Recently, we lowered the duration of our U.S. Bond portfolio and increased our allocations to inflation-protected bonds.

Recently, we lowered the duration of our U.S. Bond portfolio and increased our allocations to inflation-protected bonds.

We made this change because of future inflation and interest rate expectations.

Without any financial goals or future withdrawal needs, your allocation to stocks and bonds wouldn’t matter. Without a withdrawal rate, your portfolio would grow to whatever it grows to and an all stock portfolio gives you the best chance of appreciation.

However, when portfolios are subjected to withdrawal needs, the sequence of returns matters greatly. If stock returns are less favorable during years in which you need to make large withdrawals, the all-stock portfolio might run out of money. Adding bonds to your asset allocation allows withdrawals to come from more stable investments, gives your stock investments time to recover, and can help you achieve your financial goals.

Interest Rates and Inflation Affect Bond Prices

Buying bonds carries at least three risks. First, your purchasing power could be lost through inflation by the time your bond matures. When you get your money back, it won’t buy as much. Second, your bond could be worth less than your purchase price if you need to sell your bond before maturity and interest rates have risen. And third, the bond issuer could default, stop paying interest, and fail to return your investment.

Like stocks, each of these risks can be reduced through diversification by purchasing bonds with different maturities, credit qualities, industries, and countries.

Bond prices fluctuate daily in response to both changes in interest rates and the credit quality of the underlying issuer. As a bondholder, you should be aware that the price of a bond has an inverse relationship to changes in interest rates. If interest rates rise, then the price of an existing bond usually falls. This is because the older bond pays a lower rate than can be earned buying a new bond in the higher interest rate market.

Investors use a measurement called “duration” to model the expected price volatility of a bond given changes in interest rates. Duration can be calculated on individual bonds. For exchange-traded funds (ETFs), which hold many individual bonds, the weighted-average duration is calculated and reported by the fund. For a portfolio of ETFs, the weighted-average duration of the ETFs can be calculated to determine the duration of a portfolio.

A duration of 10, for example, would mean that if interest rates increase 1% you would expect the price of that bond to decrease about 10% and if interest rates decrease 1% you would expect the price to increase about 10%.

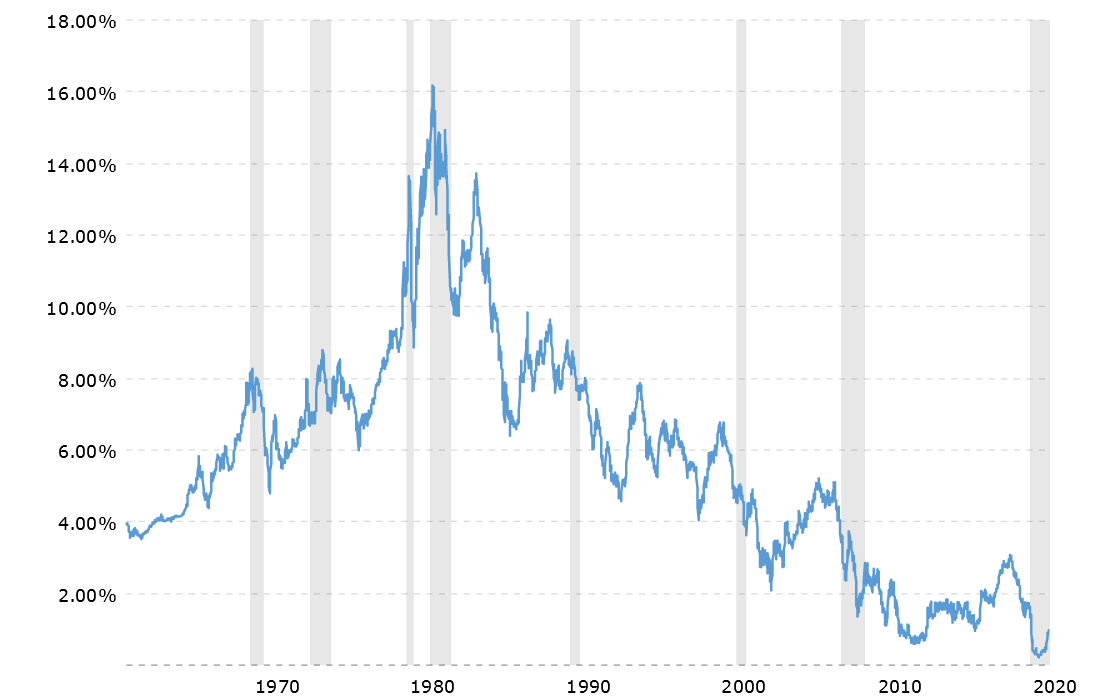

Since the 1980s, interest rates have been trending downward. Five-year treasury bond yields peaked at 16.71% in 1981 and have trended downward to around 0.90% as I write this.

