Annuity advertising is purposefully vague and confusing. As more people turn to trusting financial planning professionals over annuity salesmen, annuity companies have changed their advertising tactics from consumers to professionals. Unfortunately, not everyone is wise enough to see the deception.

This article takes an annuity company’s ad and analyzes the language and techniques used.

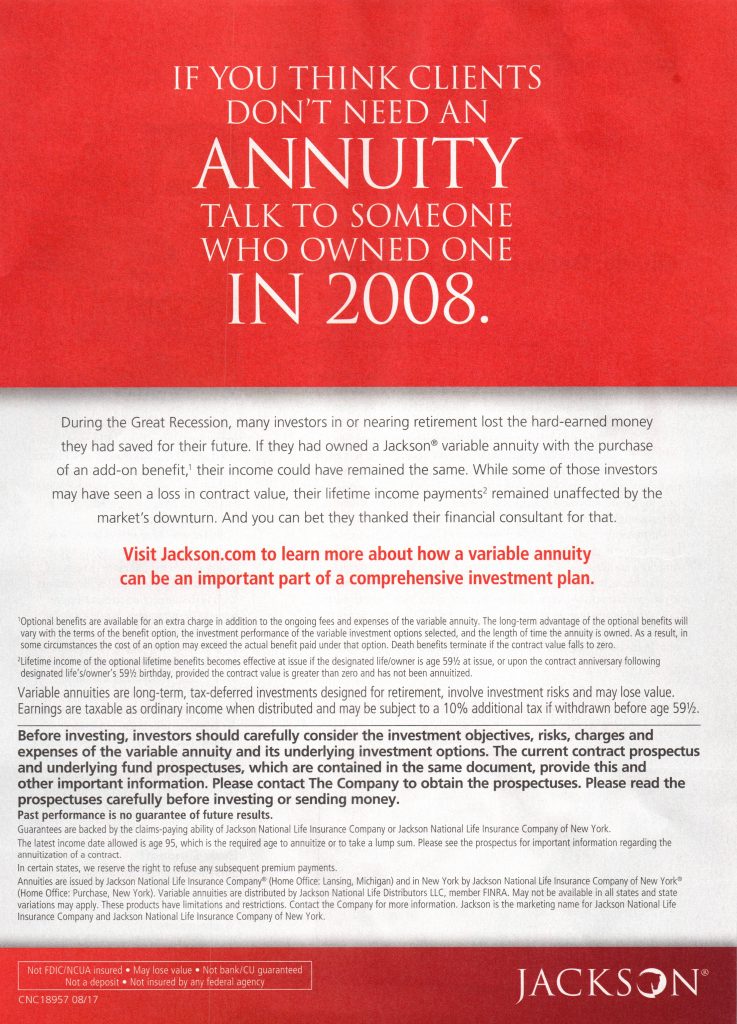

Here is the misleading annuity ad:

“If you think clients don’t need an annuity…”

Most fee-only advisors think clients don’t need an annuity.

Here is a strong case from Kipplinger against buying annuities . Suze Orman thinks “variable annuities exist for one reason only: to make money for the financial advisers who sell them. ” Fisher Investments thinks annuities are one of the worst investments you can make.

Basically only commission or fee-based advisors recommend annuities.

Regardless, the annuity industry works very hard trying to keep their image intact. To that end, there has always existed a marketing campaign to sell annuities to financial advisors.

“If you think clients don’t need an annuity talk to someone who owned one in 2008”

The language here is implying that if you think investors don’t need an annuity, then you would be wrong. They don’t say “you would be wrong” though because that would be a statement of fact which could be tested.

Instead, they say, “talk to someone who owned one in 2008” to try to imply that there is a case for an annuity.

This statement offers no objective evidence. It asks you to solicit anecdotal advice from a fictional person. It asks you to imagine what they would say.

However, what you are imagining is not reality. In reality, the person who owned one in 2008 was swindled.

Yes, fixed-annuities sales rose 60% in 2008 , but the stock market subsequently delivered a 10-year annualized return of 17.8% .

Just because people panicked in the moment isn’t a good sales pitch.

“many investors … lost the hard-earned money they had saved for their future”

The lower the market falls, the more important it is to stay invested. Once you flat-line, you have bet your retirement on your ability to get out near a top and get in at a bottom. My experience has been that most investors who fearfully exit the markets, get out late and stay out too long.

In 2008, investors only lost money over the decade if they panicked and sold near the bottom.

The term “many” in the advertisement is vague and misleading. Anyone who remained invested, which was the majority of investors, had their portfolio quickly recover as the S&P 500 experienced a sharp 6-month rebound. Some investors, it is difficult to know how many, sold at or near the bottom. Those investors lost the hard-earned money they had saved for their future. Other investors pulled out and purchased an annuity. We’ll get to those folks next.

“If they had owned a Jackson variable annuity with the purchase of an add-on benefit(1)”

“(1) Optional Benefits are available for an extra charge in addition to the ongoing fees and expenses of the variable annuity. The long-term advantages of the optional benefits will vary with the terms of the benefit option, the investment performance of the variable investment options selected, and the length of time the annuity is owned. As a result, in some circumstances the cost on an option may exceed the actual benefit paid under that option. Death benefits terminate if the contact value falls to zero.”

“their income could have remained the same”

Let’s assume their claim is true for a moment. How many investors had that exact configuration? We do not know. Many may have failed to get the right type of annuity, to get the right optional benefits, to be the right age, or to purchase at the right time.

Footnote (1) includes the disclosure that “in some circumstances the cost on an option may exceed the actual benefit paid under that option.” This is of course true for a majority of cases as that is how the insurance company makes money. This means though that the ad is cherry picking a bad investment to show one circumstance where maybe it didn’t completely fail you.

“While some of those investors may have seen a loss in contract value”

Notice the use of language. “Seeing a loss in contract value” is the same as “losing the hard earned money they had saved for the future.” One sounds ominous and foreboding while the other just seems like a possibility. The language is unfair.

“their lifetime income payments(2) remained unaffected by the market’s downturn”

“(2) Lifetime income of the optional lifetime benefits becomes effective at issue if the designated life/owner is age 59 1/2 at issue, or upon the contact anniversary following designated life’s/owner’s 59 1/2 birthday, provided the contract value is greater than zero and has not been annuitized.”

This means that only a few investors who purchased specific optional benefits and are very specific ages were unaffected by the market’s downturn. Other contract purchasers likely lost their hard earned money to the insurance company’s pockets.

It is difficult for me to imagine that anyone reading this small print would feel compelled to purchase an annuity. Yet many investors do.

“And you can bet they thanked their financial consultant for that”

You can bet, but they offer no guarantee that you will be correct.

The implication is again fraudulent. They imply that you would win such a bet, but we suspect that most of us would not.

Annuity advertising is seldom straight forward. If it were straight forward, I think that few people would be persuaded to purchase one.

When you see an annuity ad, you don’t need to analyze it in this detail to know it is misleading. All the annuity ads I’ve seen are misleading. They are trying to confuse you into buying their product. You don’t need their product. You don’t even need to know why their specific product is bad. Just say no.