Which foreign countries should you invest in? Since 2004, we’ve been advocating for a strategy we call Freedom Investing where we invest primarily in countries with high economic freedom scores according to The Heritage Foundation’s Index of Economic Freedom.

Which foreign countries should you invest in? Since 2004, we’ve been advocating for a strategy we call Freedom Investing where we invest primarily in countries with high economic freedom scores according to The Heritage Foundation’s Index of Economic Freedom.

The new 2023 Index of Economic Freedom scores came out on February 27, 2023, and they tell a sad story. The global average economic freedom score fell to the lowest it has been over the past two decades. Meanwhile, nearly all of the free and mostly free countries saw a decline in their overall freedom score with Taiwan being the notable exception posting a small improvement in overall score.

As the Heritage staff explains in the Executive summary , “the ongoing effects of the COVID-19 pandemic and Russia’s invasion of Ukraine” have slowed economic growth while simultaneously too many countries have had an “abrupt and shortsighted renunciation of the principles of economic freedom.”

While this departure from freedom may have dampened returns last year, hopefully it means that those countries which return to economic freedom see noteworthy market recoveries.

Last year in 2022, we did a historical analysis to analyze the predictive power of each sub-score on overall future investment returns and developed a new composite ranking with higher predictive power for screening country inclusion. This composite score is made from two parts of Property Rights and Monetary Freedom with one part of Government Integrity, Fiscal Health, and Labor Freedom. You can see the 2023 developed country rankings below.

2023 Developed Country Rankings

| Composite Rank | Country | 4-Year Average Composite (2020-2023) |

4-Year Average Overall Score (2020-2023) |

2023 Overall Score |

|---|---|---|---|---|

| 1 | Denmark | 88.47 | 77.93 | 77.60 |

| 2 | Singapore | 88.15 | 86.85 | 83.90 |

| 3 | New Zealand | 87.34 | 81.88 | 78.90 |

| 4 | Switzerland | 86.33 | 82.98 | 83.80 |

| 5 | Finland | 85.60 | 76.80 | 77.10 |

| 6 | Sweden | 85.50 | 76.25 | 77.50 |

| 7 | Netherlands | 84.58 | 77.83 | 78.00 |

| 8 | Norway | 84.18 | 75.15 | 76.90 |

| 9 | Ireland | 83.99 | 81.58 | 82.00 |

| 10 | Austria | 82.87 | 73.03 | 71.10 |

| 11 | Australia | 81.08 | 79.38 | 74.80 |

| 11 | Average | 80.03 | 74.56 | 73.17 |

| 12 | Germany | 79.64 | 73.95 | 73.70 |

| 13 | Canada | 78.69 | 76.60 | 73.70 |

| 14 | Japan | 78.45 | 71.65 | 69.30 |

| 15 | United Kingdom | 78.31 | 75.08 | 69.90 |

| 16 | Belgium | 77.20 | 68.93 | 67.10 |

| 17 | Portugal | 75.03 | 68.70 | 69.50 |

| 18 | Israel | 74.44 | 71.18 | 68.90 |

| 19 | United States | 73.46 | 73.53 | 70.60 |

| 20 | France | 73.17 | 65.30 | 63.60 |

| 21 | Poland | 71.89 | 68.80 | 67.70 |

| 22 | Italy | 71.45 | 64.10 | 62.30 |

| 23 | Spain | 70.85 | 67.50 | 65.00 |

Commentary on Included Countries

Last year, thirteen countries made our cut-off. This year, eleven do. Those countries are Denmark , Singapore , New Zealand , Switzerland , Finland , Sweden , Netherlands , Norway , Ireland , Austria , and Australia .

Denmark, Singapore, New Zealand, and Switzerland repeat again this year as the top four countries, although their order has swapped. They continue to show outstanding ranks in both overall score and composite score.

4-Year Averages |

Denmark | Singapore | New Zealand | Switzerland |

|---|---|---|---|---|

| Composite | 88.47 | 88.15 | 87.34 | 86.33 |

| Property Rights (x2) | 92.28 | 95.68 | 90.15 | 90.55 |

| Government Integrity | 96.48 | 92.40 | 95.88 | 90.65 |

| Fiscal Health | 97.35 | 79.40 | 89.25 | 96.33 |

| Labor Freedom | 72.30 | 84.18 | 78.75 | 66.35 |

| Monetary Freedom (x2) | 84.30 | 84.85 | 83.60 | 84.95 |

Surprisingly, this year’s country list includes two countries which received one perfect sub-score. Denmark received a perfect score of 100 in its 2023 Government Integrity, and Finland received a perfect score of 100 in its 2023 Property Rights.

Just like last year, Austria is included thanks to its composite score rather than its overall score. Its rankings included in the composite are relatively high.

