanding loans.

7. Inflation-Protected Securities Portfolio (DIPSX)

This fund has the incredibly low expense ratio of just 0.12%. The average effective maturity is 7.79 years. The benefits of an inflation-protected security is that it has a component which adjusts according to inflation along with a smaller interest payment.

8. Vanguard Short-Term Investment-Grade Fund Admiral Shares (VFSUX)

This fund has the incredibly low expense ratio of just 0.10%. The average effective maturity is 3.4 years. Since this fund has a very short maturity, it is less likely to have a year of negative returns. But its lower volatility will probably be accompanied by lower returns.

Cash

Every retirement plan has a cash option. And while cash as measured in cash will always have the lowest volatility, its buying power may also deteriorate by inflation each year. Investors greatly underestimate the danger of inflation. At a rate of just 3.00% inflation will devalue the currency by 73.56% over the next 45 years.

Frequently as part of our Comprehensive Service Level, we make employer retirement plan asset allocation recommendations to our clients. As a result, we have reviewed the fund line-up of hundreds of retirement plans. Occasionally, a retirement plan will have some low cost funds, but this is the exception rather than the rule. Too frequently plans have mutual funds with expense ratios exceeding 1%. Other plans are missing key investment categories that are important to diversification and portfolio construction.

For other plans, we are lucky if they have even one low-cost core stock fund in which we can put everything to escape the remainder of the expensive plan line-up.

The idea of a core fund for most plans is to limit the liability of being sued because you don’t have any reasonably priced choices for participants.

Because Marotta retirement plans are composed entirely of reasonably priced funds, participants can utilize the Marotta unitized trust portfolios with a greater confidence. We are including these core funds as yet another low-cost investing option.

Retirement plan sponsors have a responsibility to review their plans periodically. Failure to perform such periodic reviews is a litigable fiduciary breach. Marotta Wealth Management offers to perform such reviews at no cost for retirement plans in central Virginia.

We do this because we believe that our own retirement plan offering will most likely be better than the plan you have, and we want a chance to demonstrate that fact. Our analysis compares your current plan with what is easily available best practices within the industry. It also includes educating those stewarding the plan and can help plan sponsors and plan trustees identify potential deficiencies.

If you or your employer would like us to review your retirement plan or you would like to consider using our services just give us a call.

Photo by Patrick Tomasso on Unsplash