Many investors don’t appreciate asset allocation or understand intuitively how a diversified portfolio can exceed the sum of its parts. The efficiency of an investment is measured by the greatest return for the lowest volatility. Blending a portfolio allocation can make it even more efficient by either boosting returns or lowering volatility. Here are articles which explain the efficient frontier of investing:

|

CAPM: The First Factor of InvestingModeling investment returns seeks to find an equation to predict your expected returns as much as possible. The simplest equation for the markets would be “Return equals 11.71%.” This has been the average return from 1927 through 2010, the zero factor model. |

|

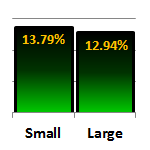

Size: The Second Factor of InvestingThe second factor of investing is size as measured by a stock’s total capitalization. Over time small cap will outperform large cap even after factoring out measurements of volatility. |

|

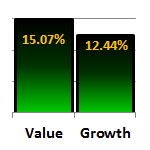

Value: The Third Factor of InvestingA stock’s valuation is measured on a continuum from “value” to “growth” In broad strokes, value stocks are cheap and growth stocks are expensive. |

|

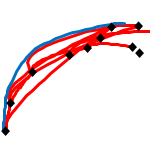

The Efficient FrontierThe efficient frontier measures all investments on a scale of risk and return. Risk is commonly placed on the x-axis, and return is placed on the y-axis. |

|

Asset Allocation and the Efficient FrontierCrafting portfolio asset allocations is a combination of art and engineering. Just as a blending of colors can produce cerulean, so a blending of indexes produces a unique shade of risk and return. |

|

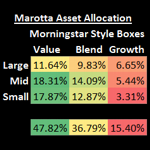

Style Boxes and the Efficient FrontierThe Marotta allocation method is a proportionally weighted allocation based on the square of each Sharpe ratio. Squaring the Sharpe ratio drastically reduces asset categories in proportion to their distance from the efficient frontier. |

|

The Shiller Ten-Year P/E RatioWhat we would really like to measure are the changes in price (P) that cause a company with a good long-term track record to look relatively cheap. Economist Robert Shiller created just such a measurement. |

|

Using Dynamic Asset Allocation to Boost ReturnsThink of static asset allocation as where to set your sails and dynamic asset allocation as a way to keep your balance as your boat glides and sometimes bounces through the waves. |