In a declining interest rate environment (like we’ve had for the past 40 years), a higher duration means a greater total return than lower duration bonds.

However, in a rising interest rate environment, a higher duration means less return because either you will take losses (sell at lower prices) in order to reinvest your money into the better paying bonds or you will hold onto a worse paying bond and make less than the current rate.

In this way, lowering duration when you expect interest rate increases can help stage yourself for those rate hikes.

For years, many have been wondering when interest rates will rise. While there have been some periods of rising inflation, the trend has largely been falling.

Even as the rate went lower, apparently there was always more room to go lower still. Now however, with interest rates under 1%, there is less room to fall than to rise. Either the Treasury will have to issue negative interest rates (unconventional and unlikely), maintain these low rates, or increase them. We feel that an increase is likely to happen but do not know when or how quickly.

Another factor that affects bond pricing is inflation. Generally, when inflation rises, bond prices fall and when inflation falls, bond prices rise. This is because inflation makes the $1,000 you are paid back worth less than $1,000 was worth when you bought the bond.

Bonds with longer terms are the most vulnerable to losses from rising inflation.

Expectations of Higher Inflation

In March 2021, the Board of Governors of the Federal Reserve had a meeting of the Federal Open Market Committee. The meeting minutes summarized part of their discussion as follows (emphasis added):

Members agreed that the Federal Reserve was committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum-employment and price-stability goals. All members reaffirmed that, in accordance with the Committee’s goals to achieve maximum employment and inflation at the rate of 2 percent over the longer run and with inflation running persistently below this longer-run goal, they would aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. Members expected to maintain an accommodative stance of monetary policy until those outcomes were achieved.

As of February 2021, overall 12-month CPI has been 1.7% . In this meeting, the Federal Reserve resolved to “aim to achieve inflation moderately above 2 percent.” Because of this commitment to higher inflation, expecting higher inflation is simply taken them at their word.

Using simple metrics to estimate future inflation expectations, it seems that the 5-Year future expected inflation is in the range of 2.53% (maturity rate of 0.87% minus % as of April 7, 2021) and the 5-year breakeven inflation rate of 2.55% as of April 8, 2021.

Using another metric, the 3-year implied inflation rate of inflation-protected bonds is 2.35% (SCHO SEC-yield of 0.13% on April 9, 2021 minus VTIP SEC-yield of -2.22%).

Additionally, the large numbers of jobless and unfilled positions suggest that wage inflation (which normally inspires price inflation) is likely on the way.

The seasonally-adjusted non-farm rate of job openings is at the highest its been since 2000 at a rate of 4.9% (over 7 million jobs) as of February 2021, implying that employers are having difficulty filling their job openings. Meanwhile, as of March 2021, 110 million people or 42.2% of the civilian non-institutional population do not have a job with an official unemployment rate of 6.0%.

With many childcare centers closed and unemployment compensation currently tax-free, employers are having to compete with unemployment benefits and higher childcare costs to entice people back into the workforce. As of March 2021, the seasonally adjusted insured unemployment rate is 2.8 percent representing over 4 million people who are receiving unemployment benefits, and as of April 3, 2021, 744 thousand people filed for their first unemployment insurance claim, joining many more who are already receiving benefits.

To encourage those beneficiaries back into working may take higher wages, meaning wage inflation.

