We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Hedge Funds Aren’t Worth The Risk Part 4 – High Fees and Poor Regulatory Control

Wanting to avoid regulations, Hedge funds appeal to investor’s snobbery to make it seem like a privilege.

Hedge Funds Aren’t Worth The Risk Part 3 – Poor Compensation Structure

You take all the risk, but the manager gets twenty percent of any winnings. This is not a good compensation scheme.

Hedge Funds Aren’t Worth The Risk Part 2 – Poor Performance

Hedge claims are equivalent to “All of the coins I want to tell you about came up heads.”

Hedge Funds Aren’t Worth The Risk Part 1 – What Are Hedge Funds?

As Hedge funds grow in popularity, beware of following the lemmings.

Rocks and Sand – Keeping Expense Ratios Low

Good portfolios have low expense ratios and minimal trading costs.

Ruling Allows Broker Conflict of Interest

Currently, stockbrokers can offer the same services as Fee-Only financial planners without being accountable to the same fiduciary standards. This exemption to the Investment Advisers Act of 1940 has been called the “Merrill Lynch rule.”

Fifty+ Retirement Investing – Part 3

We are gradually becoming our grandparents.

Fifty+ Retirement Products – Part 2

Marketing promises and good friends often cloud the facts.

Fifty+ Retirement Planning – Part 1

Many people are afraid of having their retirement progress assessed.

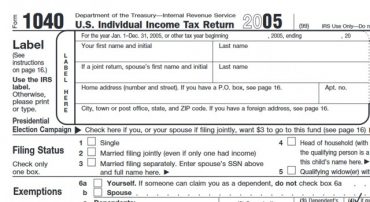

Look Over Your Tax Return

Decreasing your standard of living is the quickest path toward retirement.

You’re Fired! Now Get to Work!

“You’re fired!” can be an opportunity to work for yourself. But the best two words you might hear are yourself saying, “I quit.” Working for yourself is risky and frightening, but the financial freedom and opportunities you gain are significant.

Taxes are NOT Funny

“April is the month,” one wit noted, “when the green returns to the lawn, the trees and the Internal Revenue Service.”

Tax Freedom Day Arrives on April 17th, 2005

Two hours and twenty minutes of every eight hour day go to pay taxes. Three minutes go toward personal savings.

You Too Can Become A Billionaire (2005)

On your way to becoming a billionaire, the million markers become commonplace.

Budgeting Part 3: Reduce Your Spending

Spending less money isn’t an end it itself. Directing your spending to what you truly value is what is important.