Austria |

4-Year Average | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Composite | 82.9 | 81.3 | 84.9 | 82.9 | 82.4 |

| Property Rights (x2) | 92.4 | 97.0 | 98.4 | 86.8 | 87.3 |

| Government Integrity | 83.2 | 80.9 | 82.9 | 84.8 | 84.0 |

| Fiscal Health | 76.0 | 54.5 | 71.7 | 90.0 | 87.9 |

| Labor Freedom | 73.5 | 78.8 | 78.4 | 68.4 | 68.3 |

| Monetary Freedom (x2) | 81.4 | 80.4 | 82.3 | 81.7 | 81.0 |

Austria has a strong rule of law with high government integrity and protected property rights. Their Fiscal Health is fair in 2023, right near the world average while their historical Fiscal Health scores show higher quality. Their regulatory framework is transparent and efficient, although required high cost fringe benefits do bring down their Labor Freedom score slightly. Unlike other countries who have seen high inflation this last year, their Monetary Freedom still sits strong with the recent inflation rate being only 2.8%. Why is its overall score so much lower? For one, Austria’s 2023 Government Spending score (not included in the composite) is a dismal 13.0 as they have had a negative three-year budget balance average.

Commentary on Excluded Countries

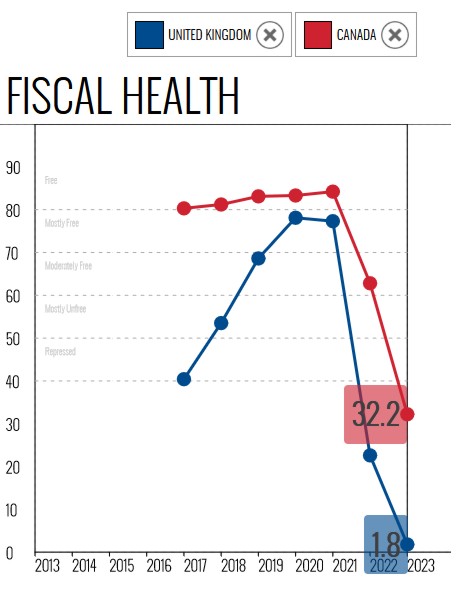

With this update, the four-year average composite of both Canada and United Kingdom fell below the standard for inclusion.

This decline in the economic freedom for both countries can be attributed to their declines in Fiscal Health. Canada’s Fiscal Health score has fallen from from 84.2 in 2021 to 62.8 in 2022 and now 32.2 in 2023. United Kingdom’s Fiscal Health score has fallen from 77.3 in 2021 to 22.6 in 2022 and now 1.8 in 2023. According to the 2023 Index, public debt equals 112.9% of GDP in Canada and 95.3% of GDP in the United Kingdom.

Fiscal Health was added to the Index in 2017 and measures as a percentage of GDP both the average deficits for the past three years and the current debt. In our regression analysis, its data set was limited by its late addition to the index, but what little data we did have suggested that the Fiscal Health score has one of the highest predictive powers on future investment returns from all the sub-scores.

On the other hand, Germany ‘s economic freedom scores put it right on the edge of inclusion. Here are its four-year composite scores:

Germany |

4-Year Average | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Composite | 79.6 | 80.7 | 83.2 | 77.0 | 77.6 |

| Property Rights (x2) | 87.5 | 94.8 | 95.7 | 78.8 | 80.5 |

| Government Integrity | 85.8 | 89.4 | 89.4 | 81.5 | 82.8 |

| Fiscal Health | 89.7 | 82.7 | 90.4 | 92.8 | 92.9 |

| Labor Freedom | 52.8 | 52.8 | 52.3 | 53.0 | 53.0 |

| Monetary Freedom (x2) | 77.2 | 75.3 | 79.5 | 77.2 | 76.7 |

You can see that Germany’s Labor Freedom score is the main drag on its composite score. Labor Freedom describes the level of labor regulations in the country, the labor force participation rate, and labor productivity. German labor regulations are succinctly described as very strict. Examples of this include required employment documentation for all employees even if no formal employment contract exists, limitations on how many hours you can legally work in a week, a fixed set of minimum holidays for full-time employees, and regulations that must be followed when terminating an employee. These regulations create friction in the movement of employees and potentially limit the productive allocation human capital in the country.

While Germany’s Labor Freedom scores are in the low 50s, the 2023 Labor Freedom scores of Denmark , Singapore , New Zealand , and the United States are 64.8, 77.3, 71.5, and 76.3 respectively.

Concluding Thoughts

It is uncommon to have a diversified ETF-based strategy that demonstrates outperformance. Most suggested investment strategies require concentrated positions or thinly traded companies. However, Freedom Investing is a strategy that invests in broad basket index funds which, in a 25-year study, on average has a 1-year advantage of 2% over the EAFE Index.

While past performance has little if anything to do with future returns, it is also all we have to design portfolios. We implement Freedom Investing at all levels of our services and include a small exposure in our free Marotta Gone-Fishing Portfolio.

Photo of Denmark by Svend Nielsen on Unsplash. Image has been cropped.