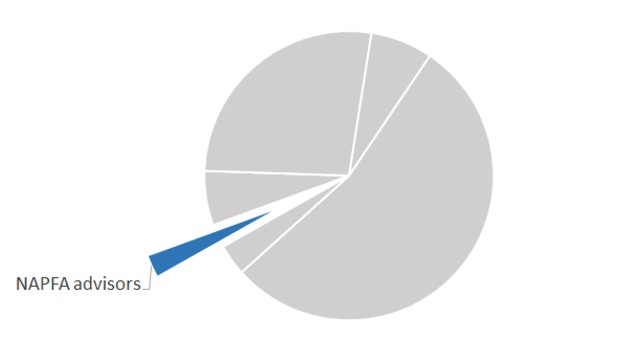

As of March 16, 2018 according to Investor.Gov, there are 116 registered firms within 15 miles of Charlottesville. Meanwhile, according to NAPFA, there are only 3 NAPFA firms within 15 miles of Charlottesville. That makes only 2.59% of the Charlottesville financial service industry guaranteed to be fee-only fiduciaries with a CFP® professional on staff offering comprehensive wealth management.

As of March 16, 2018 according to Investor.Gov, there are 116 registered firms within 15 miles of Charlottesville. Meanwhile, according to NAPFA, there are only 3 NAPFA firms within 15 miles of Charlottesville. That makes only 2.59% of the Charlottesville financial service industry guaranteed to be fee-only fiduciaries with a CFP® professional on staff offering comprehensive wealth management.

Meanwhile up to 97.41% are potentially brokerage firms or fee-and-commission-based advisors or firms that only provide investment management.

Here is how the 116 registered firms break down.

39.66% or 46 of the registered firms are or are closely related to a brokerage firm.

According to the FINRA.org website, “A brokerage firm, also called a broker-dealer, is in the business of buying and selling securities – stocks, bonds, mutual funds, and certain other investment products – on behalf of its customer (as broker), for its own bank (dealer), or both. Individuals who work for broker-dealers – the sales personnel are commonly referred to as brokers.”

Brokerage only firms do not even claim to provide financial advice; they are openly primarily securities salesperson. Meanwhile, the investment advisor firms that are or are closely related to brokerage firms commonly present large conflicts of interest in their investment options.

In the 46 brokerage-related firms, 7 are brokerage-only firms (6.03%), 31 are both brokerage and investment advisor firms (26.7%), and 8 are 4 companies that have split their brokerage filing from their advisory filing (6.90%).

On the other side of the industry are 70 investment advisor only firms or 60.34%. These can be subdivided further. While brokerage firms do not even claim to provide financial advice, investment advisors might be expected to provide advice but only some do and fewer still are trained or credentialed to do so.

The CFP® certification is the recognized standard of excellence for competent and ethical personal financial planning. The designation requires a higher education degree, at least three years of professional experience in the field, submission to the CFP Board’s Standards of Professional Conduct, passing a 6-hour examination on a comprehensive list of financial topics, and 30 hours of continuing education every two years.

Although many professionals may call themselves “financial planners,” CERTIFIED FINANCIAL PLANNER™ (CFP®) professionals have made a certified commitment to their financial planning education.

In Charlottesville, 62 firms do not have a CFP® professional on staff according to the CFP Board website or 53.45% of the 116 total firms and 88.57% of the 70 investment advisors only firms.

The world of financial services is built mostly around products and services. Many if not most of the Registered Investment Advisors who do not have any CFP® professionals on staff probably limit their advice to investment management only. Many admit that they don’t actually provide advice.

The other 7 investment advisor only firms have a CFP® professional on staff according to the CFP Board website.

We can use NAPFA to split them further. NAPFA stands for the National Association of Personal Financial Advisors. Being a member of the National Association of Personal Financial Advisors (NAPFA) means that you are held the highest standard of fiduciary duty in the financial services industry.

NAPFA advisors sign an oath promising to put their clients’ best interests first, provide full disclosure to clients of any conflicts of interest, never receive commissions, subscribe to NAPFA’s Code of Ethics, and have proven competence in designing a comprehensive investment plan.

As a NAPFA member, you:

- Always act in a fiduciary role–committing to client-centered relationships.

- Are compensated directly by our clients, which eliminates many conflicts of interest.

- Never receive compensation for recommending specific products or services.

- Strive to comply with federal and state investment advisor regulations.

- Have advanced education in the field.

- Complete 60 hours of continuing education every two years.

We believe that a NAPFA-Registered financial advisor offers you the best assurance that the firm you are working with is competent, compensated in a way that helps reduce conflicts of interest, and offers comprehensive wealth management.

Of the 7 advisory firms with a CFP® professional on staff, 4 are not NAPFA (3.45%) and 3 are both NAPFA and have a CFP® professional on staff (2.59%).

The 3 NAPFA firms are (in alphabetical order):

- Bond Wealth Management (Mark McCarron)

- Marotta Wealth Management (Our Team)

- Wrightbridge Company (Nora Gillespie)

Comprehensive financial planning is a great deal of work and therefore a great deal of value. Investment managers offer little if any of these financial planning services. Investment management may lie at the core of wealth management but we believe that by itself it doesn’t even consist of half the value of comprehensive wealth management.

Investment management is about asset allocation design. For our firm, it is just one among the many services that we offer. We extend our services from investment management into all the aspects of financial planning that comprise comprehensive wealth management.

Regardless of what you call these comprehensive services, we believe that clients need and want these services to give them the best chance to meet their goals. And we believe that many of the topics that comprise the CFP® Certification Exam are as important to a client’s financial success as investment management.

We were surprised by our survey of the registered firms in the Charlottesville area, but we believe it is representative of the country as a whole. it is no wonder that the Department of Labor and the Securities and Exchange Commission fail to enforce the laws we have and have been captured by the lobbying of commission-based agents and brokers.

Given the lack of NAPFA-Registered Advisor and others offering comprehensive financial planning, you may want to limit your search to the small percentage of firms like ours. We do accept clients who are not in the Charlottesville area. Give us a call to get started today building your future financial success.