The markets are inherently volatile. Most investors don’t understand what that means. Here are some articles to help unpack that concept for you.

|

Don’t panic, the markets are inherently volatile

As far as I know, I am the only person who has made the nightly news for predicting that the world would not end. |

|

Does Past Performance Have Anything To Do With Future Results?

Is there a correlation which would justify talking about “the momentum of the markets”? |

|

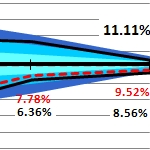

The Science of the Rebalancing Bonus

The greater the volatility, the greater the rebalancing bonus. |

|

The Whip Cracks Both Ways

Perspectives on the year ending September, 2009. |

|

Investment Strategies Part 5: In Defense of Diversification

Diversifying your asset allocation among investments with a low correlation can and should reduce your portfolio’s volatility and boost your returns. But critics are claiming this strategy is no longer valid. That’s because they don’t understand the nature of what happened in 2008. |

|

Diversification: Why Not Put Everything in Whatever Will Go Up the Most?

Five principles from analyzing the last decade of returns. |

|

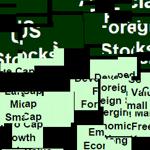

Invest in All Six Asset Classes

Many U.S. investors crowd their assets into a combination of large-cap U.S. stocks and U.S. bonds. This allocation represents only one and a half of the six asset classes described here. |

|

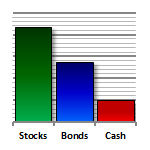

Investing Mostly in Bonds Means a Lower Lifestyle in Retirement

In the midst of this turmoil, especially after this past summer’s sharp drop, many investors wonder if they should put all of their investments into something safe and avoid the markets altogether. |

|

Does Market Volatility Cause Post-Traumatic Stress?

The best antidote to the stress of market volatility is to understand that the markets are inherently volatile. |

|

Being Reasonable

“One of an advisor’s greatest challenges? Directing client expectations – and meeting them with portfolio performance.” |

|

Behavioral Finance: Anchoring

One heuristic that the brain uses to solve complex evaluations is to make an initial guess and then adjust from that point. This is not always helpful when investing in inherently volatile markets. |

|

Behavioral Finance: Overconfidence

Think of confidence as a continuum: lack of confidence is paralyzing, self-confidence is good, but overconfidence is deadly. |

|

Ignore Daily Financial Noise

Investors are fickle. Investing should not be. When your investments go down, even slightly, you may be tempted to make poor choices. |

|

How Your Children Can Win the Stock Market Game

Find a single volatile stock and invest everything in that one stock for the duration of the contest. |

Photo credits on original posts.