It is normal to worry about your investments as you approach and enter retirement. As a result, many investors want to set some money aside in order to keep it safe. Recently we were asked about the idea of setting aside $50,000 to $100,000 and investing it in a rolling 5-year laddered Certificate of Deposit (CD) portfolio earning between 2% and 3% interest. This allocation was in addition to a bond allocation the investor already had as part of their asset allocation.

It is normal to worry about your investments as you approach and enter retirement. As a result, many investors want to set some money aside in order to keep it safe. Recently we were asked about the idea of setting aside $50,000 to $100,000 and investing it in a rolling 5-year laddered Certificate of Deposit (CD) portfolio earning between 2% and 3% interest. This allocation was in addition to a bond allocation the investor already had as part of their asset allocation.

To be clear, there was no reason to expect that this money was going to be needed during the next five years. When the first year’s CDs matured, the idea was to use the money to purchase a 5-year CD to roll the investment forward. In the investor’s mind, this plan was going to keep the money safe while still making money.

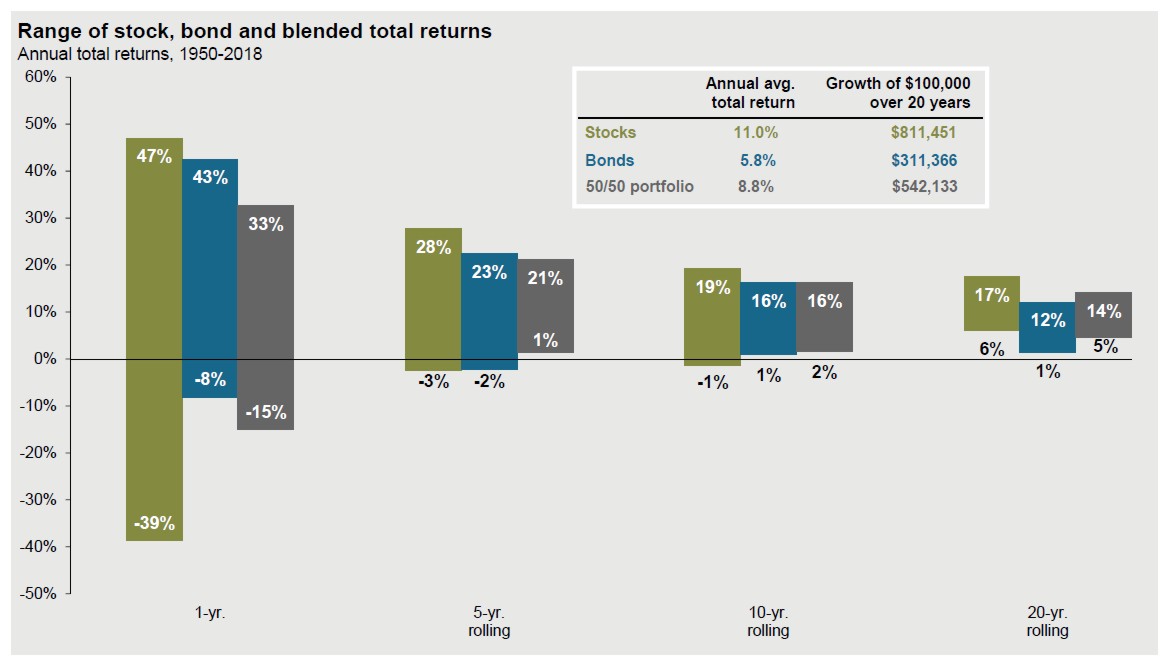

J.P. Morgan’s quarterly Guide to the Markets contains a slide entitled, “Time diversification and the volatility of returns” which contains the following chart. The description around the chart states, “Returns shown are based on calendar year returns from 1950 to 2018. Stocks represent the S&P 500 Shiller Composite and Bonds represent Strategas/Ibbotson for periods from 1950 to 2010 and Bloomberg Barclays Aggregate thereafter. Growth of $100,000 is based on annual average total returns from 1950 to 2018.”

The bars represent the range of investment returns witnessed over this 68-year time period for 1-, 5-, 10-, and 20-year time periods.

We don’t know what is going to happen in the markets. We could be on the verge of a steep market drop. We could be about to have another 11% appreciation. But from this chart we know how to think about returns.

Given these average returns, $500,115 was the lost opportunity costs of investing $100,000 in bonds averaging 5.8% rather than stocks averaging 11.0% ($811,451 – $311,336). Losing out on a half of a million dollars over the next 20 years because you were fearful and wanted to play it safe is likely not in your best interest.

Although it is true that, we don’t expect stocks to appreciate by 11.0% over the next 5 years, it is also true that we don’t expect your laddered 5-year CDs to earn 5.8% either. We have experienced much higher inflation historically than we are currently experiencing.

Regardless of the specific numbers though, the relative difference between choosing Bonds verses choosing Stocks is very significant.

If inflation is at 2.00%, we might expect an all-equity portfolio to earn 8.5%. If a laddered CD portfolio earns 2.5% over 20 years, $100,000 would grow to $163,862. Meanwhile a stock portfolio appreciating at 8.5% would grow to $511,205. This suggests a lost opportunity cost of $347,343. This three-hundred-thousand-dollar difference might be a more accurate projection assuming that inflation remains low. But even this amount is a large price to pay for trying to keep some money safe.

If you need money in the next year or two, stable fixed income investments are probably the best choice. But for money that you are not going to need in the next five years, we would recommend investing in appreciating stock investments. Looking at these calendar based returns, the worst 5-year investment time periods were not too bad.

Photo by Pixabay from Pexels