A recent article on Seeking Alpha, “Gold’s Role In A Portfolio ” has me again showing how the correct asset allocation to gold is zero percent.

Gold advocates will often go to great lengths to tout the advantages of owning gold while ignoring easier methods of achieving the same results.

Here are three ways that the article was intentionally misleading:

Cherry picking the best time period

During the time period [1969 through 2016], gold returned 7.0%, about the same as bonds, but with much greater volatility than stocks.

First, this time period includes the hyperinflation of the 1970s. And it starts right before one of the worst periods in the stock market. And it starts right before Nixon’s abandonment of the gold standards of the Bretton Woods system in 1971.

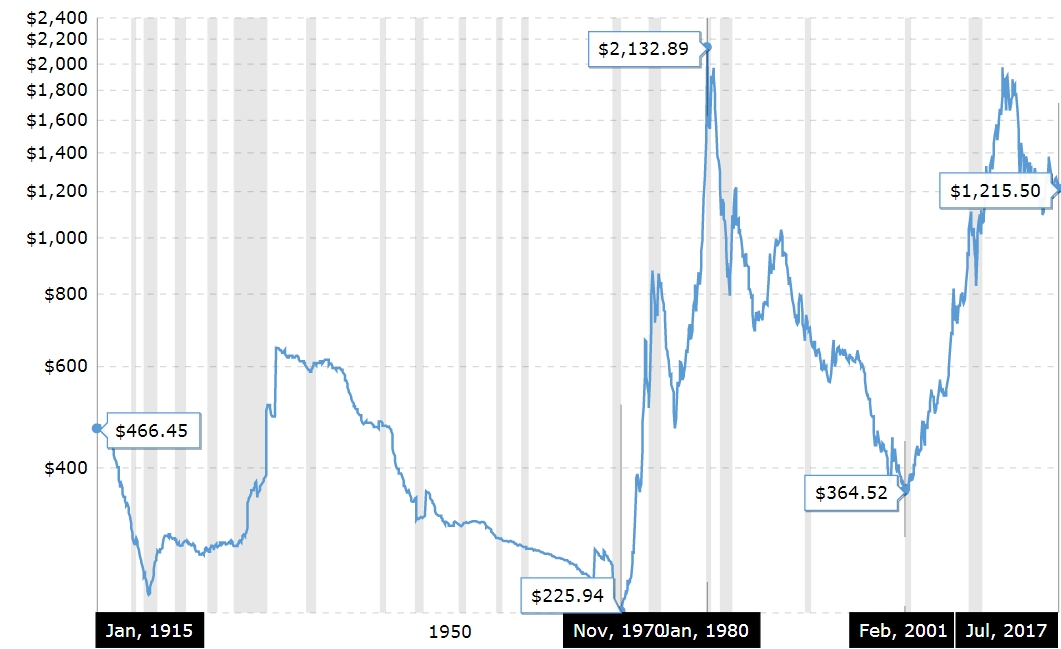

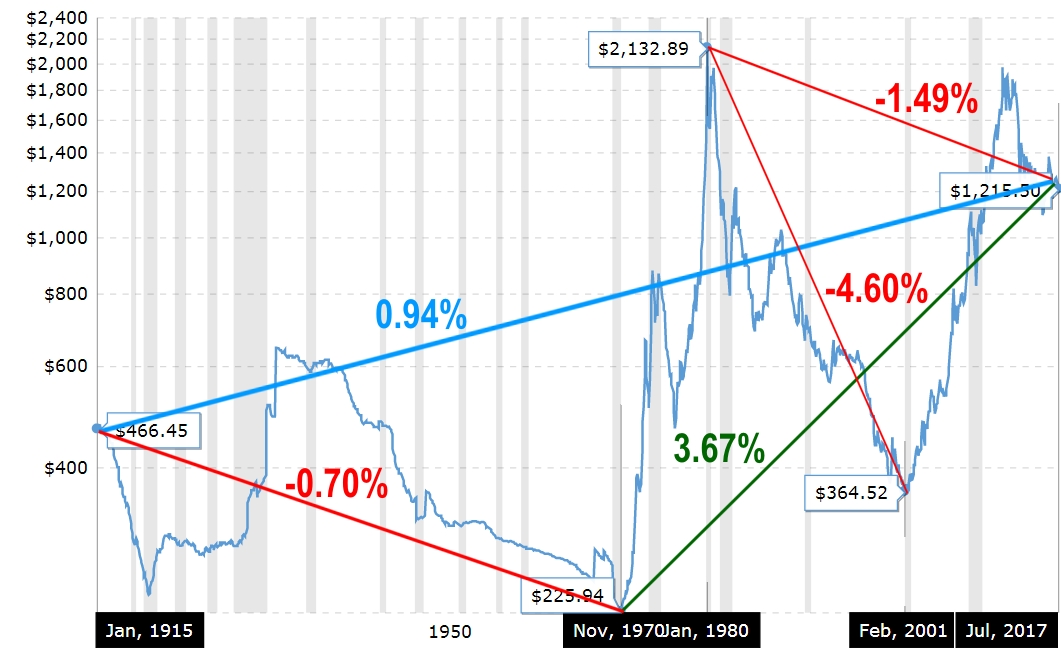

Here is an Interactive chart of historical data for real (inflation-adjusted) gold prices per ounce back to 1915. The series is deflated using the headline Consumer Price Index (CPI) with the most recent month as the base. The current month is updated on an hourly basis with today’s latest value. The current price of gold as of July 07, 2017 is $1,215.50 per ounce.

As you can see, the return between the inflation adjusted bottom gold price in November of 1970 and today is cherry picking some of the best returns. On an inflation adjusted basis this time period had a 3.67% return.

It completely ignores the previous 55 years in which gold had an average return of -0.70% annually. Once you include this time period, gold’s inflation adjusted return drops to 0.94%.

We could just as easily pick gold’s inflation-adjusted high point of January 1980 and show how gold lost -4.60% annually for the next 21 years. Or how gold has lost -1.49% annually now for 37 years.

Beware of dates which are selected specifically to show that gold is a good investment.

Not Considering All The Alternatives

Many articles which are intended to tout the advantages of a single type of investment look at how that investment could be added to a portfolio to supposedly improve the portfolio. The false claim is that if a portfolio with this type of investment is better than the portfolio which excludes it then you should invest. This is a fallacy of a false dilemma.

It assumes that there are no alternatives to diversify other than adding gold.

Modern portfolio theory teaches us that, even if an investment has a low return, it can improve the performance of a portfolio if it has a low correlation to the other investments in the portfolio. In this article, we will discuss how gold’s low correlation to both stocks and bonds make it an ideal portfolio diversifier.

The word “ideal” is defined as “a concept of something in its perfection, a standard of perfection or excellence.”

An “ideal” portfolio diversifier would be the perfect portfolio diversifier. What set of diversifiers did the author consider other than gold?

