Many clients log into their Schwab accounts in order to see how their portfolios are doing. Others log on simply to conduct their financial business, pay their bills or fund their Roth IRAs for example.

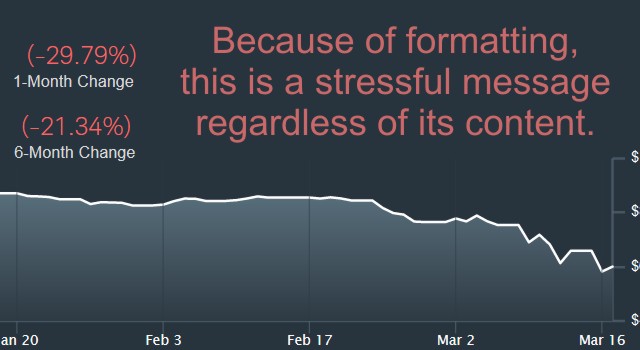

Unfortunately right now, investors will be greeted when they first log on to Schwab Alliance with a large dark grey banner that lists their “Personal Value” followed by a likely red number denoting a certain time period of change.

We’ve written before about the dangers of Schwab’s Personal Value feature in “Schwab’s New Personal Value Chart Promotes the Worst Investing Habits.” However, back then, investment returns were mostly green.

Now that we are in the midst of a bear market, investment returns are down 20% or more and Schwab’s personal value chart makes it look even worse.

Schwab’s presentation is not designed to report on your portfolio’s performance but rather it is intended to show a real time accounting of your portfolio’s value.

If you withdraw $100 from an account that has $2,500 in it, your bank not does not normally report that withdrawal as: -$100.00 (-4.00%). Contributions and withdrawals are personal accounting values. They are not usually seen with percentages. However, this is precisely what Schwab has done.

Yes, there is a small footnote on Schwab’s website which reads, “What is Personal Value?” When you click on the link you get another screen which consists of five lengthy disclosure paragraphs. Those paragraphs contain this sentence:

Changes in Personal Value may be due to factors such as deposits and withdrawals made to your account and not necessarily a reflection of investment performance.

Ideally, Schwab should have designed a reporting view that was clear enough that it does not require this disclaimer.

They could also correct the issue by making it a performance reporting number, but I would suggest that such a fix would not be a very useful homepage for Schwab Alliance to have. The dark background with the red number is a nudge to call you to action. It inspires emotion in you and begs the question, “This changed. What will you do now?” But, you shouldn’t do anything based on this number. Investors are better off when they refrain from repeatedly looking, slow down, and avoid trying to “do something.”

We suggest that our clients not look at short-term performance at all. The markets are inherently volatile. Recent returns are like the end of a whip, snapping up and down. The average number of times that the markets cross a given number is about 57 before ultimately landing on the high side of that mark. The average time after investing before your investment will be and stay above your initial investment is about six years. The median time after investing before your investments will be and stay above your initial investment is about two and a half years.

Our brains are not designed to handle such volatility. Our brains are designed to pull our hand off a hot stove quickly. But with investing, getting out of the markets after they have already gone down is normally terrible advice. You shouldn’t let short-term volatility ruin a brilliant investment strategy. And short-term even includes a decade of returns.

Just because one category did well for the past decade doesn’t mean that it will outperform for the next decade. Not only is past performance no guarantee of future results, studies suggest that past performance often reverses itself.

Volatility means little over the long term. Longer market returns are as though the holder of a whip is on a slowly rising escalator. The trend continues upward. Real returns favor holding stocks for multiple decades despite short-term volatility.

As much as it is possible, ignore Schwab’s log in screen when you go to pay your bills.

Photo is a created by author to mimic Schwab.com.