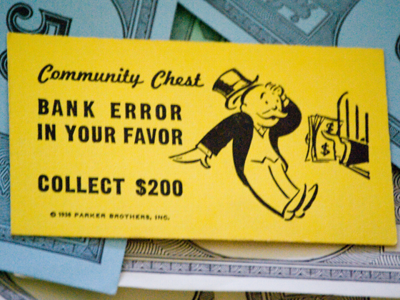

“Studies show that onetime windfalls can actually impoverish you. They make you feel rich, which inevitably leads to overspending. But wealth is what you save, not what you spend.”

I wrote those words in an article whose title, “Save 97 Percent of Any Windfall“, tells you everything you need to know. I went on to elaborate:

It is easy to expand your lifestyle and spending but very difficult to contract. … If your windfall is a once-in-a-lifetime event, only spend a very small percentage of it. If you are young, 3% would be reasonable and sustainable indefinitely. Saved and invested in a diversified portfolio, you should be able to earn at least 3% more than inflation.

Building wealth requires learning the discipline of saving since for most families wealth is what you save, not what you spend. But families who are suddenly wealthy did not build their wealth gradually and often lack this discipline. Disciplines are not easily built, and this is the reason why most lottery winners are broke a few years after their windfall. Winning the lottery doesn’t change who they are.

Windfall clients are perhaps the most difficult clients for financial planners to deal with. They tend to be, at the same time, both spendthrift and risk adverse. They haven’t learned to save; they haven’t learned the value of putting money to work for them.

I read this in Scott Schutte’s Financial Planning magazine article, “Suddenly Wealthy“:

“It’s natural for clients and advisors to gravitate toward the investments because they are concrete and easily definable. But it’s the human side that should take priority,” she says. These clients are often under a huge amount of stress, which can limit their ability to focus and make decisions. You may offer them great advice, but if they’re beset by anxiety, they won’t be able to absorb it. …

Often, getting your message across takes time and patience, especially with risk-averse clients. “Our approach is to spend as many meetings as it takes for them to truly understand investment risk, including the different types of risks and how they are measured,” Brown says. It may not yield immediate results, but plain and frequent communication builds clients’ trust and enables them to move forward.

People who are not acquainted with wealth think that living with wealth is just one string of being able to buy what you want after another. But that is like riding the pony without cleaning the stall. Anyone who has learned to build real wealth through savings and hard work will tell you that the more money you have the more work and responsibility you have stewarding that money. In truth, the wealthy man has more money sitting in his in-basket waiting to be taken care of.

For those not acquainted with anything but spending money this is both stressful and catches them lacking the ability to make the decisions necessary to steward that money well. The difference between rich and poor is a difference of a skill set or an outlook on life, whereas the difference between wealthy and broke is merely a difference in your current financial situation. You can be rich but broke. That is just temporary. You can also have a poor mindset and suddenly find yourself wealthy. Unfortunately that situation can be just as temporary. You could be wealthy but poor. But not for long!

Learn the principles of being rich before you have money so that you will steward it well when the time comes.

Photo by Megan Marotta