We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Investing Ideas – Wealth Management Carnival #10

This edition of the Wealth Management Carnival we focus on investing. We have some helpful definitions of investment vehicles and instruments, advice on what to go for and what to avoid, and all kinds of opinions on that roller coaster ride: Financial Markets.

What The Government Wishes You Didn’t Know About Antidumping Laws

Anti-dumping rules are supposed to protect domestic producers and domestic jobs from unscrupulous foreign competition, but anti-dumping rules raise prices for their consumers and producers, shrink profits, and reduce the capacity of firms to invest, expand, and hire more workers.

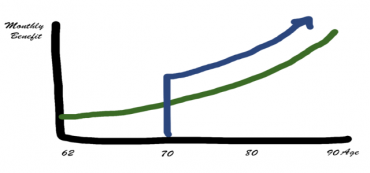

Three Reasons Husbands Should Delay Taking Social Security Until Age 69 or 70

Most married men claim Social Security at age 62 or 63, which leaves their future income well shy of what research indicates is optimal. Gentlemen, it’s time to wise up.

When The Dog Bites, When The Bee Stings: A Budget For Your Least Favorite Things

This kitten budgets for unknowns. Be more like this kitten.

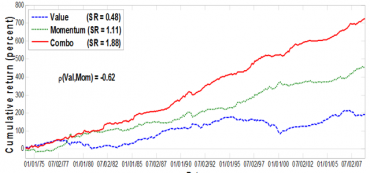

A Blended Investments Style Can Lead to High Returns With Low Risk

A blended investment style for all markets can lead to high returns with low risk.

The Benefits of Free Trade Defined: The Consumer Always Wins

All I want is a simple cup of coffee near where I work. Is that asking too much of free trade?

Radio: The Importance of Property Rights

David John Marotta was interviewed recently on radio 1070’s WINA Schilling Show discussing property rights and their importance for a free society.

Subscribe and receive the free presentation: How To Read Your 1040

Subscribe and receive the free presentation: How To Read Your 1040

Subscribe and receive the free presentation: If Not Gold, Then What?

Subscribe today and receive access to view Subscribe and receive the free presentation: If Not Gold, Then What? presentation free!

We Buy Local Produce Because It Is Better, Not Because It Is Local

If you could only pick one, would you like to buy a ripe tomato or a local one?

Do Tax Cuts Actually “Starve the Beast”?

Daniel J. Mitchell of the CATO Institute wrestles with the lack of no historical data to support the Starve the Beast model, only to find out that it’s because politicians have never really given it a shot.

Naming A Foreign 401(k) Beneficiary? ($ ?s)

You should have no problem naming your nephew as your beneficiary, but accessing the money from India after your death is more complicated.

How to Be Rich

This kitten is rich by not spending rich. Be more like this kitten.

ETF Trading: It’s ‘No Way to Invest’ Says Bogle

If Bogle is against ETFs, why does Vanguard run so many of them?

Should We Raise Taxes to Balance the Budget?

The only two ways to balance the federal budget are to spend less or to collect more. Spending less is the preferred method, but that is just not happening. As a result, politics is pushing many in Congress to try to balance the budget by raising taxes.