The author’s portfolio of 60% S&P 500 and 40% Intermediate Government Bonds is just half of one asset class (US Stocks) and a fraction of another asset class (US Bonds). Among the six asset classes we use to categorize investments, gold would definitely not be the next asset to add to the portfolio even if we believed the cherry-picked return data.

On average, gold just keeps up with inflation and is very volatile. Precious metal mining companies might have a better return. Mining and materials might have an even better return and lower volatility. But we have recently questioned weather any of these categories is on the efficient frontier. Instead much of the benefit of precious metals and materials and mining might be gained just by investing in energy and real estate.

Additionally, the addition of small investments in the emerging markets or foreign countries with freedom should be consider as diversifiers.

Modern portfolio requires that you consider all of your investment options.

Using Sharpe Ratio instead of Computing The Efficient Frontier

Finally, the author used Sharpe ratio to suggest that the portfolio which included a 10% allocation to gold was somehow superior.

To examine gold’s role in a 60/40 stock/bond portfolio, we added a 10% position in gold and reduced the weighting in stocks to 54% and bonds to 36%. This three asset portfolio had a Sharpe ratio of 0.45. That is higher than the Sharpe ratio of the 60/40 stock/bond portfolio. Stated another way, the three asset portfolio had 97% of the return of an all stock portfolio but with just 55% of the risk.

An optimum portfolio is one which has the highest return for a given level of risk. Sharpe ratios measure return in units of risk. I find this mixing of risk and return unhelpful at best and misleading at worst.

Even during this cherry-picked time frame the three asset portfolio had a return which was 0.28% inferior to the S&P 500 while the standard deviation was just 55% of the S&P 500. Since the measurements are not better in both measures they should not be compared. Unfortunately the Sharpe ratio is trying to compare them. But Sharpe ratio uses a measure of risk based on short term movements of volatility. For long term investing you may care more about long term return than short term volatility.

The efficient frontier isn’t just one point. It is a series of portfolios which have the highest expected mean return for the expected volatility. Imagine two points on the efficient frontier. One is not superior to the other just because it has a higher Sharpe ratio.

Summary

And again, all of this is predicated on starting to measure the long term nominal return of gold at the lowest inflation adjusted return in its history. If you were to start measuring 10 years later cash would have been a better investment!

Photo used here under Flickr Creative Commons.