This past year, the Securities and Exchange Commission (SEC) changed their definition of what it means to “have custody” of client assets again. Now, it appears that investment advisors who are allowed to transfer the required minimum distributions (RMDs) from a traditional IRA to the same client’s joint account with his or her spouse are deemed to “have custody” of client assets. This is because while the advisor considers the husband and wife’s assets jointly, the SEC may views the husband and wife individually. With this individualistic view, the advisor is transferring money into the control of a third party (the spouse) when they transfer to the joint account.

This past year, the Securities and Exchange Commission (SEC) changed their definition of what it means to “have custody” of client assets again. Now, it appears that investment advisors who are allowed to transfer the required minimum distributions (RMDs) from a traditional IRA to the same client’s joint account with his or her spouse are deemed to “have custody” of client assets. This is because while the advisor considers the husband and wife’s assets jointly, the SEC may views the husband and wife individually. With this individualistic view, the advisor is transferring money into the control of a third party (the spouse) when they transfer to the joint account.

I use the word “appears” and “may” because although the SEC released a “no-action” letter on February 21, 2017, it raised more questions than it answered. For over a year custodians, compliance specialists, and chief compliance officers like myself have asked for specific clarification of what the SEC means and how fill out our annual required compliance filings. I have emailed, called, and submitted questions to their supposedly live help line and received no reply. I have been told that even major brokerage firms like Charles Schwab cannot get any clear answers from the SEC after a year of trying. This short letter has caused me as our Chief Compliance Officer hundreds of hours of study and analysis none of which brought clients any value nor did they produce any actual safeguards.

We think it is an important safeguard not to give your advisor custody of your investments. But when we say that, we mean that you should use a separate custodian to safeguard your assets. Having actual custody of assets has historically been an important risk metric that the SEC uses to prioritize which advisors they visit and review each year.

However, I believe that the SEC has ruled that standing letters of authorization (SLOAs) are custody. As the SEC writes in the letter:

Moreover, “custody” includes “[a]ny arrangement . . . under which [an investment adviser is] authorized or permitted to withdraw client funds or securities maintained with a custodian upon [its] instruction to the custodian . . . .” You contend that an investment adviser simply following a client’s instructions to transfer assets pursuant to the limited authority granted to the investment adviser under a SLOA and the investment adviser’s corresponding direction to the qualified custodian do not result in an investment adviser “holding” client funds, give an investment adviser “authority to obtain possession” of client funds, or authorize or permit an investment adviser to “withdraw client funds” for any purpose, as contemplated by the Custody Rule.

We disagree. An investment adviser with power to dispose of client funds or securities for any purpose other than authorized trading has access to the client’s assets. We believe that a letter of instruction or other similar asset transfer authorization arrangement established by a client with a qualified custodian would constitute an arrangement under which an investment adviser is authorized to withdraw client funds or securities maintained with a qualified custodian upon its instruction to the qualified custodian. An investment adviser that enters into such an arrangement with its client would therefore have custody of client assets and would be required to comply with the Custody Rule.

Under this new confused definition of “custody,” our firm will now appear to have “custody” of over $200 million in assets simply because we can help clients transfer their annual RMD from their IRA to their joint account. This type of government regulation unequally burdens smaller firms with hours of compliance issues and makes the industry less safe by making it more difficult for the SEC to find and investigate the real risks of actual custody.

Having explained the difficulties associated with the SEC, there are a few steps I think the Chief Compliance Officers at firms like ours need to do in order to comply with the new definitions. This is only my opinion, my best understanding of what it takes to comply with the SEC. I have called the SEC, but so far they have not helped. They are lawyers, not financial advisors. They have failed to respond or clarify this issue for an entire year.

Our firm has standing letters of authorization which allow us to move money between client-owned accounts. We do not have actual custody of client assets; we use Charles Schwab as our custodian. We do not have third party bill pay or other means to specify checks be written to random third parties. Our clients authorize us using a very limited power of attorney (LPOA) which gives us the right to move money from one specific account to another specific account both of which are in the client’s name but which may have slight differences account or registration, such as from His or Her IRA to Their Joint Account.

We use this authorization to help our clients with these specific tasks:

- Comply with the client’s annual required minimum distributions (RMDs) by taking money out of the client’s traditional IRA or 401(k) and putting that money into the client’s trust or joint account.

- Fund the client’s Roth IRA each year by taking money out of the client’s trust or joint account and putting that money into the client’s Roth IRA account.

- Fund the client’s standard of living each month by transferring money out of the client’s investment account into the client’s individual or joint checking account.

