The term PIIGS is an ancronym made popular during the European debt crisis of 2008 and 2009. It stood for the five countries that had high debt and deficit and poor prospects of repaying their loans. These financially weak countries were Portugal, Ireland, Italy, Greece, and Spain.

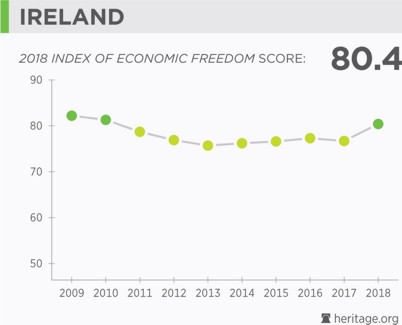

When the term was first used in the 1990s it included only the southern European countries and did not include Ireland. Ireland was added during the economic crisis as that country’s debt and deficit rose sharply. At that time I thought it was odd that a country which was relatively high in economic freedom also had a ballooning debt and deficit. But we chronicled Ireland’s deficit spending and quickly ballooning debt in articles written in 2010, 2011, and 2012. The debt and deficit also caused its Economic Freedom score to drop slightly as well. You can see Ireland’s economic freedom dip down below 80 during their high debt and deficit years.

More recently Ireland has proved that a country can significantly decrease its debt and escape the deficit spending of the ring of fire of countries.

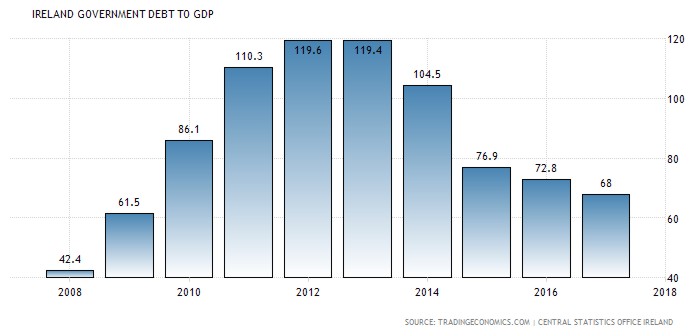

Here is the ratio of Ireland’s debt to Gross Domestic Product (GDP). Lower debt-to-GDP ratio is considered better in the same way that a lower debt-to-income ratio is considered better for individuals.

While Irish government debt to GDP rose to over 100 percent, it has since fallen back to just 68 percent last year. As the 2018 Index of Economic Freedom reports about Ireland:

Although public debt remains high, deficit-reduction measures and banking-related debt refinancing have stimulated economic recovery. Low corporate taxes and a talented high-technology labor pool attract foreign multinationals. The government opposes a September 2017 European Commission proposal to increase the corporate tax rate and screen foreign direct investment in the bloc.

Even U2 singer Bono defended the free capitalism and commerce of Ireland in 2014, as The Guardian reports:

In an interview with the Observer, …Bono said: “We are a tiny little country, we don’t have scale, and our version of scale is to be innovative and to be clever, and tax competitiveness has brought our country the only prosperity we’ve known. That’s how we got these companies here … We don’t have natural resources, we have to be able to attract people.”

Ireland is facing strong pressure from Brussels to increase its corporate tax rate so that Ireland’s low corporate rates don’t compete with the rest of the European Union. We hope for the sake of the Irish economy and Irish economic freedom that Irish tax rates remain low. Punitive tax rates are recognized to be economically destructive by economists, not just famous singers.

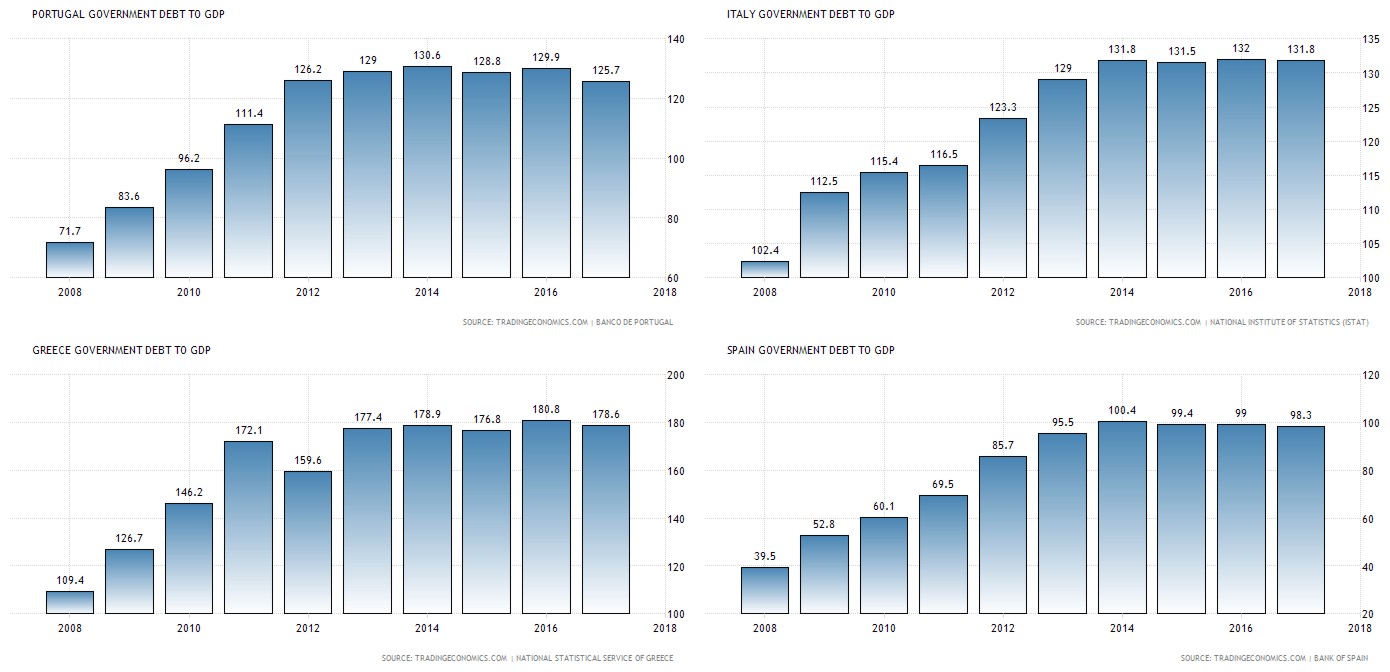

You can see from the debt-to-GDP graphs of the other PIGS of Portugal, Italy, Greece, and Spain that Ireland lowering its tax rates clearly helped. The debt-to-GDP of the other PIGS still remain around or above 100.

In recognition of its efforts to reduce its debt and deficit and Ireland’s return to the “free” category of the economic freedom index, I think the letter I for Ireland should be removed from PIIGS and it should return once more to just PIGS.