My wife and I are about to have our third child, so in between talking about our favorite baby boy and girl names (we’re waiting on the gender) it is time to reexamine our education savings plans. To assess our progress toward funding all three children, I have created age-based benchmarks that I share here.

My wife and I are about to have our third child, so in between talking about our favorite baby boy and girl names (we’re waiting on the gender) it is time to reexamine our education savings plans. To assess our progress toward funding all three children, I have created age-based benchmarks that I share here.

For a child born today, expect the costs of tuition, room and board, and books (not the paper kind we grew up with) to run a whopping $161,423 based on average in-state tuition rates and a 5% annual increase in the cost of college expenses. Reaching this goal requires a monthly savings of $371 from the day a prospective college student is born.

Those who fail to plan are often buried under a mountain of student debt. Americans now owe more on student loans than on credit cards, and many are unable to make the minimum payments.

Saving for college can feel like a catch-22. The more you saved, the less likely you will qualify for need-based financial aid. Some people use this information to justify avoiding the college savings question altogether. But the money-wise will not choose to rely on our national government’s fading ability to subsidize loans or provide grant money. You are better off preparing for a future where more citizens will have to pay their own way for a college education.

You may not know that you can finance your own retirement with any money not used up in college savings plans. The penalties imposed by taking money out of a college 529 savings plan are a wash when you factor in the tax-deferred growth of these plans. In fact, any scholarships your children receive will allow you to take money out of these plans without any penalty at all.

Once you’ve become convinced to save for college, the question becomes “How much?” In Virginia, we have a selection of excellent public colleges to choose from, so my wife and I feel quite comfortable basing our financing plans using in-state estimates. My thought is that if one of our children would like to go elsewhere, it will have to be a very compelling case. And any extra financial burden they carry will be an excellent life lesson in cost-benefit analysis.

No matter where our children attend school, we will expect them to participate in a portion of the financing. This could be through academic or athletic scholarships (I’m planning to have my boys practice field goal kicking as soon as their nap is over) or summer jobs. Paying for a quality education is a huge investment, and I want them to share the challenge.

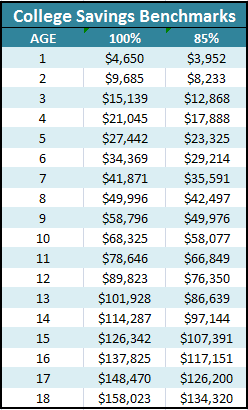

Specifically, we’ve decided to target a savings plan that will cover 85% of the projected costs. Virginia offers state tax breaks for saving in four different 529 programs which are accessible at www.Virginia529.com. Assuming that you are willing to use one of the state-sponsored market-based solutions, I created the following savings benchmarks.

Parents following this plan should have saved $23,325 by age 5 and $58,077 by age 10. The 85% college savings plan suggests a monthly savings rate of $315 per child from the day they are born. For those who are counting, that’s the opportunity cost of a monthly car payment on a 2012 Ford Focus. If you prefer, it’s also equivalent to the monthly payment for Netflix, a gym membership, bi-weekly massages and a daily Starbucks latte. Ah, the joys of parenting.

Saving 85% is daunting. $315 a month per child may be beyond the capacity of your disposable monthly income. In these cases, you will need to consider possible tax refunds, year-end bonuses, or family gifts to supplement.

The value of my college experience becomes clearer each year, and I have a strong commitment to help offer this opportunity to my children. I expect that advanced learning and networking will become even more critical in tomorrow’s interconnected global village, and so I consider the sacrifice, or 85% of it, worth making.