None of these transfers can be easily used for nefarious purposes. Each transfer is between two accounts both of which are under the client’s control.

But since none of these accounts are identically registered, they are considered third party transfers. At a minimum, in each case a spouse might be on one side of the transfer having control of a joint account but not having any interests on the other account.

Prior to this year on Form ADV Item 9 Custody, I have always answered “No’ to these two items. Now, I believe we are required to answer “Yes.”

In this Item, we ask you whether you or a related person has custody of client (other than clients that are investment companies registered under the Investment Company Act of 1940) assets and about your custodial practices.

Item 9 A.

(1) Do you have custody of any advisory clients’:

(a) cash or bank accounts? Yes.

(b) securities? Yes.

If you are registering or registered with the SEC, answer “No” to Item 9.A.(1)(a) and (b) if you have custody solely because (i) you deduct your advisory fees directly from your clients’ accounts, or (ii) a related person has custody of client assets in connection with advisory services you provide to clients, but you have overcome the presumption that you are not operationally independent (pursuant to Advisers Act rule 206(4)-2(d)(5)) from the related person.

You have to get over the straight forward definition of custody. We don’t actually have custody of any client assets. We use Schwab as our custodian.

Instead you have to read this question as, “Do you have authorization to make transfers of cash or securities on behalf of your clients regardless of the fact that those transfers can only go into other accounts of your clients?”

The next section is somewhat confusing.

(2) If you checked “yes” to Item 9.A.(1)(a) or (b), what is the approximate amount of client funds and securities and total number of clients for which you have custody:

(a) U.S. Dollar Amount $209,978,564

Total Number of Clients 286

If you are registering or registered with the SEC and you have custody solely because you deduct your advisory fees directly from your clients’ accounts, do not include the amount of those assets and the number of those clients in your response to Item 9.A.(2). If your related person has custody of client assets in connection with advisory services you provide to clients, do not include the amount of those assets and number of those clients in your response to 9.A.(2). Instead, include that information in your response to Item 9.B.(2).

Again, you have to get over the straight forward definition of custody. We don’t actually have custody of any client assets. We use Schwab as our custodian.

Instead you have to read this question as, “What is the total value of the accounts out of which you have authorization to make transfers regardless of the fact that those transfers can only go into other accounts of your clients?”

This is a difficult number to ascertain. Schwab can provide a list of accounts with standing letters of authorizations (SLOAs). There are often multiple SLOAs for the same account, giving us the ability to transfer to their checking account, or fund each of their retirement accounts. Some of these transfers might be a first party transfer (identically named) and if they are they may not count as “custody” according to the SEC.

But it is only identical titles that the SEC will consider a first party transfer. A client’s personal account and trust account may both only list that client as a party on the account. But because of the trust provisions, the assets are still not identically registered. And even if the account registrations are identical the two accounts could have beneficiary designations which differ.

For simplicity’s sake, I am going to assume that if we have an LPOA to transfer money out it should be counted as assets under this strange custody rule. This allows me to simply count every unique account in Schwab’s list of LOPAs. This may report a higher value than necessary, but it also saves me from reviewing hundreds of potential transfers trying to determine if they are first party (identically named) or third party (not identically named).

I assumed that the value the SEC is asking about is the value at the end of the year on December 31st. I can cross reference Schwab’s list with another report from our Portfolio Center software which shows the account values at the end of the year. This is the dollar amount I am reporting.

The total number of clients is an even more difficult number to compute.

In a precise world, I would assume that we would only count the number of people who have an interest in the “from” account and we would not count any of the people on the “to” account. If an account was a trust account, and only one of the trustees was a client I am not certain if you would count each trustee separately or you would only count those who were clients. And if you had three accounts all with the same client I assume you would only count the one client rather than the three accounts. None of this information is available to report anyway.

The SEC requires a number. These are the issues that a fastidious Chief Compliance Officer angsts over. Last year, I reported zero in both these fields.

For total number of clients, I decided to report the total number of accounts. These are the 286 accounts that totaled $209 million, and these are the 286 accounts on which we have a limited power of attorney.

I do not know how many “clients” are represented by those 286 accounts. The number of clients may be higher because there are more than one client on some of those accounts. Or the number of clients may be lower because one client has multiple accounts on which we have an LPOA.

I decided that reporting the number of accounts was the safest and most accurate number I had in answer to the question, “What is the total number of clients for which you have custody?” I am interpreting the question as “What is the total number of client [accounts] on which you can make transfers on their behalf?”

