The federal Securities and Exchange Commission (SEC), created after the 1929 stock market crash, regulates financial corporations. The agency was charged with ensuring that nothing inappropriate occurs in the investment world. As a result, hundreds of regulations of compliance for firms dealing with securities were created. These rules have not prevented the Enron scandal, Bernie Madoff’s Ponzi scheme or the financial crash of 2008, but they cost American corporations several billions of dollars in compliance every year.

The federal Securities and Exchange Commission (SEC), created after the 1929 stock market crash, regulates financial corporations. The agency was charged with ensuring that nothing inappropriate occurs in the investment world. As a result, hundreds of regulations of compliance for firms dealing with securities were created. These rules have not prevented the Enron scandal, Bernie Madoff’s Ponzi scheme or the financial crash of 2008, but they cost American corporations several billions of dollars in compliance every year.

Registered Investments Advisors (RIAs) are required to complete several filings with the Securities and Exchange Commission (SEC). One of them is Form ADV Part 1.

Form ADV Part 1 is a series of short answer, numerical, and bullet point questions. Its intent is to be a standardized way that you can compare two financial firms to one another. In reality, the data is too inconsistent to be useful.

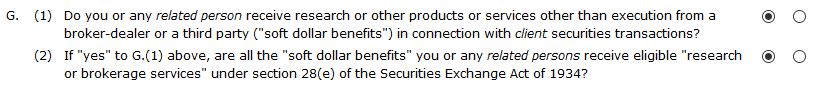

Item 8 Participation or Interest in Client Transactions Section G Question (1) asks:

We answer “Yes” to both of these questions and have a full two pages describing these so-called “soft dollar benefits” that we receive from Charles Schwab in our ADV Part 2. In part, we write:

Advisors with at least $100 million in client assets are not charged a fee by Schwab for use of the Institutional Intelligent Portfolio technology. Otherwise Schwab would charge an annual licensing fee of 0.10% on the value of our clients’ assets in the program. This requirement gives us an incentive to custody sufficient assets at Schwab.

Schwab also makes available various support services. Some of those services help us manage or administer our clients’ accounts; others help us manage and grow our business. Schwab’s support services generally are available on an unsolicited basis (we don’t request them) and at no charge to us as long as our clients collectively maintain a total of at least $10 million of their assets in accounts at Schwab. If our clients collectively have less than $10 million, Schwab may charge us quarterly service fees of $1,200.

We generally don’t think about these services at any time except compliance time. As we conclude in our ADV Part 2:

The $100 million minimum may give us an incentive to recommend that clients maintain their accounts with Schwab, based on our interest in receiving Schwab’s services that benefit our business rather than based on your interest in receiving the best value in custody services and the most favorable execution of your transactions. This is a potential conflict of interest.

We believe, however, that our selection of Schwab as custodian and broker is in the best interests of our clients. Our selection is primarily supported by the scope, quality, and price of Schwab’s services and not Schwab’s services that benefit only us.

Furthermore, we have over $400 million in client assets under management, and we do not believe that having our clients collectively maintain at least $100 million of those assets at Schwab to avoid paying Schwab quarterly service fees represents a significant conflict of interest.

Our choice to disclose these benefits and answer “Yes” to these two questions is uncommon. Many firms have the exact same compliance requirements as we do, custody client assets at Charles Scwab or with Schwab’s Institutional Intelligent Portfolio technology, and yet they choose to answer “No” to both questions.

Their rationale is as varied and unique as human experience. Some feel that mere “research” is not soft dollars. To them soft dollars is something more substantial. Others say that if they don’t use the services, then they don’t need to report them. Still others say that their compliance specialists would have mentioned it if it had been a problem. To others they are simply trying to avoid the impression that having a “Yes” can give as soft dollars can be a bad thing for clients as “Investors Lose Out When Advisors Use Soft Dollars ” suggests.

The point of this blog post is that with disparate reporting, asking this compliance question is useless. To some advisors soft dollars are something sinister such that nothing that they do could be misconstrued as being included. To others, the definition of soft dollars is so broad that everything is just part of the landscape.

Identical firms answer questions like these differently making the resulting data meaningless and useless. If anyone wants to use this data, the SEC will need to standardize answers first. If no one wants to use this data, we should eliminate the burden of having to provide it.

Currently, the OMB estimates that it requires 23.77 hours for RIAs to comply with Form ADV Part 1 and 29.28 hours for ADV Part 2. This year, they have added a new requirement of ADV Part 3 Form CRS for which they have not yet assigned an estimated average burden, but on which we have already spent countless hours of compliance efforts listening to online presentations and reading compliance articles and SEC instructions. RIAs are also required to file the assets they hold through the Electronic Data gathering, Analysis, and Retrieval (EDGAR) system which, according to the OMB, requires an additional 23.8 hours per quarterly filing.

When you suggest additional government regulation, you should know that regulation doesn’t make you safer. Regulation means more useless data entry required by innocent people and never put to any useful purpose by government. As SEC Commission member Hester Peirce suggests:

Our rule writers and examiners ask for a lot of data. The temptation to collect more data only grows with the sophistication of our analytical techniques and tools. … Once we start down the road of collecting data, it is hard to rein ourselves in. … We ought to think carefully about how much data is enough.

The SEC should scale back their data collection. Imagine how you would feel if some government agency asked you to spend over 150 hours a year (3.75 weeks) forced to work for free during your vacation days as a government data entry clerk.

Photo by Jon Tyson on Unsplash