Expectations of Rising Interest Rates

This is the current yield curve as of April 8, 2021 compared to the start of the year on January 4, 2021:

| Date | 1 mo | 2 mo | 3 mo | 6 mo | 1 yr | 2 yr | 3 yr | 5 yr | 7 yr | 10 yr | 20 yr | 30 yr |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01/04/21 | 0.09 | 0.09 | 0.09 | 0.09 | 0.10 | 0.11 | 0.16 | 0.36 | 0.64 | 0.93 | 1.46 | 1.66 |

| 04/08/21 | 0.02 | 0.02 | 0.01 | 0.04 | 0.05 | 0.14 | 0.33 | 0.85 | 1.30 | 1.64 | 2.22 | 2.32 |

| Change | -0.07 | -0.07 | -0.08 | -0.05 | -0.05 | +0.03 | +0.17 | +0.49 | +0.66 | +0.71 | +0.76 | +0.66 |

You can see from this chart that interest rates are fairly low and longer term bonds are seeing interest rate increases. The market is demanding higher interest rates because of the higher expected inflation risk.

If you like the yield of a bond, then it doesn’t really matter what the price of the bond does. If interest rates increase, you may technically miss out on higher yields but your coupon payment stays the same.

If you don’t like the yield and think interest rates might go higher, then exposing yourself to duration volatility is likely not worth it.

Description of Bond Update

In response to these two forecasts of higher inflation and higher interest rates, we decided to adjust our bond strategy.

Previous to this update, our U.S. Bond strategy was 26% inflation-protected and 28% short-term bonds, and had a duration of 5.3908.

In this update, we decreased our aggregate bond holding (SCHZ, the Schwab U.S. Aggregate Bond ETF) and added a short-term inflation protected bond (VTIP, the Vanguard Short-Term Inflation-Protected ETF).

Treasury inflation-protected securities (TIPS) increase their rate of return by the CPI-U inflation measurement. Semiannually, the bond’s principal increases by the same percentage as the CPI-U index. With the same interest rate, a higher principal means higher dollar-value interest payments.

This adjustment changed our U.S. Bond strategy to 61.0% inflation-protected, 70.0% short-term bonds, and a duration of 3.8752.

More inflation-protected bonds means that we are protecting our Stability allocations from the dangers of losing purchasing power.

Our new bond allocation means that we are holding:

- Intermediate-term aggregate bonds which should perform well if neither inflation nor interest rates rise,

- Intermediate-term inflation-protected bonds which should perform well if inflation increases but not interest rates,

- Short-term inflation-protected bonds which should perform well if both interest rates and inflation increase, and also

- Short-term bonds which should perform well if interest rates increase but not inflation.

In this way, we have mitigated the affects of rising interest rates and inflation while maintaining a balanced bond portfolio.

If our guesses are wrong and interest rates don’t go up more, then we could have gotten better yield if we’d stayed with longer-term bonds. Similarly, if inflation doesn’t rise, then we could have gotten a better return if we’d stayed out of inflation-protected bonds.

In the world where neither interest rates nor inflation substantially increase, then the next five years might look more like the past two decades. Using historical returns for estimates as a guess, we may be missing out on some return if our assumptions are wrong. On historical five-year periods, the extra annual total return we might be missing if we have guessed wrong could be between 0.98% (2010-2015 returns of 2.854% versus 1.874%) and 0.312% (2005-2010 returns of 4.771% versus 4.459%) annual return.

That being said, the primary goal of our stability allocation is to protect Stability assets from inflation. We feel lost yield pursuing this goal is a worthy trade.

Asset Allocation

Families who are not withdrawing from their portfolio can afford any asset allocation. They might have a pension which is sufficient for their needs. If they put the entire amount in stocks, they can afford the markets bouncing up and down. It won’t change how they eat. If they put the entire amount in bonds, they don’t need to keep up with inflation.

We recommend that those in retirement have 5-7 years worth of safe spending in Stability (bonds). The rest of the portfolio, with a time horizon of 8 years or more, we recommend putting in Appreciation (stocks). The balance is between sleeping well tonight and eating well in ten years.

We add bonds to allocations to keep a portion of the assets safe when the markets drop. When the market does drop, we rebalance by selling some of these safe bond investments and putting the money back into the stock markets.

For this reason, we do not care as much about bond yield. The Appreciation side of our allocation is the engine of growth. If you want more appreciation, we recommend more stocks.

If you are not anticipating withdrawing from any of your investment accounts over the next 7 years, then you do not need a bond allocation. Some people want a bond allocation anyway because of their risk tolerance and small withdrawal needs.

Photo by Willian Justen de Vasconcellos on Unsplash