For Section 9 B, we are not using a custodian that has a relation to us to custody client assets so we answer this section “No”:

B. (1) In connection with advisory services you provide to clients, do any of your related persons have custody of any of your advisory clients’:

(a) cash or bank accounts? No.

(b) securities? No.

You are required to answer this item regardless of how you answered Item 9.A.(1)(a) or (b).

(2) If you checked “yes” to Item 9.B.(1)(a) or (b), what is the approximate amount of client funds and securities and total number of clients for which your related persons have custody:

(a) U.S. Dollar Amount

(b) Total Number of Clients

Given that advisors like us are deemed to have custody, other SEC rules now get applied to such advisors. For firms that actually have real custody the SEC requires an annual surprise examination to make sure that client funds are safe and have not been embezzled. A surprise audit for our firm would be a waste of time. We have no assets to audit. Everything is at the custodians.

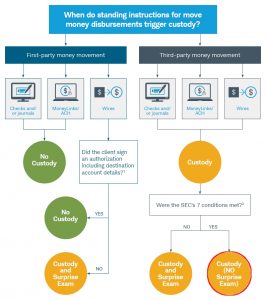

The SEC requires that seven conditions be met in order for advisors to avoid the custody rule’s annual surprise exam requirement. Those seven conditions are:

- The client provides an instruction to the qualified custodian, in writing, that includes the client’s signature, the third party’s name, and either the third party’s address or the third party’s account number at a custodian to which the transfer should be directed.

- The client authorizes the investment advisor, in writing, either on the qualified custodian’s form or separately, to direct transfers to the third party either on a specified schedule or from time to time.

- The client’s qualified custodian performs appropriate verification of the instruction, such as a signature review or other method to verify the client’s authorization, and provides a transfer of funds notice to the client promptly after each transfer.

- The client has the ability to terminate or change the instruction to the client’s qualified custodian.

- The investment advisor has no authority or ability to designate or change the identity of the third party, the address, or any other information about the third party contained in the client’s instruction.

- The investment advisor maintains records showing that the third party is not a related party of the investment advisor or located at the same address as the investment advisor.

- The client’s qualified custodian sends the client, in writing, an initial notice confirming the instruction and an annual notice reconfirming the instruction.

For six of these (all but number 6), we have to rely on our custodian to ensure that their processes and procedures satisfy the SEC. Schwab produced a chart of their best guess at how to comply with the new SEC custody rules. Although it costs me nothing to report that I have custody in my annual filing with the SEC, I would prefer avoiding the need for an annual surprise exam costing $10,000 even though there are no assets of which we actually hold custody. Therefore we need to meet all seven of the SEC’s conditions.

For six of these (all but number 6), we have to rely on our custodian to ensure that their processes and procedures satisfy the SEC. Schwab produced a chart of their best guess at how to comply with the new SEC custody rules. Although it costs me nothing to report that I have custody in my annual filing with the SEC, I would prefer avoiding the need for an annual surprise exam costing $10,000 even though there are no assets of which we actually hold custody. Therefore we need to meet all seven of the SEC’s conditions.

Schwab helps us satisfy all except number 6, maintaining records showing that we or a related party is not an owner on the account into which funds can be transferred. For most of the accounts, we need only verify that although we can transfer money from Mr. Smith’s traditional IRS into Mr. and Mrs. Smith’s joint account we are not associated with their joint account in any way.

However, I am not able to show that I am not related to my own accounts.

I have an inherited IRA account with the firm and have authorization to transfer the RMD into my joint account. How could I possibly record the fact that I am not related to myself?

Furthermore, as a perk of working at our firm, each employee is allowed to extend our full client service to their family. This includes helping their parents transfer their RMD from dad’s individually-owned IRA to mom and dad’s joint account. How can the advisors at Marotta continue to help their parents take their RMD out each year?

Compliance is never simple. A definition of custody which isn’t really custody subjects advisors to a list of seven requirements, the sixth of which cannot be implemented if you participate in your own services, forcing them to have a surprise examination over assets that they don’t actually hold.

I do not think the intent of the strange new SEC custody rules is to require surprise exams whenever an advisor helps his parents take their RMDs. I have looked for family exemptions, and although nothing has been written about this particular issue, there are other custody exemptions for advisors helping their own family, such as this Q&A from the SEC :

Question II.2

Q: If an employee of an advisory firm serves as a trustee to a firm client, does the firm have custody?

A: Generally, yes. The role of the supervised person as trustee is imputed to the advisory firm, thus causing the firm to have custody.

