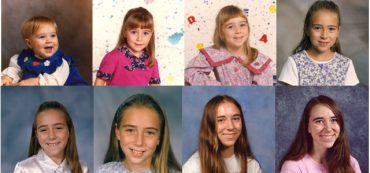

Rich Dad, Empowered Daughter

With impulses reeling, it is easy to find a gift that children will appreciate but difficult to find one that they will love to have. The gifts that I loved to have and the presents that I still cherish are the vocational gifts that my parents purchased for me.