We have been expecting a raise in interest rates since more than a year ago when our investment committee decided to lower the duration of our U.S. Bond portfolio and increase allocations to inflation protected bonds. After that decision we wrote, “Updates to Our Bond Allocation (April 2021)” which chronicled our expectations of higher inflation and rising interest rates and how we had shortened the duration of our U.S. Bonds in anticipation. During 2021, longer term bonds fared better than short-term bonds, but in the first quarter of 2022 bonds with longer duration suffered the largest losses.

We have been expecting a raise in interest rates since more than a year ago when our investment committee decided to lower the duration of our U.S. Bond portfolio and increase allocations to inflation protected bonds. After that decision we wrote, “Updates to Our Bond Allocation (April 2021)” which chronicled our expectations of higher inflation and rising interest rates and how we had shortened the duration of our U.S. Bonds in anticipation. During 2021, longer term bonds fared better than short-term bonds, but in the first quarter of 2022 bonds with longer duration suffered the largest losses.

The recent Wall Street Journal article, “Bond Market Suffers Worst Quarter in Decades “, began:

U.S. bonds’ worst quarter in more than 40 years has come to a close. The question for many investors now is whether it is time to buy the biggest dip in recent memory.

Now that interest rates have risen and bond prices have fallen, bonds are paying a much better rate. This rate is more attractive and buying bonds may be attractive despite the scheduled additional hikes in interest rates. The impact of those expected hikes may already be priced into the market, but we think keeping our U.S. Bond duration relatively short is warranted.

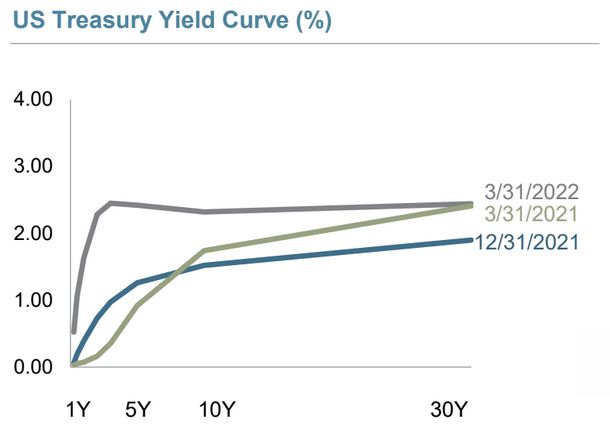

These rate hikes have also flattened the yield curve.

This flattening of the yield curve does not mean that a recession is imminent. It is like suggesting that people carrying umbrellas is the best indicator that it is going to rain.

First, there are many more times that the yield curve has inverted than we have had recessions. And recessions come around every 5.6 years on average.

Second, when recessions have followed an inverted yield curve they can take up to 24 months to materialize. Two years is a long time to wait for a recession which may not even affect the stock market. The market may continue upwards during that entire time.

We think holding your next seven years of spending in relatively safe bonds is always a good idea. But holding too much in bonds may not keep up with inflation and is not ideal for your long-term investment strategy.

Photo by Janek Holoubek on Unsplash. Yield curve graph from Dimensional Fund Advisor’s Institutional Unbranded Slides.