Footnote 139 of the Adopting Release explains, however, that the role of the supervised person as trustee will not be imputed to the advisory firm if the supervised person has been appointed as trustee as a result of a family or personal relationship with the grantor or beneficiary and not as a result of employment with the adviser. A similar analysis would apply where the supervised person serves as the executor to an estate as a result of a family or personal relationship with the deceased. A personal relationship developed as a result of providing advisory services to a client over many years is not the type of “personal relationship” contemplated by footnote 139. (Modified March 5, 2010.)

Therefore as Chief Compliance Officer, I am interpreting that so long as an advisor’s family members are on both the “from” account and the “to” account it will act as an exception to condition number six and transfers between these accounts will not trigger a requirement of a surprise exam. I’ve asked this question of the SEC repeatedly over the past year and to date they have not answered.

As a result of my interpretation I have filled out section 9 C as follows:

C. If you or your related persons have custody of client funds or securities in connection with advisory services you provide to clients, check all the following that apply:

☒ (1) A qualified custodian(s) sends account statements at least quarterly to the investors in the pooled investment vehicle(s) you manage.

☐ (2) An independent public accountant audits annually the pooled investment vehicle(s) that you manage and the audited financial statements are distributed to the investors in the pools.

☐ (3) An independent public accountant conducts an annual surprise examination of client funds and securities.

☐ (4) An independent public accountant prepares an internal control report with respect to custodial services when you or your related persons are qualified custodians for client funds and securities.

If you checked Item 9.C.(2), C.(3) or C.(4), list in Section 9.C. of Schedule D the accountants that are engaged to perform the audit or examination or prepare an internal control report. (If you checked Item 9.C.(2), you do not have to list auditor information in Section 9.C. of Schedule D if you already provided this information with respect to the private funds you advise in Section 7.B.(1) of Schedule D).

None of these questions were intended for the SEC’s strange new custody rule.

For 9 C (1), a qualified custodian (such as Schwab) sends account statements at least quarterly. The investments we supposedly have custody over are not really pooled investment vehicles, but I checked this box anyway.

Since I’ve interpreted that we are not subject to an annual independent surprise audit I did not check (2), (3), and (4).

I answered section 9 D through F as follows:

D. Do you or your related person(s) act as qualified custodians for your clients in connection with advisory services you provide to clients?

(1) you act as a qualified custodian No.

(2) your related person(s) act as qualified custodian(s) No.

If you checked “yes” to Item 9.D.(2), all related persons that act as qualified custodians (other than any mutual fund transfer agent pursuant to rule 206(4)-2(b)(1)) must be identified in Section 7.A. of Schedule D, regardless of whether you have determined the related person to be operationally independent under rule 206(4)-2 of the Advisers Act.

E. If you are filing your annual updating amendment and you were subject to a surprise examination by an independent public accountant during your last fiscal year, provide the date (MM/YYYY) the examination commenced: [LEFT BLANK]

F. If you or your related persons have custody of client funds or securities, how many persons, including, but not limited to, you and your related persons, act as qualified custodians for your clients in connection with advisory services you provide to clients? [SEE UPDATE BELOW]

You might think if you are deemed to have custody you must be a custodian. This is not the case. According to the SEC :

“Qualified custodians” under the amended rule include the types of financial institutions that clients and advisers customarily turn to for custodial services. These include banks and savings associations and registered broker-dealers. …

Many advisers registered with us are themselves qualified custodians under the amended rule. These advisers may maintain their own clients’ funds and securities, subject to the account statement requirements described below and the custody rules imposed by the regulators of the advisers’ custodial functions. Advisers may also maintain client assets with affiliates that are qualified custodians.

A qualified custodian is the entity which actually holds and protects the account holder’s funds and investments. Some advisors also act as qualified custodian. We do not.

March 5, 2017 UPDATE: The SEC has Completeness Check rules coded into their online system which are now inconsistent with their new compliance rules. If advisers have answered “Yes” to Item 9 A in compliance with their new ruling it requires an answer to Item 9 F of at least “1”. If you fail to provide an answer it returns the error message, “Item 9 Custody Item 9.F – How many persons act as qualified custodians must be answered and value provided must be at least ‘1’.”

While this is technically wrong, I believe that it is safer to answer 9 F with a “1” than failing to answer 9 A “Yes”.

If you have made it to the end of this article, my guess is that you are an investment advisor struggling with your own compliance in the wake of last year’s rulings. I hope you found this article helpful. And if you have decided to interpret compliance in your firm differently that does not make one of us wrong. I’d love to hear your response to these rules.

If you are an interested reader who made it to the end of this article, I hope that this gave you a peak into the real cost of regulation and compliance.

Photo by Thought Catalog on Unsplash