How To Distribute from A College America 529 Plan to a Designated Beneficiary

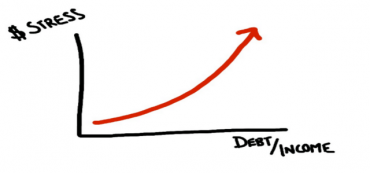

You can distribute any amount of money to the designated beneficiary for any reason, but only distributions which are reimbursing for qualified education expenses are tax and penalty free.